Everything you need to know about crypto in one essay

If you want to know what crypto is, why it's important, and why you should care, this is the one essay you need to read.

Part I: slaying the vampire squid

“In a society governed passively by free markets and free elections, organized greed always defeats disorganized democracy.”[i]

This is the somewhat bleak conclusion of one of the most famous financial exposés of all time.

In it, Rolling Stone’s contributing Editor, Matt Taibbi rails against Goldman Sachs, describing it as “a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.”

He shows how it caused, and profited from, every major financial crisis in American history, from the Great Depression to 2008.

According to Taibbi, it did it using a simple formula:

Goldman positions itself in the middle of a speculative bubble, selling investments they know are crap. Then they hoover up vast sums from the middle and lower floors of society with the aid of a crippled and corrupt state that allows it to rewrite the rules in exchange for the relative pennies the bank throws at political patronage. Finally, when it all goes bust, leaving millions of ordinary citizens broke and starving, they begin the entire process over again, riding in to rescue us all by lending us back our own money at interest, selling themselves as men above greed, just a bunch of really smart guys keeping the wheels greased

So, in the run-up to the 2008 crisis, for example, Goldman:

· Bundled junk mortgages with good ones and sold the bundle as a AAA-rated investment product.

· Took up a position against insurance firm AIG, which meant that if those products defaulted, AIG would need to pay Goldman a lot of money.

· Sold those products to pension funds and insurance companies.

· Then publicly stated it was shorting those very same products.

Guess what happened next.

The housing bubble collapsed and triggered the financial crisis.

Goldman was investigated for its part and ordered to pay a $60 million fine.

Meanwhile, Bear Stearns, Lehman Brothers and AIG collapsed.

And millions of ordinary people saw their pension pots evaporate, along with their standard of living and future job prospects.

But here’s the best part: AIG, unable to pay its debts, was bailed out by American taxpayers… and $13 billion of that bailout money ultimately went to Goldman Sachs.

So, as Taibbi says, Goldman “made out on the housing bubble twice: It f***ed the investors who bought their horses***t CDOs by betting against its own crappy product, then it turned around and f***ed the taxpayer by making him pay off those same bets.”

Okay, but what does any of this have to do with crypto?

Well, as you’ll soon discover, crypto – or rather Bitcoin – was created to put an end to this kind of parasitic behaviour.

The financial system is set up to be sucked dry by parasites

As you’ve just seen, there is an awful lot of money to be made fleecing people of theirs.

But parasites like Goldman Sachs don’t just make money in such blatantly corrupt ways as the above.

Investment banks and the financial elite suck money out of the system almost imperceptibly, thanks to something called the Cantillon effect.

From Investopedia:

When a central bank or other monetary authority expands the supply of money and credit in an economy, the new units of money always enter the economy at a specific point in time and into the hands of specific market participants, and then spreads out gradually as the new money changes hands in successive transactions. Over time this causes most or all prices to adjust upward, in the familiar process of price inflation, but this does not happen instantaneously to all prices.

Early recipients of the new money are thus able to bid up prices for the assets and goods that they purchase before prices in the rest of the economy rise. This is part of the economic phenomenon known as a Cantillon Effect.

So basically, when the economy gets into trouble, central banks print money to get things moving again.

However, that new money doesn’t land in everyone’s hands equally. The banks and financial institutions get it first and they use it to bid up asset prices.

In the case of the 2008 crisis, banks caused it with schemes like the one we’ve just explored… and then banks benefited from all the money printing governments did to get us out of it.

But it’s not just the banks that benefit. It’s the financial elite, too. They are the ones who hold the majority of the assets getting bid up by all that new money.

Meanwhile ordinary people are left poorer.

This dynamic was summed up well by the Guardian back in 2019[ii]:

While helping keep borrowing costs low, low rates and QE [money printing] drove up asset prices. As well as the anniversary of the rate cut, this week also marks 10 years since the FTSE 100 hit its post-financial crisis nadir of 3,512, before going on one of the biggest bull runs in history, doubling to more than 7,000.

