This month in crypto: It’s 2017 all over again

The latest bull run is so reminiscent of the 2017 bull run that we even have the same fear, uncertainty and doubt (FUD) bringing it down.

I was going to start this month’s issue with the classic quote: “History may not repeat. But it rhymes”.

Then I remembered I already started my NFT essay with that same quote a few weeks back.

So let’s go with another: “Those who cannot remember the past are condemned to repeat it.”

Because it turns out that in crypto, history really does repeat itself.

The latest bull run is so reminiscent of the 2017 bull run that we even have the same fear, uncertainty and doubt (FUD) bringing it down.

People talk about 2017 as though it were a magical time like Christianity’s vision of the world before original sin – where nothing bad could ever happen.

Then in January 2018 someone ate an apple and all kinds of horror was loosed upon the world. Well, the crypto world, at least.

Actually, maybe Pandora’s jar is a better analogy. Apparently the only thing that didn’t escae it before she could jam the lid back on was hope.

And if you were around for the 2018/19 crypto winter, you’ll probably recall it was a pretty hopeless time.

Anyway, enough mixed metaphors.

The truth is that 2017 was also full of FUD and gut-wrenching market crashes. Not dips, crashes.

I know, because in 2017 I managed to buy into Ethereum just days before it dropped by roughly 50%... and I did it not only once, but three times.

One of the biggest of these crashes came at the beginning of September.

Bitcoin had just hit a heady $5,000 (£3,530) for the first time in history.

And Ethereum had also just about regained its all-time high of around $400 (£280), which it first hit in June, before falling 50%.

I remember the exact dates here because I was on holiday in Greece at the time.

I started getting texts from friends and family that I hadn’t spoken to in months asking how to get into “Bitcoin.”

It was great. I was on holiday and crypto was flying.

Then as soon as Bitcoin hit $5,000 it started to crash. Ethereum crashed even harder.

Within a few days Bitcoin was back around $3,000 (£2,100) and Ethereum was down to around $200 (£140).

Bitcoin wouldn’t cross the $5,000 threshold again until mid-October. Ethereum wouldn’t reclaim $400 until late November.

So just to recap before we get onto the reason for the drop (which you’ll definitely want to hear) Ethereum:

Hit around $400 in June.

Fell 50% by July.

Hit around $400 again in August.

Fell around 50% again in September.

Then finally regained $400 in late November.

You can see it all playing out in this chart:

Bitcoin had a similar journey, although not quite as dramatic. Its drops were only around 30% each time.

Of course, we all know what happened next. Bitcoin hit just under $20,000 in late December… then crashed and didn’t fully recover for three years.

Ethereum hit around $1,400 in early January… then crashed and didn’t fully recover for three years.

In conclusion, 2017’s golden bull run wasn’t as stress-free as people like to remember. It was just as shaky and uncertain as what we’ve been seeing over the last few weeks.

Following this one simple rule will save you a lot of heartache down the line

Which is why it’s so important to always follow the three golden rules of crypto investing.

You can follow that link to read all three. And all three are important. But number one is by far the most important.

It’s so important that I’ll quote it here in full:

1. Never invest more than you are happy to lose

This is the single most important rule when it comes to crypto investing.

It doesn’t matter what you invest in, or how you invest in it, so long as you follow this rule.

The reasons for this are twofold:

1. It will keep you sane.

If you’re only ever putting money into crypto that you don’t need. Money that you are perfectly willing to see go to zero, then you won’t be so stressed about the frequent ups and down of the market.

You’ll be free to live your life, without the constant need to check crypto prices, and the constant fear that you are losing money you actually need.

2. Strangely, it could mean you and up making more money.

Here’s the thing. Crypto is extremely volatile. That’s why it’s so fun to invest in. So a very small stake could make a significant difference to your life.

In the last crypto bull run, many people had the chance to make 10 times their money or more, simply by investing in the biggest cryptos.

They also would have frequently seen their crypto investment drop by 50% or more in a matter of days.

