This week in crypto: I declare bankruptcy!

We finally got an answer to the $22 million question: is Terra’s ecosystem sustainable?

And the answer is:

That would be a no then.

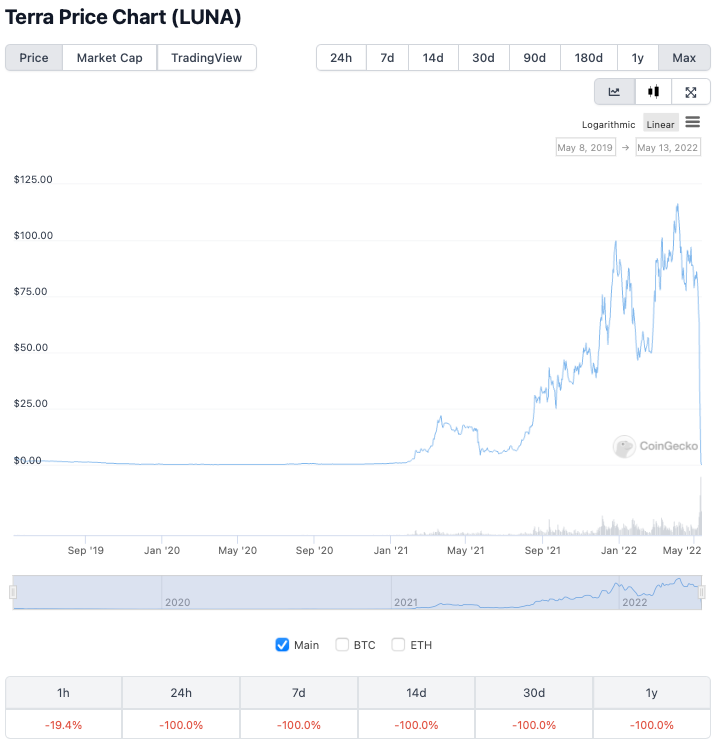

A week ago, Terra’s Luna tokens were trading for $80, today (before the network was shut down) they were trading for $0.000001.

Or to put it in market cap terms, last Friday Terra’s market cap was about $28 billion. Today, it’s roughly $0.

And because so much of crypto has been using Terra’s stablecoin (UST), the “contagion”, as people like to call it, soon spread to the wider crypto market.

Which made crypto front-page news around the world, for all the wrong reasons:

So, what happened?

The basic idea behind Terra is that it’s inextricably linked to its stablecoin UST.

The way it works is fairly simple.

In theory, one UST is always convertible for $1 worth of Terra’s Luna token.

If UST goes down to, say $0.98, you could buy 1 UST for $0.98 and convert it to $1 of Luna, making $0.02.

Do enough of these trades and you make a lot of money… for doing basically nothing. There are people who make trades like this as a career, called arbitrageurs.

When you do the swap, that UST is burned, so it reduces its supply and increases its price.

Do this enough, and UST will eventually return to $1.

Ah, but what if UST goes over $1, say to $1.02?

Well, you can do the opposite, you can convert $1 of Luna for $1.02 of UST. This increases the supply of UST and decreases the supply of Luna, and brings down the price of UST.

Tragedy foreshadowed

This system has been working pretty well for Terra over the last year and a half.

But last May, there was a crypto flash crash, and UST was worth a fair bit less than $1 for a while.

It turns out there’s a $20 million limit on the number of Luna to UST conversions you can do in a 24-hour period.

The May 2021 flash crash overwhelmed Terra’s system because people wanted to convert more than $20 million of UST and Luna in 24 hours.

Terra wrote a whole thread on what happened and how they solved it.

But this was the key part:

So how did they solve it, and make sure it would never happen again in the future?

Easy, they upped that $20 million limit to $50 million.

At the time people were warning Terra could go into a death spiral:

But Terra said this could never happen, for various reasons it outlined in the thread.

Terra becomes too big to fail

All was well. Terra and UST grew to mammoth proportions, Terra soon became a top 10 crypto, and one of the best performing cryptos of the bull run.

Then the bull run came to an abrupt end.

Most investible asset classes peaked in November and they’ve been on a downward slide ever since.

By the beginning of this week:

- The S&P 500 – the world’s benchmark – was down 17.2% from its all-time high (ATH).

- The “tech heavy” Nasdaq was down 28.3% from its ATH.

- Facebook was down 49% from its ATH.

- Apple was down 16.9% from its ATH.

