This week in crypto: bankruptcy bingo

Let me take you on a journey through one of the most insane weeks crypto has ever seen.

Well this is awkward.

I already used the “I declare bankruptcy!” meme last month, when Terra self-combusted.

But in the last two weeks, we’ve seen bankruptcy after bankruptcy after bankruptcy… even if the companies involved aren’t admitting it out loud just yet.

It all started with rumours about Celsius’ insolvency.

As I reported two weeks ago:

According to SmallCapScience, Celsius holds $1.5 billion stETH. And if stETH continues to depeg from Ethereum, Celsius – and its users – could be in real trouble. …

Adding all this together, it’s fair to say Celsius might be a risky place to store crypto right now.

Or this could all just be a very well-orchestrated FUD campaign. I guess we’ll find out eventually.

“Eventually”, as it turned out, was less than 24 hours after I published.

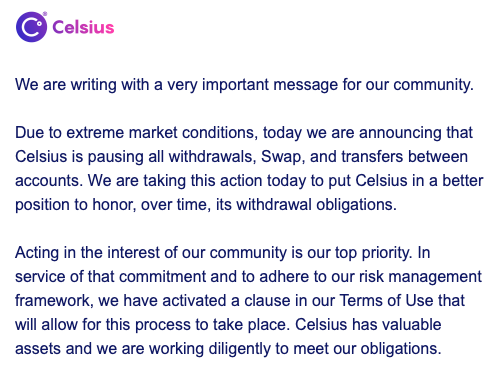

On Monday morning, I, and more than a million other customers, woke up to this email from Celsius:

I would hope that anyone who read my newsletter and SmallCapScience’s twitter thread managed to move any funds they had off Celsius in time.

But the vast majority of Celsius’ 1.7 million customers likely weren’t so lucky.

And as the news surfaced, the crypto community – understandably – went nuts.

Will any customers get their crypto back? As with most things in crypto, no one really knows.

What we do know is that shortly after halting all withdrawals, Celsius called in Citigroup to advise “on potential financing options”.

In short, it’s not looking good for Celsius.

And like most crypto blow ups, this one has the project founder acting incredibly hypocritically just days – or in this case, hours – before it all kicked off…

D…d…dominoes

Celsius was far from the only major player to implode this week.

Fellow crypto lender, Babel Finance also suspended withdrawals, citing “unusual liquidity pressures.”

But the big one was Three Arrows Capital (3AC) – one of the biggest crypto Venture Capital firms in existence.

3AC lost a lot of money on the Terra Luna UST collapse. Reportedly between $200 million and $450 million.

At first people thought 3AC was big enough to take the loss. But things soon started to unravel.

On the 15th of June, two days after Celsius suspended withdrawals, Zhu Su, founder of 3AC sent an ominous tweet:

Eeeeeeeeeee…

Rumours started circling. Surely 3AC couldn’t go down, too?

Oh yes it could.

The next day BlockFi’s CEO, Zac Prince confirmed it had liquidated “a large client that failed to meet its obligations.”

Although he didn’t mention 3AC by name, it was easy to connect the dots.

Later that day, the Financial Times reported both BlockFi and Genesis (another big crypto exchange and lender) liquidated “at least some of Three Arrow’s positions”.

And now its emerged 3AC has failed to repay $666 million in loans to Voyager Digital.

From the Wall Street Journal:

Voyager Digital said it lent 15,250 bitcoin and $350 million in USD Coin to Three Arrows Capital. The company initially asked for a repayment of $25 million USD Coin by June 24 and then asked for the entire balance to be paid by June 27. These loans amount to $666 million based on bitcoin’s current price. Neither of these loans has been repaid, it said.

The Wall Street Journal also reports that in order to meet its “customer liquidity needs”, Voyager Digital then took out a loan from Almeda Research, including “$200 million in cash and USD Coin and 15,000 bitcoin”.

Meanwhile, BlockFi – the ones who liquidated 3AC’s position – had to ask crypto exchange FTX for a $250 million loan of its own.

I’m sure there’s a joke here I could make about lending companies needing to lend money themselves, but it’s frying my brain just trying to get all this onto the page.