But the chances are, they wouldn’t have seen that 10x gain if they hadn’t stayed in after that 50% loss.

Over the course of 2017, Ethereum dropped by 50% three times. It may have even happened more than three times. But I certainly remember those three.

However, by January 2018 it was way up.

If you’re only investing money you don’t care about, then you don’t mind seeing that money lose 50%, or even 90% of its value. So you can stay invested.

However, if you actually rely on that money, when it drops you will be forced to cash out… and then you’ll likely miss the 10x gain.

If a stock falls by 50% or more in a matter of days, it’s probably never going to recover. Or at the very least, it may take years, or even decades to do so.

In crypto, we see 50% drops followed by 200%+ gains all the time.

Or to put it another way, your maximum loss is capped by the amount you put in (unless you’re using leverage. Never use leverage in crypto, you maniac.)

But your maximum gains are unlimited.

Say you put $150 into Ethereum. You can only ever lose $150. But you could potentially make thousands. $26,250 in the case of 2017.

But for the chance to make that $26,250, you have to be happy to watch your $150 go to zero.

I would be happy to watch a $150 investment go to zero. I wouldn’t be happy to watch a $15,000 investment go to zero.

Only you know how much money you’d be happy to lose in crypto. And you have to be happy about it, otherwise what’s the point of investing at all?

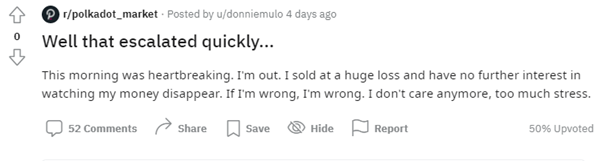

What happens if you don’t follow this rule?

Take a look…

Another post read:

I’ve seen this same story playing out again and again and again over the last few weeks.

One of the worst I’ve seen was this one:

But there are many more.

My advice is to steer clear of the message boards whenever there’s a big move in crypto – up or down. It will save you a lot of stress.

Also, because people are understandably scared, they tend to lash out at each other.

This was the top rated comment on the “well that escalated quickly” post:

If you’ve been in crypto for a few years, I know it’s easy to shrug off these crashes. You’ve seen them many times before and you know you’ll see them again.

But if you’ve only joined crypto in the last few months, or even the last year or so they feel like – and are – a very big deal.

So I’m not going to play this latest crash down. It is a big deal.

And I have some solid advice coming up on how to protect yourself from the major stresses of these crashes in the future… or at least, what helps me anyway.

But why did that big (ongoing) crash happen in the first place?

(Aside from the key reason behind every crypto drop ever, as I covered in my explainer: “Why are crypto prices falling? The definitive guide”.)

Well, remember what I told you about 2017 repeating itself…

What was the reason for this big drop?

It was the same reason for that big drop in September 2017 that tanked crypto markets for months… China banned Bitcoin.

Here’s how it played out back then.

First reports started circulating that China was banning Initial Coin Offerings (ICOs) – the main fuel behind 2017’s bull run. Then a few days later it announced it was banning crypto altogether.

From the BBC on the 13thof September 2017:

All Bitcoin exchanges in Beijing and Shanghai have been ordered to submit plans for winding down their operations by 20 September.

The move follows the Chinese central bank's decision to ban initial coin offerings in early September.

Top exchange BTCC said it would stop trading at the end of the month.

Chinese authorities decided to ban digital currencies as part of a plan for reducing the country's financial risks.

Back then China was, by far, the biggest crypto market in the world. So anxiety was at all-time highs. People were panicking.

There was no “institutional” interest like we have today. No positive crypto pieces in the press. No $60 billion DeFi industry. And certainly no proposed Central Bank Digital Currencies.

The China ban was peak fear.

Little did we know then that it didn’t really matter.

The big Chinese exchanges like Binance moved out of China, and other countries picked up the crypto torch.

It took a few months filled with doomsaying, but crypto came back stronger than ever and no one even mentioned China for a long time.

Fast forward to today. China bans crypto again.