- Amazon was down 42.3% from its ATH.

- Netflix was down 75.3% from its ATH.

- Google was down 25.7% from its ATH.

- Bitcoin was down 54.8% from its ATH.

- Ethereum was down 52.9% from its ATH.

- And the overall crypto market was down 46.3% from its ATH.

Over this time more and more people fled these assets, particularly crypto, and sought safety in cash. Or in the case of crypto investors, in stablecoins.

And it just so happened that Anchor – part of the Terra and UST ecosystem – was offering 19.5% yield on UST.

So UST became incredibly popular. Crypto people also liked the idea of an “algorithmically-backed” stablecoin, like UST over a currency-backed one, like USDC or Tether.

UST’s market cap swelled to more than $18,000,000,000.

And Luna’s market cap swelled right along with it.

Unlike the rest of crypto, which has been losing value since November, Terra continued to gain value.

In fact, Terra’s Luna token only recently hit its ATH, reaching $119 on the 5th of April this year.

Not everyone is so enamoured

Terra was unstoppable.

Or so it seemed.

But there were dissenting voices, warning it was unsustainable.

If you read my article on Terra and its co-founder Do Kwon, you’ll know about the $22 million bet.

Basically, a big crypto trader called Terra a “big ass Ponzi” and offered Do Kwon a $1 million bet that its price will be lower next year than it is today.

(At the time Luna was trading at $92.)

Do took the bet, and landed a jab at the trader, saying he “would prefer to ask whatever your net worth is and bet 90%... But maybe this is what that is already.”

An even bigger trader, called Gigantic Rebirth, saw this and joined the bet with $10 million of his own. Do put up another $10 million. (Here’s the transaction on ether scan.)

So now the face of Terra had a very public $22 million bet that Terra would hold its price.

Gigantic Rebirth then offered to double the bet, but Do never replied.

This was all in March.

Then, just a few days ago, Gigantic Rebirth showed that he’d shorted Luna for another $10 million himself.

But Terra was battle tested, nothing could go wrong, right?

At this point, some people would say the signs were all there.

And I’ve seen a lot of commentary from people saying this was all so obvious. Of course it was all going to end in tears, with Luna going to zero.

But was it, really?

I mean, billionaires were buying into the project. Surely they had done their due diligence?

Billionaire investor and crypto bull, Mike Novogratz, even got a Luna tattoo.

Yes, really:

(Lunacits are what people who are really into Terra call themselves, and that @ is Do Kwon’s twitter handle.)

So although history will remember this collapse as completely obvious, it honestly wasn’t.

I’ve written two articles about the Terra ecosystem this year.

Both times the biggest question I tried to answer was, is it sustainable?

And both times I reached the same conclusion: who the hell knows?

Here’s the conclusion from my most recent one, written in March:

Here’s the $22 million question: is Terra’s ecosystem sustainable?

All of that TVL has brought a ton of attention to Terra, UST and Anchor recently.

The big question is, is it sustainable?

And the answer is… no one really knows.

There are certainly reputable voices who believe Terra’s ecosystem is just one big Ponzi… as we’ve seen today.

And if it does all come crashing down, because UST is becoming such a major stablecoin, it’s likely to take the rest of the crypto market with it.

However, there are also many people who believe Terra may have created a self-sustaining financial system, offering better rates than anything the traditional financial world can compete with.

No matter how it goes, it’s providing an amazing study for other big cryptos and future DeFi projects.

Then the suicide reports started rolling in

There was a pretty big asset crash on Monday (9th of May). Stock markets plunged and crypto plunged even more.

Then UST started to “de-peg”, which means it wasn’t holding its $1 “peg” like it should.

No problem, most people thought, its just because of the big crypto crash, lots of people are moving money into and out of UST.

This was nothing compared to the crypto flash crash of May 2021, and UST survived that. And now it had extra safeguards in place…

Then things took a turn, UST really lost its peg, and the printing of Luna to try stabilise it reached epic proportions.

Then the fabled death spiral appeared. And Terra couldn’t do anything to stop it.

I watched in real-time as Luna fell from $80 to less than $0.80 over the course of a day.

It was absolute carnage.

Just for fun I set up some limit-buys of Luna with about £100, going down from $0.99 to $0.01.

In the end they all got filled.

I think I have about 10,000 Luna right now.

Here’s what’s crazy about that:

Last week, that 10,000 Luna – which I bought for less than £100 – would have been worth about $800,000. Today, it’s worth roughly $0.