To get back on topic…

Both Almeda Research (the ones who bailed out Voyager) and FTX (the ones who bailed out BlockFi) were founded by crypto billionaire Sam Bankman-Fried, or SBF as he’s known.

SBF is the second richest person in crypto, with an estimated fortune of $24 billion. And his FTX exchange is also doing much better than others during this crypto winter (more on that later).

So if anyone can bail out the failing crypto companies, it’s him. And the fact he’s already bailed out two big ones led to memes about him bailing out the whole world.

But SBF wasn’t the only one looking to snap up some bargains help out fellow crypto companies in need.

Crypto lending firm Nexo has very publicly offered to buy up Celsius’ assets:

Nexo was also quick to distance itself from the 3AC fiasco saying, “Over 2 years ago, we declined 3AC’s request for unsecured credit. We learned that they acquired it elsewhere.”

And now, to come full circle, Nexo has hired none other than Citigroup – the ones helping Celsius with “potential financing options” – to advise it on new acquisitions.

Breaking: as I was writing this, Goldman Sachs – the great vampire squid itself – is seeking $2 billion to snap up Celsius’ assets.

From CoinDesk:

Goldman Sachs is looking to raise $2 billion from investors to buy up distressed assets from troubled crypto lender Celsius, according to two people familiar with the matter.

The proposed deal would allow investors to buy up Celsius’ assets at potentially big discounts in the event of a bankruptcy filing.

Wow. This is turning into a Barbarians at the Gate moment for crypto. I can’t wait to see how this all progresses.

But let’s get back on track.

Nexo and FTX have really been winning this crypto winter so far. Other exchanges are doing less well…

Top crypto companies start to crumble

Amid the market chaos, Billionaire investor and founder of Galaxy Digital, Mike Novogratz (yes the same Mike Novogratz who got a Terra Luna tattoo shortly before its collapse) prophesied that 2/3 of crypto hedge funds would go bankrupt during this crypto winter.

(How’s that for a long sentence?)

Speaking at a conference earlier this month, he said:

Volume will go down, hedge funds will have to restructure. There are literally 1,900 crypto hedge funds. My guess is two-thirds will go out of business.

If he’s right, the 3AC mess could just be the beginning. I have a feeling we’re going to start hearing the word “contagion” an awful lot.

And it’s not just crypto hedge funds.

This month:

- BlockFi (the company that needed a bailout from SBF) is firing 20% of its staff.

- Crypto.com (the company that paid an insane $700 million to rebrand the Staples Center to the Crypto.com arena) is firing 260 workers.

- And Coinbase cut 18% of its staff then later announced it was closing Coinbase Pro.

Now Coinbase is an interesting one. It’s the biggest US crypto exchange by volume, and it’s one of the only crypto companies to be publicly listed.

Back in 2017 it really felt like Coinbase was going to become the Amazon of crypto. But recently it seems more likely it’s going to be crypto’s AOL. Huge in the beginning and then fading into obscurity.

Case in point, its stock price is down 75% Year to date (YTD). Its entry into NFTs was a flop (which it paid a former Google VP a ridiculous $646 million to make). It’s having to fire 18% of its staff to cut costs. And it now has extreme competition from other exchanges.

As CNBC reports:

Coinbase shares fell almost 10% on Wednesday after rival crypto exchange Binance.US said it’s dropping certain trading fees for customers.

Binance.US, the U.S. affiliate of the largest crypto exchange in the world by trading volume, said it will allow users to make spot bitcoin trades for the U.S. dollar and stablecoins tether, USD Coin and Binance USD without paying spot trading fees.

Speaking of Binance, it’s one of the few crypto firms that seems to be flourishing, despite the downturn.

“Binance, Kraken, FTX Go on Hiring Spree as Rest of Crypto Crumbles,” reports TheStreet.

Right now it’s looking like one of those three firms is most likely to become the real “Amazon of crypto”. Time will tell.

Things get weird. Really weird

Solana is making a phone

Well, it wouldn’t be crypto without some ridiculous things happening despite – or maybe because of – the capitulation.

First of all, Solana announced it was making a phone.

