We need to talk about FTX

First it happened to Big Tech, now it’s happening to crypto.

Well, that escalated quickly…

As I’m sure you know by now, FTX – crypto’s third biggest exchange, with more than $600 billion trading volume in 2022 – collapsed this month.

This isn’t just like your average scammy exchange going to the wall. FTX was one of the most trusted named in crypto.

You might remember that during the last crypto collapse, it was FTX bailing out all the failing companies.

(For more on that, see my bankruptcy bingo issue, which will bring you up to speed on that whole debacle.)

If it wasn’t for FTX many more crypto companies would have gone to the wall, and the “contagion” would have been much more widespread.

Now it’s emerged FTX itself was on the verge of bankruptcy throughout all this chaos. The problem was, no one at FTX, or anywhere else, knew.

And now that FTX has declared bankruptcy, no one knows how far the shockwave will go.

BlockFi, for example, is now preparing to file for bankruptcy because FTX was the only thing propping it up.

Even the Facebook twins’ famous Gemini exchange is floundering. It’s paused withdrawals and is likely heading for bankruptcy, too.

SBF goes from angel to antichrist

At the heart of all this is one of crypto’s most loved and trusted people, Sam Bankman-Fried.

At least he was one of crypto’s most loved and trusted people until about two weeks ago. Now he’s its number one villain.

Sam Bankman-Fried, or SBF as he’s known, said all the right things publicly and took all the right actions publicly.

He was one of those “good” billionaires that seemingly didn’t care about money and just wanted to help people.

Back in June he signed the giving pledge and promised to give away most of his (then) $21 billion fortune to good causes.

And when Three Arrows, Celsius, Voyager and the rest collapsed in July, he stepped in to stem the bleeding, giving BlockFi $400 million credit and loaning Voyager $465 million.

He was anointed as “the new John Pierpont Morgan”.

John Pierpont Morgan was a titan who bailed out the US government in the panic of 1893 and 14 years later bailed out Wall Street in the financial crisis of 1907.

For a while, it really looked like SBF was set to become crypto’s John Pierpont Morgan.

But just as John Pierpont Morgan’s bail-out eventually led to the creation of the Federal Reserve, SBF’s antics could well lead to a whole new world of crypto regulation.

Because the thing is, far from being a titan himself, it turns out SBF was just another scammer.

The road to crypto hell is paved with bad intentions

So, what went wrong?

It’s not like SBF purposefully set out to defraud people and lose his customers’ life savings.

If we go back to basics here, what happened was this:

- FTX is an exchange created by SBF.

- Alameda is a hedge fund created by SBF.

FTX secretly stole customers’ deposits and gave them to Alameda to gamble with.

Meanwhile, FTX publicly stated that it “never invests customer deposits”.

Just how much money did FTX steal from its customers to give to Alameda?

When this came to light SBF said, “We didn’t secretly transfer [the $10 billion of customer funds]. We had confusing internal labelling and misread it.”

A few days later in a bombshell interview with Vox, SBF went one better.

Instead of apologising or admitting he’d done anything morally wrong, he invented a weird illogical argument to try exonerate himself:

He’s basically saying: “FTX didn’t gamble with customers’ funds, Alameda did. And we never said Alameda wouldn’t gamble with customers’ funds.”

You’ve probably come across a similarly structured argument to this before, in primary school.

I can’t believe he actually put that out into the world.

Remember up until this point SBF was seen as an absolute hero. The saviour of crypto.

And it’s worth pointing out that the promise not to invest customers’ funds wasn’t just a PR exercise, it was literally in black and white in FTX’s terms of service.

Here’s what those terms said:

You control the Digital Assets held in your Account. Title to your Digital Assets shall at all times remain with you and shall not transfer to FTX Trading.

None of the Digital Assets in your Account are the property of, or shall or may be loaned to, FTX Trading; FTX Trading does not represent or treat Digital Assets in User’s Accounts as belonging to FTX Trading.

Axios reports that FTX’s blatant breaking of these terms could lead to a criminal fraud case against its executives. And that’s in addition to the existing civil case.

So it turns out all of SBF’s supposed “ethics” were just an act, as he admits in that Vox interview:

But, like I said, while Alameda was doing okay no one was any the wiser.