From Reuters on the 18th of May 2021:

China has banned financial institutions and payment companies from providing services related to cryptocurrency transactions, and warned investors against speculative crypto trading.

It was China’s latest attempt to clamp down on what was a burgeoning digital trading market. Under the ban, such institutions, including banks and online payments channels, must not offer clients any service involving cryptocurrency, such as registration, trading, clearing and settlement, three industry bodies said in a joint statement on Tuesday.

The initial drop this time was blamed on Elon Musk. A figure that the cryptosphere both loves and hates, depending on whether he’s saying something pro or anti crypto.

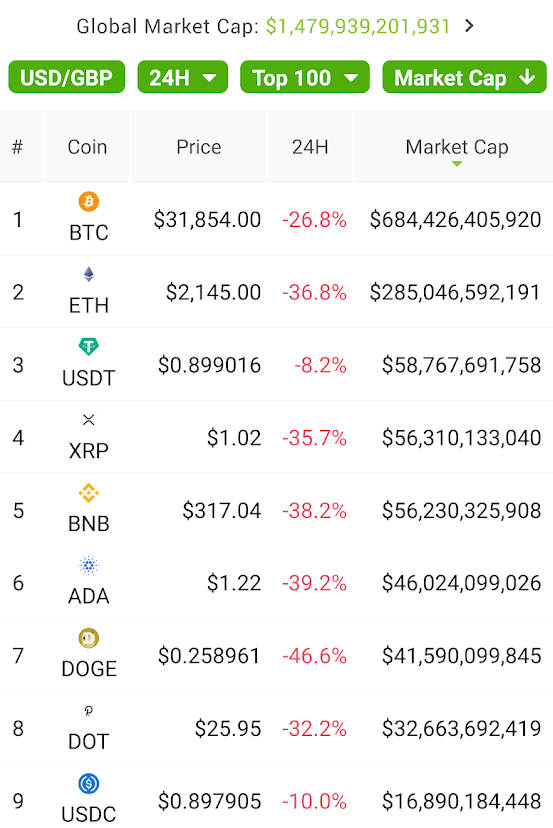

My own portfolio fell 41% in the space of an hour. And I was far from the only one. Most of the top 100 cryptos were down by 25%-60%.

I managed to grab a quick screen capture of the drop, just after it started to rebound:

And over the next few days crypto prices were up and down like a yoyo (or some other equally tired cliché) but mostly down.

It soon became clear this crash was caused by something more substantial than Elon Musk’s tweets.

Then the China ban hit the headlines.

Then more and more FUD came out. The US was also planning a crackdown.

Just this Wednesday, the new SEC head, Gary Gensler, said he wants to provide more protection (regulation) for crypto investors.

You can see the clip here.

Meanwhile…

The old vampire squid itself, Goldman Sachs (See why I’m calling it that here) released a great report calling Crypto a new asset class, and predicting Ethereum would overtake Bitcoin’s market cap…

2020’s hottest asset manager, Ark Invest, snapped up $20 million of Bitcoin…

And, as Coin Telegraph put it, in a good article worth reading: “When Bitcoin nosedived, institutions held fast”.

You wouldn’t have seen that happening back in the crypto crash of 2017.

Here’s why these crashes don’t bother me

Aside from following the three golden rules of crypto, I also have another tactic I use to keep my stress level low in times like these.

I mentioned this in my second premium issue: core cryptos for a happy life. But I’m also going to repeat it here.

When I brought it up in that issue, crypto was still on an absolute tear. And, to be fair, it still is… if you look at the 12 month gains.

But I wanted to include it in that issue because I knew we would see some big crashes along the way… even if that felt like an impossibility back in April.

I only hold five cryptos myself. I listed them in that issue. And then I gave my explanation for why that is:

And to tell you why I don’t hold a huge portfolio of every crypto under the sun, here’s something I wrote about my choices back in May 2018, right in the middle of the crypto winter:

Since January discussion in crypto circles has gone through a transformation. From hype, ecstasy and invulnerability, through to anger, depression, and despair.