No. This isn’t an April fools. It’s very real:

NEW YORK, June 23, 2022 /PRNewswire/ – Solana Mobile, a subsidiary of Solana Labs, introduced Saga, a flagship Android mobile phone with unique functionality and features tightly integrated with the Solana blockchain making it easy and secure to transact in web3 and manage digital assets, such as tokens and NFTs.

Solana has fast become one of the new cryptos everyone loves to hate.

A combination of big VC backing, a massive price rise, network outages, a big price drop and general crypto tribalism have created the perfect storm of crypto hate against Solana.

Personally, I think even with its problems, it’s still better than 99% of other cryptos (as you’ll know if you read my Solana deep dive).

But that’s beside the point. Bringing out a “Solana” phone in the depths of a crypto winter just seems crazy.

Celsius’ CEL token jumped 923% after it basically declared it was bankrupt

Only in crypto…

After Celsius halted withdrawals and called in restructuring experts, you’d have thought its CEL token would have dropped in value.

Instead, it did a 10x in eight days.

Why?

Well for the answer to that, we’ll turn to that oft quoted maxim: “The market can stay irrational longer than you can stay solvent.”

Basically the Celsius community decided to buy up as much CEL as they could to create a “short squeeze” a la the infamous GameStop short squeeze during the pandemic.

Even today, CEL is still up 560% from its low on the 13th of June. How long will it last? Who knows? But surely, it’s heading to zero eventually, right?

Eminem and Snoop Dogg drop a new single where they’re bored apes

If you didn’t know, Snoop Dogg is really, really into NFTs.

In fact, he and Eminem just released a new track where they become bored apes. Again… yes, really.

And the greatest story of them all… as crypto burns, Vitalik reviews his new backpack

There is no figurehead quite like Vitalik Buterin.

Even if he wasn’t the genius that created Ethereum, he’d still be a super interesting person.

I mean, how many other people on the planet would donate $1.5 billion to charity just days after becoming a billionaire?

As I wrote in May:

When Ethereum broke through the $3,000 (£2,114) barrier on the 3rd of May, it made 27-year-old Vitalik the world’s youngest crypto billionaire. And the second youngest self-made billionaire in history.

That’s a big achievement.

But what he did next was unprecedented.

A number of scam, hype and meme coins tried to gain credibility by sending large percentages of their total supply to crypto wallets owned by Vitalik.

Not only did this lend the projects fake credibility – “Vitalik is our biggest holder” – but it also meant no one was going to “rug pull” investors.

Vitalik would never sell those scam tokens, right?

Wrong.

In an absolute masterstroke, Vitalik took that $1.5 billion of shitcoins and donated them to charity. He gave $1 billion to India’s Covid relief fund alone. (source: Tech Crunch).

It may even go down as one of the biggest charity donations in history.

Sure, most people probably like to think they would act as Vitalik did/does if they ever got rich. But when it comes down to it, no one really does.

And in keeping with Vitalik just living his best life and being his own person, this week, while crypto was burning down, he wrote a blog post reviewing his new 40-liter backpack.

(that’s what the photo at the top of this article comes from.)

It’s actually a really good guide to minimalist travel.

And it was so popular that it reportedly crashed Uniqlo’s website because so many people want to buy the items he recommends.

There really is no one quite like Vitalik. What a legend.

So, what’s the lesson from this week?

The same one crypto has taught us over and over and over and over again since its inception… NOT YOUR KEYS, NOT YOUR COINS.

Thanks for reading.

Harry

Full disclosure: At time of writing, I held the following cryptos: Ethereum, IOTA, Radix, Mina Protocol, Aleph Zero.

Disclaimer: This content does not constitute financial advice, tax advice or legal advice. Your money and how you choose to spend it is your responsibility. Nothing that appears here should be construed as investment advice or recommendations to buy or sell any securities, cryptos or investments. coin confidential does not offer investment advice. We merely provide information. Crypto investing is highly risky. You should not base any investment decision solely on information we publish. We believe all information we publish to be accurate, but we cannot guarantee it. Always do your own research before making any decisions about your money. See the full disclaimer for more.

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).