Wealth inequality has soared. The least wealthy 10% of households saw their real wealth rise by £3,000 between 2006-08 and 2012-14, versus £350,000 in gains for the wealthiest 10%.

…

Blanchflower, who will publish a book this summer, Where Have All the Good Jobs Gone?, on the cost of the policy reaction to the crash, said: “It made people think: ‘Those bastards, they got rescued.’ The banks raised asset prices and the stocks that fell suddenly came back up. If I don’t have assets, what’s happened is I’m pissed off.”

So thanks to bailouts and money printing, the banks and the financial elite get richer at the expense of everyone else, especially the poor.

(I wrote a whole essay on this: What does inflation have to do with Bitcoin anyway?)

But that’s just the way the system is.

There’s nothing normal people can do to make it fairer because it benefits those who are already in positions of power.

What was needed was an entirely new monetary system, which couldn’t be so easily corrupted.

Enter Bitcoin.

Bitcoin was created to slay the vampire squid

Written into Bitcoin’s first ever transaction and preserved for all eternity was the following string of text: “The times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

This was no accident. It was a statement of intent.

Bitcoin was created by a mysterious figure using the pseudonym Satoshi Nakamoto.

Over the years, many people have claimed to know who Nakamoto is. Some even claim to be Nakamoto themselves.

But Nakamoto’s true identity remains a mystery. And the most likely candidate (Hal Finney) is now deceased. So we may never actually know with certainty who Nakamoto really is or was.

However, given that Nakamoto was a fairly prolific poster on various platforms, we do know something of their values.

And it’s clear that Nakamoto wasn’t a fan of traditional currency, central banks or banking in general.

From Nakamoto:

The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.[iii]

The core idea behind Bitcoin is that it allows people to send money safely, over the internet, without the need for any central authority to guarantee or oversee their transactions.

Bitcoin does away with the need for central banks to create money and national banks to move it around.

And perhaps most importantly, its supply can never be artificially inflated. There will never be more than 21 million Bitcoin in existence.

So no more Cantillon effect and no more reverse-Robin-Hood economics, with the rich getting richer at the expense of the poor.

At least, that’s the idea.

Gaming greed to make things fairer for everyone

Remember that quote we began with: “In a society governed passively by free markets and free elections, organized greed always defeats disorganized democracy.”[iv]

Well, the genius of Bitcoin is that it does the exact opposite. It harnesses greed to create democracy.

The Bitcoin network is maintained by “miners”. These are people that lend their computer power into keeping the Bitcoin network secure. For doing this, they get rewarded in Bitcoin.

Anyone can become a Bitcoin miner. All you need is a computer and an internet connection.

And the more people that decide to mine Bitcoin, the more decentralised, democratic and powerful its network becomes.

In this way, Bitcoin is flipping the Goldman Sachs model on its head.

Of course, in practice, it doesn’t work quite as smoothly as this. As more and more people mine, it gets harder and harder to make money at it and so smaller players get pushed out.

Right now, it’s hard to make money mining unless you live somewhere with very cheap electricity. And then there’s also the problem of Bitcoin’s massive energy usage.

Even so, it’s a very elegant model to harness greed and self-interest for the good of the many.

And it’s worth noting that both of these problems have now been solved by second generation cryptos, which don’t rely on solving mathematical problems to keep their networks secure.

(I’m planning to cover the energy issue in a future essay.)

So, how has Bitcoin been received over the 12 years since its inception?

Has it really made a difference, or has it just become another speculative asset for Goldman and its ilk to jam their blood funnels into?

First they ignore you

Bitcoin launched in 2009 and went largely unnoticed for a few years.

The only people using it were computer geeks and drug dealers on the dark web.

Then in 2017 everything changed.