But other people were making real trades. I’m sure some people made out like absolute bandits. At one point Luna went from $0.69 to over $5 in minutes.

But on the other side were people who had held their life savings in UST and Luna, or at least a big chunk of them.

There were so many heart-breaking posts of people losing everything it became impossible to keep track.

Suddenly it stopped being so fun.

People really believed in the Terra ecosystem, Mike Novograts has a Luna tattoo, for god’s sake!

Then the suicide reports started rolling in.

It’s easy to preach that you should only ever invest money you’re happy to lose. But it’s no good telling people that after they’ve lost everything.

Once Luna capitulated, the rest of the market collapsed along with it.

And that’s when we started getting news reports on the hourly news about the crypto crash. That’s when it became the top story on the Daily Mail and other mainstream media. And that’s when everyone I know who invests in crypto started messaging me.

One of my friends lost $40,000 on Luna.

He’s had many big wins and big losses over the years in crypto, so he knew things like this come with the territory. But still…

Crypto was declared dead, just like it was in 2011, 2012, 2013, 2015, 2017, 2018, 2019, 2020 and 2021.

Is it really dead? No. But the newspapers will say it is for a while, and then conveniently forget they ever said it was dead when it goes back up again, like they always have and always will do.

Of course, it could take months or even years to “go back up again”.

Many projects will die out, as they always do. But Bitcoin, Ethereum and a number of top alts will survuve.

But I’m pretty sure Terra isn’t coming back. People are talking about taking a network snapshot from last week and forking the whole thing.

Even if something like that does happen, the faith in the project is gone. I can’t see it holding its value.

The only thing that can really be taken from this are learning lessons.

As a normal person, I think what I wrote in my feature: Why are crypto prices falling? The definitive guide, remains highly relevant.

Especially the “never invest more money than you’re happy to lose” part.

And for creators of future – and current – DeFi projects, this is going to prove as a fantastic case study.

Like I said in my Anchor Deep Dive:

So, in conclusion, is Anchor safe? Who the hell knows!

The current DeFi scandals could do it massive damage. Or they might be a blessing in disguise.

And even if there was no Abracadabra and no scandal and no mass exodus, who knows how it would fare in the long term.

Everything aside, Anchor is definitely a very interesting project. And even if it doesn’t succeed, it’s bound to spawn something that does.

I really do believe it will end up spawning DeFi projects that really do change the world.

But it’s now almost certain that Terra, Anchor and UST won’t be among them.

What caused the crash to end all crashes?

There’s a lot of theories floating around about what caused the initial mega dump that triggered Terra’s death spiral.

I’ve seen GameStop-inspired conspiracy theories involving Citadel and even BlackRock. They seem to have originated on 4chan, and I’m pretty sure they’re nonsense.

Also both companies have denied any involvement. Plus, BlackRock makes index funds and ETFs, it’s not a hedge fund… which shows how ridiculous that conspiracy theory is.

Still, it didn’t stop Cardano’s controversial founder, Charles Hoskinson, retweeting it. Which then caused news outlets to say it was Hoskinson that came up with it.

I was just looking for his tweet about it, but he’s deleted it.

Ah, but in searching I’ve found a CoinDesk article all about it, basically saying what I’ve just said. It was made up on 4chan and then Hoskinson tweeted it and it went mainstream.

So what really happened?

No one really knows, yet.

There likely was an attacker or attackers. I mean major traders were making multimillion dollar bets against Luna. But right now, like I said, no one knows who set it all off.

However, as I’ve seen people saying, if it could be brought down like this, then it wasn’t really worth anything at all.

Still, that’s not gonna make all the people who lost money feel any better.

Okay, that’s all for this week. And what a crazy week it’s been.

Thanks for reading.

Harry

Full disclosure: At time of writing, I held the following cryptos: Ethereum, IOTA, Radix, Mina Protocol, Aleph Zero… and about $0 worth of Luna that I bought for fun as it was going to zero.

Disclaimer: This content does not constitute financial advice, tax advice or legal advice. Your money and how you choose to spend it is your responsibility. Nothing that appears here should be construed as investment advice or recommendations to buy or sell any securities, cryptos or investments. coin confidential does not offer investment advice. We merely provide information. Crypto investing is highly risky. You should not base any investment decision solely on information we publish. We believe all information we publish to be accurate, but we cannot guarantee it. Always do your own research before making any decisions about your money. See the full disclaimer for more.

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).