Things fall apart

Then, on the 2nd of November, CoinDesk released a report exposing Alameda’s questionable balance sheet.

It turned out that billions of dollars of Alameda’s “assets” were held in FTX’s own FTT token.

FTT is FTX’s exchange token that gives users cheaper trading fees and other perks, like Celsius’ CEL token did, and Crypto.com’s CRO token still does.

From CoinDesk:

Bankman-Fried’s trading giant Alameda rests on a foundation largely made up of a coin that a sister company invented, not an independent asset like a fiat currency or another crypto. The situation adds to evidence that the ties between FTX and Alameda are unusually close.

The financials make concrete what industry-watchers already suspect: Alameda is big. As of June 30, the company’s assets amounted to $14.6 billion. Its single biggest asset: $3.66 billion of “unlocked FTT.” The third-largest entry on the assets side of the accounting ledger? A $2.16 billion pile of “FTT collateral.”

There are more FTX tokens among its $8 billion of liabilities: $292 million of “locked FTT.” (The liabilities are dominated by $7.4 billion of loans.)

When this news surfaced Binance’s creator and CEO Changpeng "CZ" Zhao announced Binance was dumping all its FTT tokens.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

This was significant because Binance was the first big investor in FTX, and still held a huge amount of FTT tokens.

Chaos reigns

CZ’s tweet was like a stick of lit dynamite being thrown into the lake of crypto.

Everyone is still jumpy from this summer’s crypto bankruptcies. No one wants their crypto stuck on a failing exchange that could suspend withdrawals at any second. So, everyone starts yanking their crypto off FTX.

SBF then does what all failing crypto CEOs do and tweets some blatant lies to try and buy himself some time (The CEO of Celsius did exactly the same thing – even talking about “false” rumours – earlier this year as Celsius went bankrupt):

Then for a brief moment it seemed like everything was going to be okay, as CZ stepped in and said Binance would bail out FTX (pending due diligence).

The irony of the king of bail out’s needing a bail out himself was not lost on anyone.

But for a few hours it seemed like everything might be okay.

The centre cannot hold

Things were not okay.

It took Binance less than 24 hours to see that FTX’s accounts were an absolute sham and pull out of the deal.

The next day Almeda shut down. And the day after that FTX filed for bankruptcy.

Meanwhile, billions of dollars of customer funds are missing, likely gone forever, and the crypto market has gone into meltdown once again.