And as the recovery has begun [lol, little did I know at the time], it’s left people really questioning their investment decisions.

When everything is going up, it’s tempting to start throwing money at projects you don’t really believe in, simply because they are rocketing.

It’s only when the market inevitably crashes again that you reassess and do the real research you should have done in the first place.

In the last bull run from November last year to mid-January, many people piled into projects that had no promise, simply because they had crypto gains to burn.

One weekend in early January, at the peak of the bull-run, I decided to do the same.

I read up on all of the coins in the top 200 that I wasn’t familiar with and decided to move about 5% of my portfolio into a few of them.

I convinced myself I was doing it because I had found some opportunities that I’d missed earlier in the year. But in reality, I was getting sucked into the hype.

The next day I had “a moment of clarity”. I was getting careless with my gains and traded back out of all but one of those cryptos.

A week or so later the January crash happened. And I was glad I only had money in cryptos I really believed in.

Market corrections are like hangovers. They make you seriously evaluate your path in life.

And just like when you’re hungover, you can choose to mope around, resigned to your misery. Or you can look at the decisions you made that got you into this mess and learn from them.

That’s what crypto investors have been doing over the last few months. Taking a long, hard look at their holdings and diving into the research. Getting rid of the hype coins and concentrating on cryptos that have true potential.

Although I follow the news on most of the major cryptos – or at least try to – I only hold a few projects that I’ve done a lot of research into and really believe in.

So maybe if you’ve been YOLOing into memecoins and projects whose only purpose is to make money, now would be a good time to reassess.

Do some serious research into them and see if they hold up. Or… get a premium subscription and let me do that research for you. Or preferably both.

Because, although crypto has a habit of making anyone who tries to predict its moves look like an idiot, you can be sure we’ll see many more 50% crashes – no matter how long this current run lasts, or how high crypto prices go.

Okay, that’s my commentary over. Now let’s get on with the news.

The amount of money flowing into stocks right now is mindboggling

Here’s a crazy statistic for you:

More money has flowed into stocks in the last five months than in the last 12 years combined.

From Reuters:

“[Bank of America] said $576 billion had gone into equity funds in the past five months, beating the combined $452 billion inflows seen in the last 12 years.”

Just think about that for a minute. There has been more money pumped into the stockmarket in the last five months than in the previous 12 years combined.

Why?

Well, this week Axios’ main financial newsletter writer, Dion Rabouin, left the company.

And on his last day, he wrote a fantastic piece on “the state of the world, according to me”.

You can read it here. And I recommend that you do. It’s great.

It’s kind of similar to what I wrote about bitcoin, wage growth and inflation. And what I spent a lot of time writing about in last month’s premium issue. But obviously without the crypto slant.

Basically, rich people are getting richer because of ever-increasing asset prices.

Meanwhile, average people and poor people are getting poorer because there is no wage growth, no interest on savings accounts and now growing inflation.

The only place to put your money for any kind of decent return is stocks and property. But only the rich can afford to do this.

As Rabouin put it:

Wealthy people aren't consumers. They buy more expensive things, yes, but as a percentage of their income, wealthy people save far more than they spend.

Poor people, on the other hand, generally spend what they have and save very little. As Donald Glover's character in "Atlanta" points out, "Poor people don't have time for investments because poor people are too busy trying not to be poor."

No cap: We're living in a world now where the wealthy have so much money they literally don't know what to do with it. I wrote an article about it in June 2019 and the problem has only gotten worse — more money and even fewer places to put it.

Corporations are hoarding trillions on their balance sheets, cash just sitting idle, largely because there's no such thing as a safe investment anymore.

Globally, many bond yields are rising but are still near record lows, meaning investors get compensated next to nothing and they lose money for the privilege.

The best high-yield savings accounts are currently paying 0.5% interest, which translates to -3.7% in real yield because of the current state of inflation.

On the other side: Those who aren't asset holders haven't even benefited from the risk-asset inflation that's accompanied housing, medical and education price inflation for the past decade because wage inflation hasn't even come close.

