Fantom review: a tale of two cryptos

Fantom has some of the best attributes of any crypto I’ve seen to date. It also has some of the worst attributes of any crypto I’ve seen to date. Does the good outweigh the bad? Let’s find out.

Note: All price data taken between the 26th and 27th of November 2021.

A few years ago, I wrote an article about Hedera Hashgraph.

Hedera did not like it.

In fact, out of the hundreds and hundreds of articles I’ve written over the years, that one remains the only one where the company I was writing about contacted me to tell me they didn’t like it.

I guess my headline may have been a little inflammatory: “Is Hedera Hashgraph crypto’s salvation, or its antichrist?”

When I wrote the article (mid-2018) Hedera was gaining a lot of attention. It promised to solve all the problems plaguing crypto at the time.

From my article:

There is a new technology called Hedera Hashgraph that’s been making waves in crypto circles.

It claims to be able to do everything blockchain technologies like bitcoin and Ethereum can do but much, much better.

According to its white paper, it can process over 250,000 transactions per second (tps).

That’s about five times what VISA can do. About 12,500 times what Ethereum can currently do, and about 30,000 times what bitcoin can currently do.

It will also allow smart contracts, like Ethereum, built in Ethereum’s solidity programming language.

And it will do away with miners, using a proof-of-stake mechanism, rather than proof-of-work like bitcoin. The proof-of-work mechanism is what causes bitcoin to use so much energy.

You can’t buy into its initial coin offering (ICO). It doesn’t need the money – we’ll get into why that is in a second. But it will soon be available on exchanges and released for developers to build on.

It sounds like the ideal crypto, doesn’t it? Smart contracts, super-fast and super-scalable (it also claims to be super-secure).

But is it really?

It's funny looking back at that three-and-a-half years later. Scalability and energy usage are still the biggest issues in crypto.

Although, nowadays I’d probably add centralisation into the mix, too… which I noted was a problem for Hashgraph at the time.

It was a pretty long article. I looked into the whitepaper and other documentation and drew this conclusion:

In conclusion: don’t believe the hype

I went into this completely neutral about Hedera Hashgraph, but I have come out of it convinced it is not a good crypto.

It is incredibly centralised. It uses fees. It is closed source. Its corporate leaders can change its code and rules at will. And it could even lead to patent wars in crypto – something most cryptos have worked hard to avoid.

Personally, I won’t be investing in Hedera Hashgraph.

That’s not to say that it won’t do well. It has a lot of money and power behind it, and it makes some very big claims.

Most people will not look into it this deeply, and even if they do they may not see these red flags in the same way I do.

Some people may even see its centralisation and structure as a benefit. I do not.

Once it gets its full release it will be very interesting to see how the crypto community and the wider media respond.

I also highlighted a Reddit post that nicely summed up my issue with its structure and ideology:

The way I see it at the moment is, Hedera Hashgraph Council plays the role of rule-maker, indirectly sets the rules, fees, and approve new software updates via Governing Board which is elected by HH Council, and the community just plays the role of rule-enforcer, running nodes to verify transactions and apply only the rules of the software written and approved by the Governing Board.

This worries me, because IMO it is opposite of the typical politic model we often see, the people/the mass/the community plays the role of rule-maker (via electing a parliament etc...), and the government only plays the role of rule-enforcer.

So, how should we be sure this HH Council will not become corrupted or make the decisions that optimize the benefit for themselves but not the mass? Especially according to the whitepaper, Hedera Hashgraph Council is a for-profit LLC!

It's not necessarily to be something hugely and clearly evil to be concerned about, the Council is obviously not incentivized to sabotage the network. But it could be some decision that just slightly lean toward the Council's benefit instead of the whole, small changes over time, steer the development to a path that optimize the benefit for them.

Say, if some day Hedera Hashgraph is mass adopted around the world, many crucial global applications run on Hedera platform, then the HH Council (especially Swirlds) would become an organization with supreme power. Even if the Council becomes corrupted, people would have no way to change it because we have no right to vote, because the HH Council is a closed group which could make the decisions that benefit themselves best, then elect the new Council members who have the same minds, then the new Council repeats,... This is the endless loop and the degree of corruption might rise over time this way.

As I said at the time:

I think the idea that Hedera Hashgraph is designed to run in the opposite way to democracy is a very important point. Especially as most crypto is about the democratisation of technology. This is exactly the opposite of Hedera Hashgraph’s approach.

And I still think that’s the biggest issue with Hedera Hashgraph. It is an absolute red flag for me.

Well, that, and the fact it’s run by a for-profit LLC (again from my article):

Another thing you realise, once you study the white paper, is that unlike many cryptos, which form non-profit foundations, Hedera Hashgraph has formed a for-profit foundation.

From the white paper (the single mention, emphasis mine):

“Hedera Hashgraph Council is a for-profit LLC that will be governed by up to 39 renowned enterprises and organizations, across multiple industries and geographies.”

And yet it wants to be “the new internet”. If the internet had been created as a for-profit foundation and built on closed-source software, the world would be a very different place now. A much less collaborative and much less technologically advanced place.

At this point, I should make it very clear that I haven’t really looked into Hedera Hashgraph much over the last few years. So perhaps these problems have bee—

Actually, let’s take a quick look into it. Give me a second.

…

Okay, it’s still governed by a 39-member council… which it claims means it has “fully decentralised governance”.

No, fully decentralised governance would mean anyone who uses the network could propose changes and vote on them. (For example, like with Fantom. Don’t worry we will get to Fantom soon.)