Crypto, and Bitcoin in particular, hit the mainstream. Suddenly everyone was talking about it.

Then they laugh at you

At the beginning of 2017 if you told someone you were putting money into Bitcoin they would usually have one of two reactions. They’d either ridicule you or they’d have no idea what you were talking about.

By the end of 2017, those same people would be ringing you up, asking how they could get in on it.

Bitcoin went from “magic internet money backed by nothing” to the world’s hottest investment in the space of a year.

Then they fight you

As Bitcoin gained popularity and started being taken seriously, financial cronies scuttled out of the woodwork to denounce it.

JPMorgan’s boss, Jamie Dimon famously called Bitcoin “a fraud”, saying “It’s just not a real thing, eventually it will be closed.”[v]Adding that he’d fire any JPMorgan employee found trading it.[vi]

Goldman Sachs’ boss, the vampire squid himself, Lloyd Blankfein called it “a vehicle to perpetrate fraud”.[vii]Oh the irony…

Warren Buffett was early to the party, he’d been bashing Bitcoin since 2014, saying “the idea that it has some huge intrinsic value is just a joke in my view”.[viii]

Meanwhile in 2018 his Berkshire Hathaway partner, Charlie Munger said trading Bitcoin was “immoral” and “almost as bad” as “trading freshly-harvested baby brains”. [ix]

Wow.

And Warren Buffett reiterated that it was “rat poison squared”.

Most of these cronies made these comments under the pretence that they were saving people from losing their money investing in a highly volatile and hugely risky asset.

Which is strange, given that they don’t usually seem to care all that much about ordinary people losing money, as we’ve already seen. Perhaps it’s just that this time they weren’t in line to profit from it.

Then in 2018, Banking goliaths Lloyds, JPMorgan, Citigroup,[x]Capital One, Discover and Bank of America[xi]all banned customers buying crypto on credit cards.

Fair enough, it’s pretty dumb to borrow money to invest in any risky asset. But the same banks still let people gamble online and in person using their credit cards.

Then you win

Over the next couple of years, something strange happened.

Financial institutions started launching crypto trading desks and creating crypto products of their own.

It turns out that while JPMorgan’s Jamie Dimon was bashing Bitcoin in public, in private he was getting his employees to build a crypto of his own.[xii]

JPM Coin is a stablecoin built on top of Ethereum and will be used to speed up moving money around.

In 2019, Wells Fargo announced it was also creating its own crypto called Wells Fargo Digital Cash.[xiii]

And right now, China[xiv], the US[xv], the European Central Bank[xvi], Japan[xvii], Canada[xviii]and even the Bank of England[xix]are all working on national cryptocurrencies of their own.

In fact, China is already trialling its national cryptocurrency as you read this.[xx]

In the space of two or three years, crypto has gone from being laughed at, denounced and banned to being the unequivocal future of money.

What changed?

Well, the financial industry realised it was fighting the same fight that many industries have faced before and always ended up being obliterated by. The fight against technology.

So it’s taken an “If you can’t beat ‘em, join ‘em” attitude and decided to integrate crypto into its own systems.

Or to put it another way, it’s decided to jab its blood funnel into the world of crypto and see if it can suck up any more money.

What it doesn’t realise at this point is that along with that money, it’s also sucked up a trojan horse.

Subscribe for exclusive content

As a free subscriber, you’ll get our "this month in crypto" newsletter and access to members-only crypto guides, explainers, reviews and reports.

Part II: crypto’s Trojan Horse

So here we are.

In the last few years, Bitcoin has begun to change the face of money.

And as a direct result, countries around the world are creating their own cryptocurrencies, which they call Central Bank Digital Currencies (CBDC).

(I have a whole explainer on CBDCs here if you want to know more about them.)

And the investment banks, who caused the 2008 financial crisis that birthed Bitcoin, are creating cryptocurrencies of their own.

Is this really what Satoshi Nakamoto set out to achieve?