Even in the roaring economy that was 2018, 40% of Americans had negative net incomes and were borrowing money to pay for basic household needs.

And this trend has only worsened in the years since 2018 and then accelerated at warp speed as a result of the pandemic and policy response.

You may think, what does this have to do with crypto?

But I’m sure you know that pretty much all investments are intertwined. And as we’ve seen time and again, what happens in stocks – and in people’s actual lives – does affect crypto.

Crypto is a speculative asset. And if people are feeling scared that the stockmarket is in dangerous territory, they are likely to pull money out of risky investments.

Or maybe they’ll be looking to diversify into crypto.

But either way, it’s all more connected than many in crypto would like to admit. Especially as we have big financial institutions involved with crypto now.

And on that note.

Hedge fund conspiracy theories invade crypto

Remember all the Wall Street Bets GameStop madness earlier this year?

Well, it’s back, with a vengeance.

And this time, it’s loaded with conspiracy theories about how hedge funds are about to bring down the entire financial system.

What’s the only way to avoid the carnage? Buy GameStop and AMC, screw the hedge funds and become a millionaire as the world burns.

That’s pretty much the thesis. And it’s got a whole lot of traction.

As I write this, over the last five days, GameStop is up 33% and AMC is up an incredible 110%.

And it’s mostly because of this theory that they call the EVERYTHING short or the mother of all short squeezes (MOASS).

Here’s their tl;dr (which is pretty long in itself):

Citadel and friends have shorted the treasury bond market to oblivion using the repo market. Citadel owns a company called Palafox Trading and uses them to EXCLUSIVELY short & trade treasury securities. Palafox manages one fund for Citadel - the Citadel Global Fixed Income Master Fund LTD. Total assets over $123 BILLION and 80% are owned by offshore investors in the Cayman Islands. Their reverse repo agreements are ENTIRELY rehypothecated and they CANNOT pay off their own repo agreements until someone pays them, first. The ENTIRE global financial economy is modeled after a fractional reserve system that is beginning to experience THE MOTHER OF ALL MARGIN CALLS.

THIS is why the DTC and FICC are requiring an increase in SLR deposits. The madness has officially come full circle.

And here’s the full post, if you want to read it.

That post, or variations of it have been doing the rounds in all the fringe financial message boards I read. And particularly in the crypto ones.

The main cryptocurrency subreddit ended up banning all posts relating to it because they were taking over.

Basically people were (and still are) blaming the crypto crash on hedge funds needing money and selling out of their positions.

For example:

I’ll admit, it’s an interesting theory.

And Reuters reports that GameStop and AMC short sellers lost nearly $1 billion in the five days leading up to the crypto crash.

So I would imagine it probably did play a role in the crypto crash.

But as for the whole borrowed treasury bonds being used as collateral and bringing down the whole financial system aspect… it all seems a bit too much like a conspiracy theory.

But one that’s far too complicated to unpick… which makes it a great conspiracy theory.

Overall, I think this movement kind of fits with what that Axios’ newsletter was saying about massive wealth inequality.

People realise the system isn’t working for them and they want to know why. And they want to know how they can fight back.

Then along comes a strong narrative that makes sense – with clear good guys and bad guys… and a pot of gold at the end of the rainbow.

What better way to fight back than by bankrupting the hedge funds that control the system that’s kept you down… and becoming rich doing it.

That is a seriously compelling narrative. And it’s seriously gaining traction.

I have no idea where or how it will end. But it’s worth keeping an eye on.