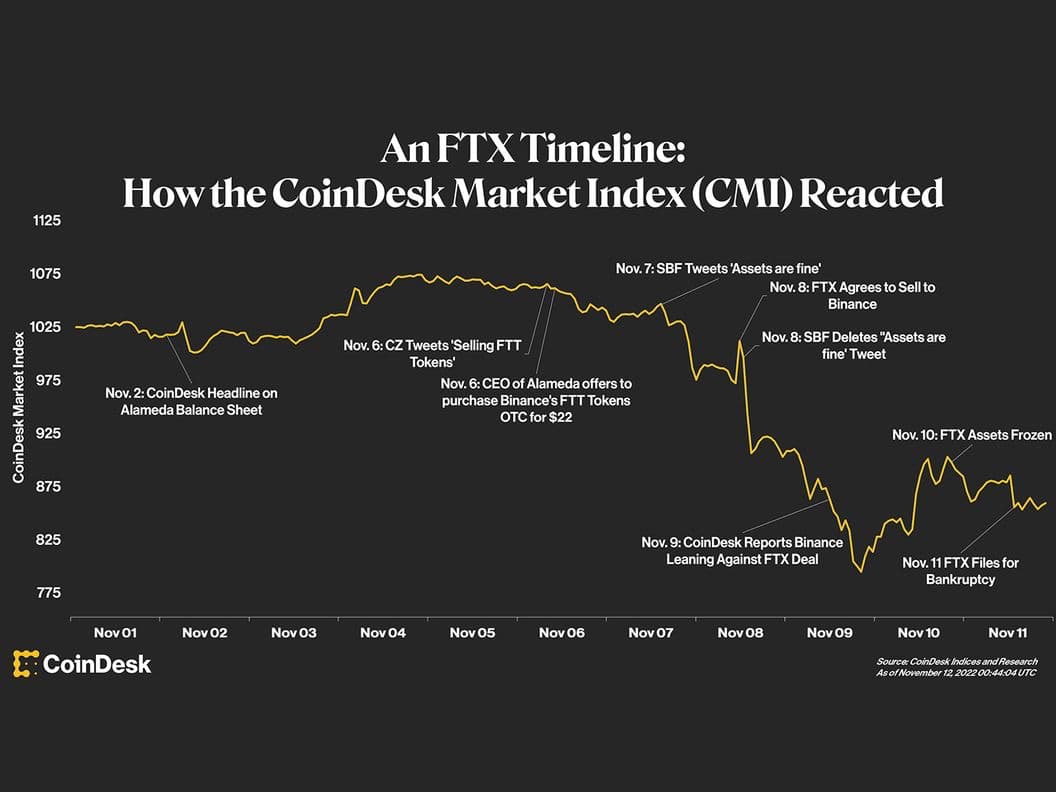

CoinDesk did an annotated chart of how all this played out on the crypto market:

It gets even weirder, with a state-ordered $600 million “hack”

In the middle of all this chaos FTX was “hacked” to the tune of $600 million.

The main theories about the hacker was that it was either a company insider funnelling some money to themselves, or a lower-level employee that was bribed.

In that Vox Interview, SBF confirmed it was a hack:

But then on Thursday, news surfaced that SBF was lying again. There was no hack. It was the Bahamian government.

From CNBC:

FTX in a bombshell emergency court filing Thursday said it has credible evidence that Bahamian regulators directed former CEO Sam Bankman-Fried to gain “unauthorized access” to FTX systems to obtain digital assets belonging to the company after it had filed for Chapter 11 bankruptcy protection.

The filing said Bankman-Fried transferred those assets to the custody of the Bahamian government

Why would FTX agree to something like this?

Well, because FTX is based out of the Bahamas, and that’s where SBF lives. At the time of this “request” he was being held in the custody of the Bahamian authorities.

Here’s what FTX said in court:

[I]n connection with investigating a hack on Sunday, November 13, Mr. Bankman-Fried and [FTX co-founder Gary] Wang, stated in recorded and verified texts that “Bahamas regulators” instructed that certain post-petition transfers of Debtor assets be made by Mr. Wang and Mr. Bankman-Fried (who the Debtors understand were both effectively in the custody of Bahamas authorities) and that such assets were “custodied on FireBlocks under control of Bahamian gov’t.

The Debtors thus have credible evidence that the Bahamian government is responsible for directing unauthorized access to the Debtors’ systems for the purpose of obtaining digital assets of the Debtors—that took place after the commencement of these cases. The appointment of the JPLs and recognition of the Chapter 15 Case are thus in serious question.

How crazy is that?

Surely it was illegal.

Yes, of course it was.

From Reuters:

FTX's new CEO John Ray who took over from FTX founder Sam Bankman-Fried when the company filed for Chapter 11, said in a Thursday court filing that the asset seizure "flaunted" U.S. bankruptcy law, which stops creditors from seizing assets from bankrupt companies.

What will come of it?

There’s gonna be a good ol’ fashioned showdown between the US and Bahamas regulators on Tuesday.

Who will win?

I have no idea.

But the twists and turns in this catastrophe are likely to keep on coming. Netflix is probably already putting out casting calls for who it wants to play SBF.

I think Jonah Hill would be a good candidate. He could basically just play the same character he did in War Dogs.

The shockwaves are far from over

When Celsius, Tree Arrows and Voyager went under this summer, it trashed crypto’s reputation. And it also wreaked havoc among pretty much every other company and project in the industry.

However, all of those companies were really just bit-players.

FTX was the third biggest exchange in the entire crypto industry. And it’s already taken BlockFi – another major player – with it.

In short, this is far from over.

As this all plays out other major and minor players will no-doubt fall.

The best thing anyone can do right now is get their cryptos off exchanges and into their own custody, preferably into a hardware wallet from Ledger or Trezor.

What lessons can we learn from this fiasco?

The same lesson people have been learning over and over and over again, ever since the earliest days of crypto and the almost industry-ending Mt Gox collapse…

NOT YOUR KEYS, NOT YOUR COINS.