To create a technology that would be twisted by the banks and used to suck even more money out of the financial system?

If I had to guess, I’d say probably not.

But what the banks don’t yet realise is while they have been twisting Bitcoin’s technology to their own ends, the wider crypto community has been doing exactly the same thing to them.

What we are now seeing is the emergence of Decentralised Finance (DeFi). And what Bitcoin did for money, it promises to do for the entire financial system.

DeFi, not Bitcoin, is the real financial revolution

Bitcoin allows you to make and receive payments without a bank.

DeFi allows you to do everything you can in traditional finance without a bank.

Banking first began with lending and borrowing, and that’s exactly where the majority of DeFi is happening right now.

But eventually it will incorporate every area of traditional finance, from stocks and bonds to mortgages and insurance.

So while the banks have been busy copying Bitcoin, crypto has been busy recreating the entire banking system – with one major difference.

That difference is decentralisation.

In a centralised system, like a bank, the central authority sets the rules and collects the profits.

In a decentralised system, like for example Ethereum-based DeFi platform Compound, the people who use the system set the rules and collect the profits.

(Note, I’m using compound in these examples because it’s currently one of the biggest and most well-known DeFi platforms, but there are myriad out there.)

And because the people actually using the system set the rules, they tend to be much fairer for everyone involved.

Beating the bankers at their own game

To give you an example of just how much better DeFi is for the people that use it, let’s take a look at DeFi lending.

DeFi lending allows you to borrow money at lower rates and lend money out at higher rates than you could get with a bank.

Right now, on the Compound DeFi platform you could lend out the DAI stablecoin at 7.11% interest.[xxi]

Or if you didn’t want to put your money into DAI, you could lend out USDC stablecoin (which is backed 1:1 with US dollars and regularly audited) at 2.69% interest.[xxii]

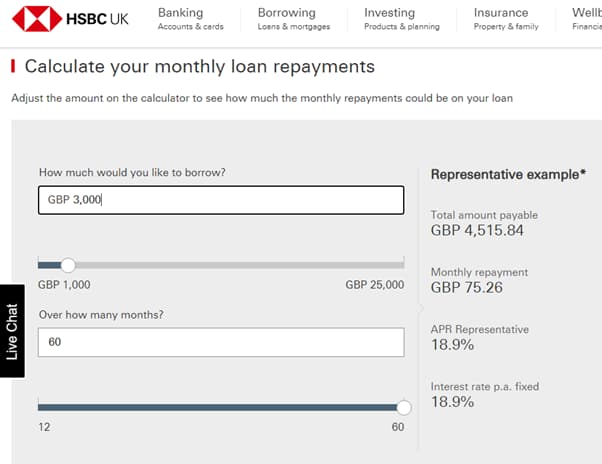

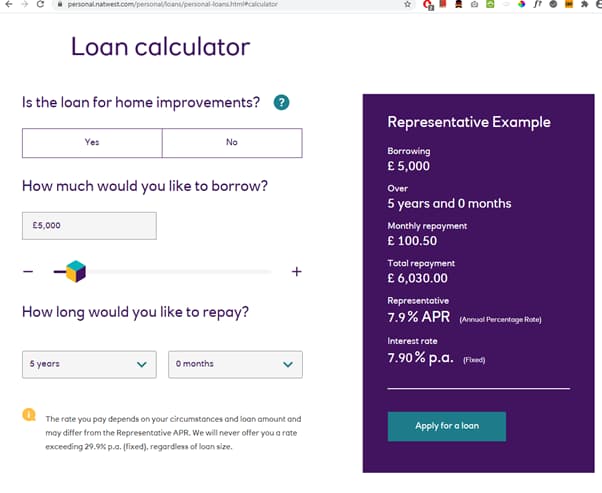

Compare this to the 0.01% interest you can get through a typical savings account with NatWest[xxiii], HSBC[xxiv], Lloyds[xxv]or most any other bank you care to mention, and you start to see why DeFi is gaining so much traction.