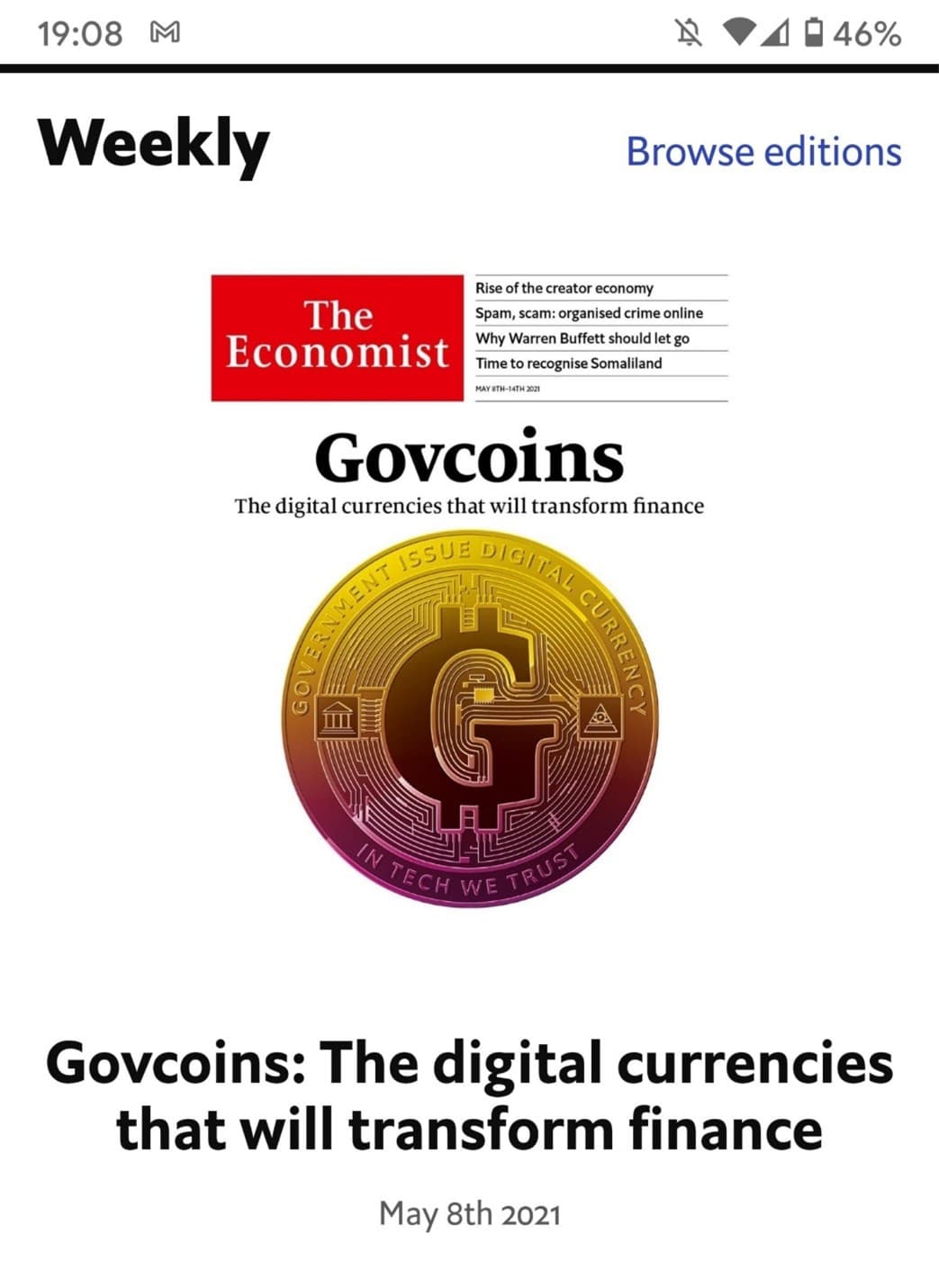

The Central Bank Digital Currency race hots up

On the 8th of May, I opened up The Economist app, to see this was their weekly cover story:

They decided to use the term “Govcoins” instead of Central Bank Digital Currencies (CBDCs), but CBDCs were what they devoted the issue to. Or, at least, the leader.

I guess that’s a sign that the mainstream is finally catching on. You might remember I wrote an explainer on CBDCs around a year and a half ago. And they’ve appeared in just about every issue I’ve written since.

You can read their article on CBDCs here if you have an Economist subscription. Or you can just use outline to read it if you don’t.