Basically, don’t trust crypto companies with your funds for any longer than is absolutely necessary.

Yes, use exchanges. But only use them to buy/sell/trade. And as soon as you’re done with your buy/sell/trade get your coins off there as soon as possible and into your own wallet.

A possible exception to this might be Coinbase, which is basically the only listed exchange in crypto, trading on the Nasdaq.

This means it has actual, real regulations to follow. It couldn’t get away with any of the crap FTX pulled. At least, in theory.

But then again, there’s a long line of listed companies that scammed the public and regulators alike. Think Enron.

It’s going to take crypto a long time to recover its already tarred reputation after this.

Will it come back from this? Of course.

But in the meantime prepare yourself to read a lot of opinion pieces about how crypto is dead, was always doomed to fail, and will never come back.

What happened to the issue that was promised?

As you may remember, for this month’s issue I was planning to look at how things are going in six key areas of crypto: DeFi, NFTs, hacking, regulation, current prices and future outlook.

But then this whole FTX thing happened, and it had such a huge impact on all six of these areas that I decided to cover it instead.

So I’ll now be writing that six key areas issue next month. I guess it’s kind of apt to have a “where we’re at” issue as the last one of the year anyway.

In next month’s premium issue I’m doing a deep dive into the much-hyped Aptos project

As I said in my “I’m changing things up” note, I’ll be doing a lot more deep dives in my premium issues from now on.

And next month we’re kicking things off with a deep dive into Aptos.

If you follow crypto news, you’ll have heard a lot about Aptos in the last few months.

It seems to be both super-hyped and super controversial, which means it will be a lot of fun to investigate.

From what I’ve seen so far it could be “the next Solana”. Although it could equally be “the next Internet Computer”.

Basically, it seems to be a super advanced crypto created by VC bros and ex-Facebook employees… hence the hype and controversy.

If you’re a premium subscriber, the deep dive will hit your inbox on Sunday the 4th of December.

And if you’re not yet a premium subscriber, you can join here. When you do, you’ll also get instant access to my full archive of deep dives, including: Avalanche, Algorand, Aleph Zero, IOTA, Fantom, Solana, Radix, Polkadot and more.

Okay, that’s all for today.

Actually, I just have one last thought…

You either die a hero, or you live long enough to see yourself become the villain

Something interesting I noticed about this whole episode is SBF – in fact, the entire crypto industry – has had the same narrative ark as Big Tech.

Back when Big Tech wasn’t so big, it was always striving to make the world a better place.

Google’s official company motto used to be “don’t be evil”. Facebook was all about connecting people to their friends and family in a way that wasn’t possible before the internet. Twitter gave the average person a platform and a voice.

Then in around 2018, the Big Tech backlash happened.

Facebook was caught selling users’ data to the highest bidder and inadvertently destroying people’s faith in democracy.

Google ditched its “don’t be evil” corporate code when it realised it had gotten too big to, well, not be evil.

And Twitter soon descended into a vile pit of hatred and outrage.

Basically Big Tech got too big and turned into the very thing it was railing against in the beginning… big, evil corporate behemoths.

Now crypto seems to be going through a very similar narrative ark. It was created in the wake of the 2008 financial crisis, as an antidote to the corrupt financial system.

Now it’s become its own corrupt financial system. In many ways it’s even more corrupt than the traditional financial system.

Situations like this always bring me back to that scene in The Dark Knight, where Harvey Dent says those fateful words: “You either die a hero, or you live long enough to see yourself become the villain.”

First it happened to tech, and now it’s happening to crypto.

I thought that was interesting.

Okay, that really is all for today.

Thanks for reading.

Harry

Full disclosure: At time of writing, I held the following cryptos: Ethereum, IOTA, Radix, Mina Protocol, Aleph Zero.

Disclaimer: This content does not constitute financial advice, tax advice or legal advice. Your money and how you choose to spend it is your responsibility. Nothing that appears here should be construed as investment advice or recommendations to buy or sell any securities, cryptos or investments. coin confidential does not offer investment advice. We merely provide information. Crypto investing is highly risky. You should not base any investment decision solely on information we publish. We believe all information we publish to be accurate, but we cannot guarantee it. Always do your own research before making any decisions about your money. See the full disclaimer for more.

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).