Yes, that’s right. Traditional savings accounts currently pay just 0.01% interest to people supplying them with money.

(You can read my essay: What does inflation have to do with Bitcoin anyway? For more on that.)

The same goes for borrowing.

As you can see, you can borrow USDC at 3.86% APR.

This is much lower than the 18.9% APR you’d pay to borrow £3,000 from HSBC[xxvi], or even the 7.9% APR you’d pay to borrow £5,000 from NatWest.[xxvii]

So basically, DeFi allows ordinary people to earn more than 700-times as much interest on their money as they can through a traditional bank.

And it allows them to borrow against their money at less than half the interest rate they would get through a traditional bank.

But here’s the kicker, by “ordinary people” I mean anyone, anywhere in the world. Because just like Bitcoin, DeFi is borderless.

This is why people have started calling DeFi crypto’s “killer app”.

Not only does it allow people to get better rates than they could through their bank, but it allows them to bypass their bank completely and lend out or borrow money on their own terms.

To give you an idea of how much ground DeFi is gaining, here’s a handy chart, courtesy of DeFi Pulse:

Over the last three years, the amount of money locked up in DeFi has gone from $0 to $43.7 billion.

And to give you an idea of just how fast this is growing, back in August 2020, when I was first researching this essay, the amount of money locked up was only $3.8 billion.

Like most revolutionary ideas DeFi took a while to gain traction. But once it did… well, take a look at that chart.

How is this possible?

Now you may be wondering, what changed?

Why is it only in the last year or so that DeFi really took off when Bitcoin has been around for over a decade.

That’s because DeFi isn’t built on top of Bitcoin.

Bitcoin is a great technology, but it is also extremely limited in what it can do.

Although it was originally created as a day-to-day currency, it has become more like digital gold.

Which is interesting, given that countries’ currencies used to be backed by gold.

The reason countries stopped backing their currencies with gold was so that they could print as much money as they wanted without consequence.

That is, unless you consider what we looked at in part one as a consequence.

We can think of Bitcoin as crypto 1.0.

It is perfectly good for storing and transferring value, but not much else.

Crypto 2.0 took this idea and ran with it.

Just like a computer system, second generation cryptos are programmable.

Instead of just transferring a single type of value, like Bitcoin, second generation cryptos can create and transfer any type of value you can think of.

They do this by using something called “smart contracts”.

These are contracts, written into code, that execute automatically when certain conditions are met.

A smart contract, for instance, could represent a company bond.

And it could be programmed in such a way that it works just like company bonds do today.

It would pay out a set amount of interest every year for a set number of years, and at the end of the term, it would pay out the original amount on top.

The advantage here would be that once it was programmed, everything would happen automatically with no human input… cutting out layers and layers of financial middlemen.

This smart contract would be represented by a “token”, which you could buy, sell and trade with whomever you wanted, at any time you wanted and for any price you both agreed on.

And again, you could do it without anyone else ever being involved or taking a cut.

Second generation cryptos like Ethereum, are the reason DeFi exists, and they didn’t really get going until 2017.

In fact, it would be fair to say that second generation cryptos, not Bitcoin, are what caused the 2017 bull run.

Initial Coin Offerings (ICOs) were all built on top of second generation cryptos, using smart contracts.

The more traditional finance integrates crypto, the easier it will be for crypto to consume it

We left part one with traditional finance – or the vampire squids – moving in on Bitcoin and recreating it in its own image.

But what we now know is that while all this has been going on, crypto has been moving in on traditional finance and recreating it in itsown image.

The situation reminds me of the sci-fi novel Solaris, written by Stanisław Lem in 1961.

In that novel, humans discover alien life in the form of an ocean-based planet.

As a group of scientists set about trying to investigate and understand it, strange things start happening to them.

And by the end of the novel, they have all gone insane.