It doesn’t say anything new. But having the Economist run a cover story on CBDCs really shows the idea has caught on. It’s inevitable. And it’s definitely something worth learning about.

But more interesting than their article, was a letter one Economist reader responded to it with.

I’ll repost it here in full:

E-taxes

Mike Godwin's law of Nazi analogies states that as an online discussion grows longer, the probability of a comparison involving Nazis or Hitler approaches one. A corollary adage might be that as an economic discussion grows longer, the probability of creating a new form of taxation approaches one. Your leader on the rise of e-money violated this proper economic discussion by creating no new tax (“The digital currencies that matter”, May 8th). In fact, tax got no mention at all.

You summed up well the positive aspects of central-bank digital currencies (cbdcs). Yet government-issued fiat currencies are deeply entwined with tax (fiat currencies are arguably just tax credits). cbdcs provide new tax-collection powers. Complex taxation algorithms can be applied to any cbdc transaction in real time. Once people realise the power of cbdc systems to support various taxation initiatives at low transaction costs, we should expect avalanches of proposals: town taxes, child-noise taxes, sugar taxes, alcohol-consumption taxes, foreign-visitor taxes, and so on.

In 2016 I gave an example of such a cbdc-based tax to the House of Lords. Given widespread sentiment that London is too overweening, imagine a populist redistribution tax whereby transaction taxes rise in wealthy districts. To bring about levelling up, politicians increase the taxation rate as you approach Trafalgar Square, up to 99.9% beside Nelson’s Column, or spend your money in the Outer Hebrides at 0.1% tax. Technology cuts two ways.

professor michael mainelli

Executive chairman

Z/Yen Group

London

And on that note…

The Bank of England says it needs a CBDC to keep faith in fiat currency

From Coin Telegraph:

The Bank of England's deputy governor Jon Cunliffe has argued that a sea change in the issuance and circulation of public and private monies could make general access to a digital form of central bank money crucial for ensuring financial stability in future.

The crux of Jon Cunliffe’s argument is that most people don’t realise the money they hold is actually issued by private banks, not the state. And in times of crisis those private banks may fail. So we need a state-backed money that is less vulnerable.

From Jon Cunliffe’s speech:

The majority of the money held and used by people in the UK today is not physical ‘public money’, issued by the state, but ‘private money’ issued by commercial banks. Around 95% of the funds people hold that can be used to make payments are now held as bank deposits rather than cash.

It looks probable in the UK that if we want to retain public money capable of general use and available to citizens, the state will need to issue public digital money that can meet the needs of modern day life.

The writing’s on the wall here. The UK will be getting a CBDC sooner or later. And so, I imagine, will most countries around the world.

Cunliffe also hinted that new regulations may be coming to stablecoins:

This has attracted enormous attention, including from public authorities, like the Bank of England, who are now wrestling with the thorny question of what regulatory framework should apply to non-bank issuers of private money. (I do not propose to wrestle with that question today- the Bank of England will shortly be issuing a discussion paper on the public policy implications of non-commercial bank digital money)

US moves forward with CBDC development

With China already in trials for its CBDC, the US is feeling the heat.

From CNBC on the 20th of May:

The Federal Reserve is moving forward in its efforts to develop its own digital currency, announcing Thursday it will release a research paper this summer that explores the move further.

Though the central bank did not set any specific plans on the currency, Chairman Jerome Powell cited the progress of payments technology and said the Fed has been “carefully monitoring and adapting” to those innovations.

“The effective functioning of our economy requires that people have faith and confidence not only in the dollar, but also in the payment networks, banks, and other payment service providers that allow money to flow on a daily basis,”

As that article states, China’s CBDC progress has “stirred worries that it could undermine the dollar’s position as the global reserve currency.”

But what crypto will all these CBDCs be built on?

That’s the killer question, isn’t it?

If a major country were to build its CBDC on top of any of the current cryptos… well… just remember what happened to Bitcoin’s price after Tesla said it had bought some.