It does say the council doesn’t receive profits, which they seem to have changed. Council members were originally supposed to get dividend payments. So that’s good.

It’s still a permissioned network. But it says it has plans to go permissionless at some point.

And it’s still owned by an LLC, not a DAO or a non-profit foundation like the majority of cryptos.

But it has recently allocated 20% of the total supply (worth $5 billion at the time) towards development initiatives. Basically, paying people to build on it.

It’s able to do things like that $5 billion grant because Hedera initially owned 80% of the total supply.

The rest (17.45%) was bought by private investors (VCs, insiders, etc), and 2.42% was used for rewards and airdrops.

You see that bit that says, “Founders & Project”? Usually that would say “Foundation”. But remember, Hedera is a for-profit company. It’s not your typical crypto.

Anyway…

Fast forward to today and Hedera Hashgraph is the 41st largest crypto by market cap.

It still hasn’t really taken off.

Honestly, I thought it would end up being ranked a lot higher by now.

It has so much money and corporate power, it’s hard to see how it didn’t. I mean look who’s on its “decentralised” governing council:

It now also has many investors who really like it – and who see corporations owning and governing it as much better than individuals doing so.

I guess they think, “corporations are good at making money. So it makes sense to invest in the ‘professional’ crypto run by corporations.”

And I’m probably going to get some of them writing me angry emails after I publish this. I just hope Hedera itself doesn’t get in contact with me again.

I should also point out that whether you care about its structure, morals, ideology or whatever…

If you’d invested back in September 2019, when it first started hitting exchanges, you’d be up a lot.

Let me check how much.

…

So, you’d be up 212%.

Wait. I must have that wrong. It must have performed better than that.

No. It’s right.

But Hedera’s price did plumet after it first started hitting exchanges.

It fell to around $0.03, and stayed there for a long time.

So if you’d waited a couple of months and bought in November 2019, you’d be up around 1,000% now.

Although over that same time-frame Bitcoin is up around 1,000%, and Ethereum is up more than 2,300%.

I was gonna say, so you’d be very happy with your returns. But you could have made a lot more, with a lot less stress, by just buying Bitcoin or Ethereum.

Maybe the issue with Hedera Hashgraph is that the majority of crypto investors don’t like how it’s run and what it stands for.

I guess that makes sense if you look into how crypto got started in the first place (see my everything you need to know about crypto in one essay for more on that).

So it’s never really caught on.

Now to finally get back on topic…

What if you took the best of Hedera Hashgraph’s technology…

Improved on it in just about every way…

And created a new crypto?

And what if you ran it like a “proper” crypto – which is owned and run by its community, not a corporation…

Well, you’d get Fantom.

In fact, their technology is so similar that Fantom references Hashgraph a lot in its whitepaper (while showing why Fantom is far superior).

And many in the Hashgraph community see Fantom as some kind of rip-off of Hashgraph. (It’s not, and we’ll get into that later.)

I guess I haven’t helped to dispel that myth by writing an intro to Fantom that’s all about Hashgraph.

But my point is… Hedera Hashgraph had huge potential but ended up as a sort of anti-crypto money/power grab.

Fantom is everything Hedera Hashgraph could have been, and a whole lot more.

So it’s been gaining a lot of popularity recently. And more importantly, a lot of actual adoption.

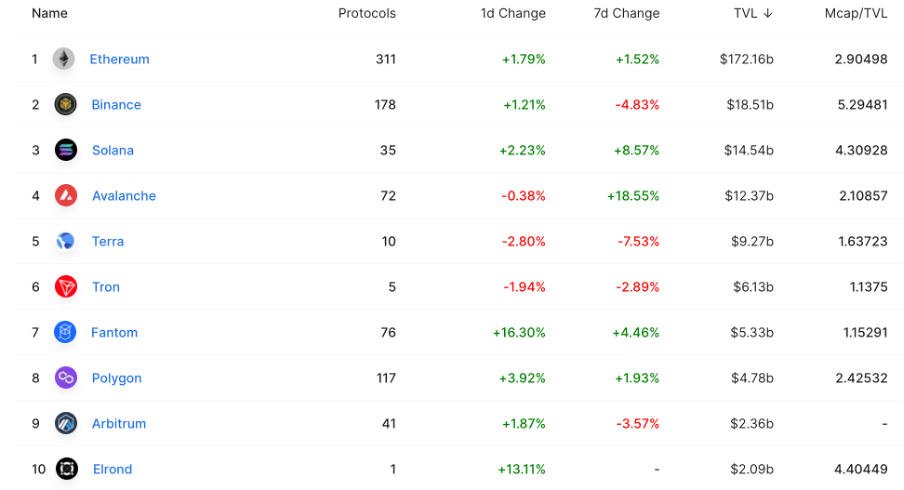

Fantom is currently the 7th most used crypto in the whole DeFi space… with over $5 billion of total value locked.

And yet, it’s currently only the 42nd biggest crypto by market cap.

That tells you a lot about its price potential.

However, like every crypto, it has some big caveats. In fact, the downsides are big enough to give me pause.

The main downsides are very similar to Solana’s, in that insiders own most of the supply.

As usual, I’ll cover the positive and negative points in detail, and you can make your own mind up.

Right, with that rambling intro out of the way, let’s get on with the full review…

Become a premium member to read the rest of this article

As a premium member, you’ll get access to all our deep dives, features and guides, as well as our premium newsletter.

SubscribeAlready have an account? Log in