It turns out that while the scientists thought they were investigating the planet, the planet was actually investigating them.

And the planet turned out to be much, much more powerful than anyone could have ever imagined.

Right now, traditional finance simply doesn’t understand how revolutionary and powerful DeFi is.

It’s not just a new technology they can integrate into their own systems. It is their antithesis, and at some point in the near future, it is going to engulf them.

The vampire squid has found itself swimming in Solaris’ ocean.

So where does that leave us?

Well, here’s the amazing thing about crypto, which you’ll discover in part three. It’s not just money and finance that crypto is revolutionising.

It is doing exactly the same thing to all of our core industries, from food to transport to communication.

Through the power of decentralisation, crypto is creating a fairer world for everyone.

Finding this interesting? Subscribe for more

As a free subscriber, you’ll get our "this month in crypto" newsletter and access to members-only crypto guides, explainers, reviews and reports.

Part III: Take The Power Back

So if crypto began as an alternative currency and then grew to become an entire alternative financial system, what does the future hold?

That’s what the third part of this essay is about.

The maths, the computer code, and the networks that enable crypto are complicated. But the core idea of crypto is a simple one: decentralisation.

This is how Satoshi Nakamoto began the first ever public communication about Bitcoin:

“I've been working on a new electronic cash system that's fully peer-to-peer, with no trusted third party.”[xxviii]

Decentralisation takes the power away from central authorities and spreads it out among the people.

It’s like going from feudalism to democracy.

In terms of finance, we relied on these central authorities to make sure everything ran smoothly. Paying them for this service was only fair.

But, as the famous line goes, “power tends to corrupt, and absolute power corrupts absolutely.”

And over the course of the 20th century, as these central authorities, these financial institutions, became more powerful, they also tended to become more corrupt.

We saw what happened with that in part one.

By decentralising financial systems, it takes the power away from financial institutions and puts it into the hands of those using the system.

No longer is the system owned and run by a powerful third party, but by its participants. It is peer-to-peer.

Strength in numbers

This crypto revolution is about a lot more than just the world of finance.

And it’s about a lot more than just making money, too.

As we’ve seen, the main power of crypto is decentralisation. But there are two other major benefits to decentralisation that we haven’t looked at yet.

The first is strength. The second is security.

You’d have thought if Bitcoin were any real threat to central and national banks they would have simply had it shut down, as JPMorgan’s boss Jamie Dimon thought they could back in the day.

But that’s the thing about crypto – real, decentralised crypto – you can’t shut it down.

To find out why, let’s look at how the blockchain technology crypto is built on works.

· A blockchain is like a distributed database.

· Many different computers called nodes keep identical copies of this database and they must all agree on what it contains.

· Updates to this database are grouped together into a block of data. The nodes look at this block of data and all have to agree it is true.

· If the nodes all agree the new block of data is true, they add it to the database.

· These blocks are chained together in the order they were added and form a chain of blocks, or a “blockchain”.

· Once the new data becomes part of the blockchain it cannot be removed, or changed – ever.

· In order to change it you would have to take over more than 51% of the nodes and force them to agree on a change. And the older the data the harder it is to change.

A well-established blockchain like Bitcoin or Ethereum is essentially impossible to change, even if you had billions of dollars at your disposal.

The key part of all this is the decentralisation. The database is not controlled by a central authority. It is controlled by thousands of different people all over the world.

The fact they all have to agree on what the database contains means if you hack one, or even a number of them, it doesn’t matter. You can’t change anything.

Since Bitcoin’s inception in 2009, its network has had zero downtime – ever.

It’s kind of scary to think that no one can shut down Bitcoin. But it’s also true democracy in action.

If the world wants Bitcoin to keep going, there’s nothing any government can do to stop it. And the same goes for any other decentralised crypto.

Truly decentralised systems are infinitely stronger than centralised ones because there is no single point of failure.

Which brings us to security.

In order to “hack” a blockchain you need to take control of over 50% of the network.

This would mean hacking thousands and thousands of computers at the same time, or buying more computing power than all the computers currently securing the network.

As I said, for a big blockchain like Ethereum or Bitcoin, that would cost tens of billions of dollars and may not even really be possible even with unlimited money.

Don’t get sucked in by pseudo crypto

It’s probably worth noting here that all those twisted cryptos currently being created by banks are not decentralised.

The bank that created them has power over their networks. They aren’t secured or maintained by anyone but the bank that created them. They aren’t public. And you need permission to use them.

You may have heard the phrase, “Without decentralisation, crypto is nothing more than an inefficient database.”

Well that sums up cryptos like JPMorgan’s JPM Coin.

They were created because, as Forbes says: “banks like JPMorgan are coming under extreme pressure because their role as middlemen is in jeopardy”[xxix]

So they have created pseudo cryptos to try trick the rest of the financial industry into sticking with them.

But eventually, people will realise that there isn’t any benefit to using a private, permissioned, centralised crypto over just using a traditional database… which would be faster, cheaper and more efficient.

If you’re not getting the benefits of decentralisation that we’ve looked at today, you would be much better served with a traditional database.

As Charles Hoskinson, Cardano’s founder and Ethereum’s co-founder said when asked about JPM Coin: “[They] just don’t get this space, [they] just don’t have any idea how these things work. It’s an abomination of a cryptocurrency, it’s an abomination of a concept.”

Adding, “it’s just proof of concept for the sake of being a proof of concept to say that they’re in the space and they can justify some sort of bizarre executive fantasy.”[xxx]

Bridging the gap

So second generation cryptos, with their smart contracts, allow us to create platforms that are cheap, efficient, strong, secure and self-sustaining. Oh, and fairer for everyone involved in them.

Basically they allow you to take any industry and make it fairer, more efficient and, perhaps most importantly, more profitable.

The customers benefit from reduced fees and a faster service and the providers benefit from better efficiency and reduced costs.

The people that lose out are the middlemen, the parasites.

But how on earth do you bridge the gap between a computer network and the real world?

Crypto works well in the financial world because finance is all based on computers and code already.

How do you expect crypto to change real-world industries like property, energy and transportation?

Through something called tokenisation.

Tokenising the world with NFTs

Tokenisation is basically representing a real-world asset or contract in the form of a crypto token.

These tokens aren’t new cryptos, they are smart contracts built on top of second generation cryptos.

As I said in part two, most of the ICOs during the crazy days of 2017 were for tokens, almost all of which were built on top of Ethereum.

But tokens can represent anything.

Property is a good example, and one that’s gained a lot of traction over the last couple of years.

Basically a building’s title gets tokenised and shared between a set number of tokens.

If you own one of the tokens, you legally own a corresponding share of the property.

And these tokens can even be programmed to pay out a corresponding percentage of the property’s rental income every month.

With tokenisation, huge property deals can be opened up to everyone.

Instead of having a minimum investment amount of a few hundred thousand pounds, you could get in for as little as £1.

And instead of dealing with armies of middlemen – lawyers, surveyors, estate agents, mortgage brokers, banks and local officials – you deal directly with the seller.

And instead of being locked into your investment for years or even decades, you can trade it anytime you like, day or night on any crypto exchange.

But property is just one example.

To give you an idea of just how powerful tokenisation can be, there is now around $10.8 billion worth of Bitcoin tokenised on Ethereum… which is a crazy thing to try get your head around. [xxxi]

And you can use this model to tokenise anything, from stocks to art to energy to air-miles.

At the moment we’re seeing a big craze in tokenising art and music with Non Fungible Tokens (NFTs).

That may sound complicated, but “non-fungible” just means the token is unique.

To give you an idea of how big this idea is getting, in March this year an NFT representing a piece of art was auctioned at Christie’s for $69.3 million.[xxxii]

And one of the biggest bands in the world, Kings of Leon are tokenising their next album and releasing it as an NFT.[xxxiii]

Once tokenised, all these things can then also be built into DeFi projects. The possibilities for combination of tokenisation and DeFi are virtually limitless.

Which is why, I don’t think it’s an exaggeration to say…

This is the next internet

Over the last 20 years or so, many of our major industries and businesses have moved onto the internet.

And some of the biggest companies around today simply would not have existed, had it not been for the internet.

No Google, no Amazon, no Netflix, no Facebook.

Today we take the internet, and all the things it has enabled, for granted.

It’s hard to see any technology having as much impact on our lives as the internet has done.

But crypto might just come close.

In the short time it’s been around, crypto has gone from merely being a currency to creating a new decentralised financial system.

But the biggest thing crypto has going for it is that just like the internet it is a platform that other people can build things on top of.

Only, as we’ve seen, when things are built on top of crypto they are inherently fairer, safer, securer and more efficient.

Within the crypto ecosystem, you don’t cede control over to a central authority in order to participate.

In a social network built on crypto, for example, users could control their own data.

If Facebook were built on crypto, for example, it wouldn’t be able to access its users’ data without their permission. So it wouldn’t be able to sell that data on without their permission, either.

What’s more, users would be able to revoke Facebook’s access to their data at any time they wished.

And if they chose to, they could sell their data directly to advertisers themselves.

It may sound like a farfetched idea, but this is essentially how Brave Browser and Basic Attention Token work. And they have been working successfully for a couple of years now.

To give you an idea of just how well this idea is working, Brave Browser now boasts over 25 million monthly active users.[xxxiv]

But this is just one example.

Over the next few years, we are going to see entire new businesses and industries being built on top of crypto – just like we have with the internet – many of which we can’t even conceive of right now.

And this time around, it won’t just be the businesses that benefit. It will be their users, too.

Thanks for reading.

Harry

Found this interesting? Subscribe for more

As a free subscriber, you’ll get our "this month in crypto" newsletter and access to members-only crypto guides, explainers, reviews and reports.

[i] https://www.rollingstone.com/politics/politics-news/the-great-american-bubble-machine-195229/

[ii] https://www.theguardian.com/business/2019/mar/08/the-verdict-on-10-years-of-quantitative-easing

[iii] https://satoshi.nakamotoinstitute.org/posts/p2pfoundation/1/#selection-45.1-45.480

[iv] https://www.rollingstone.com/politics/politics-news/the-great-american-bubble-machine-195229/

[v] https://www.cnbc.com/2019/12/20/jp-morgan-ceo-jamie-dimon-in-2017-calls-bitcoin-a-fraud.html

[xiv] https://www.coindesk.com/coindesk-50-how-peoples-bank-china-became-cbdc-leader

[xvi] https://www.ledgerinsights.com/digital-euro-central-bank-digital-currency-cbdc/

[xviii] https://www.coindesk.com/bank-of-canada-central-bank-digital-currency-project-manager

[xx] https://www.coindesk.com/coindesk-50-how-peoples-bank-china-became-cbdc-leader

[xxi] https://compound.finance/markets

[xxii] https://compound.finance/markets

[xxiii] https://personal.natwest.com/personal/savings/instant-saver.html

[xxiv] https://www.hsbc.co.uk/savings/products/premier/

[xxv] https://www.lloydsbank.com/savings/easy-saver.html

[xxvi] https://www.hsbc.co.uk/loans/products/personal/

[xxvii] https://personal.natwest.com/personal/loans/personal-loans.html#calculator

[xxviii] https://satoshi.nakamotoinstitute.org/emails/cryptography/1/

[xxxi] https://btconethereum.com/

[xxxiii] https://www.rollingstone.com/pro/news/kings-of-leon-when-you-see-yourself-album-nft-crypto-1135192/

[xxxiv] https://brave.com/25m-mau/

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).