However, it seems highly unlikely a country like the US or UK would build on top of a platform they can’t control.

Although, that’s kind of the point of decentralisation. In theory countries should trust it because no one can manipulate, censor or control it, which makes it neutral.

However, my guess would be these CBDCs would be built on a private version of one of the current cryptos, or a completely new, private one.

But like I said in my CDBC explainer all those months ago, if CBDCs can easily interact and exchange with other cryptos… it’s going to be a massive boost for crypto, and DeFi in particular.

Imagine having a stablecoin that didn’t just promise to represent USD or GBP in a vault somewhere… but actually was that USD or GBP itself.

I would also think it would lead to an increased take up of decentralised stablecoins like DAI.

Because let’s not forget, with a CBDC the state will be able to reverse any transaction it chooses and blacklist any wallet or individual. And that goes against everything DeFi and crypto is about.

It’s going to be an interesting few years.

The vast majority of people have absolutely no idea what’s coming, and how it might affect their lives.

And I’ll be honest. I don’t have a clue, either. I don’t even think the people developing these CBDCs do.

PayPal and Revolut to allow crypto withdrawals

This week PayPal’s blockchain lead made a surprise announcement:

“[PayPal customers] want to bring their crypto to us so they can use it in commerce, and we want them to be able to take the crypto they acquired with us and take it to the destination of their choice.”

You may remember when PayPal first introduced crypto trading it didn’t allow withdrawals.

Without the ability to move crypto off a platform, you can never really know if you own it or if it’s just an IOU.

This announcement came only a week or so after Revolut said it was doing the same… but only for customers who pay for its “metal” service.

So now we have PayPal, Revolut and Robinhood allowing tentative crypto withdrawals.

And for those of us in the UK, that Revolut one is growing in importance.

More and more legacy and challenger banks are blocking any payments or transactions to do with crypto.

I think there’s only Barclays and Revolut left that don’t have explicit policies against crypto.

And since Revolut actually encourages you to trade crypto itself, this is a major plus. It may become the only UK bank that lets you move money in and out of crypto exchanges without any issues.

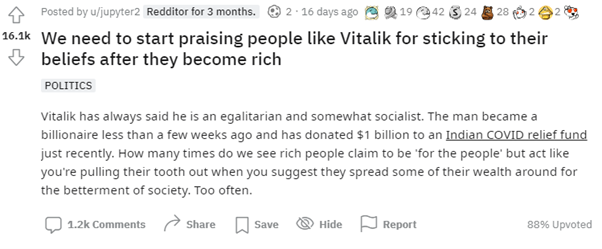

Good guy Vitalik becomes a billionaire and donates $1.5 billion to charity within days

This month was a big one for Ethereum’s co-creator and lord and saviour, Vitalik Buterin.

When Ethereum broke through the $3,000 (£2,114) barrier on the 3rd of May, it made 27-year-old Vitalik the world’s youngest crypto billionaire. And the second youngest self-made billionaire in history.

That’s a big achievement.

But what he did next was unprecedented.

A number of scam, hype and meme coins tried to gain credibility by sending large percentages of their total supply to crypto wallets owned by Vitalik.

Not only did this lend the projects fake credibility – “Vitalik is our biggest holder” – but it also meant no one was going to “rug pull” investors.

Vitalik would never sell those scam tokens, right?

Wrong.

In an absolute masterstroke, Vitalik took that $1.5 billion of shitcoins and donated them to charity. He gave $1 billion to India’s Covid relief fund alone. (source: Tech Crunch).

Of course, when he did this, the prices of these shitcoins crashed. But they were still worth a lot of money.

It may even go down as one of the biggest charity donations in history.

And let’s not forget, he’d literally only just joined the billionaires’ club.

This reddit post made shortly afterwards sums up my thoughts on all this:

There are also some good comments in that thread if you feel like reading it.

The flippening mentioned in UK parliament

Continuing with the Ethereum news, this week “the flippening” was mentioned in UK parliament.

If you haven’t heard that phrase before, that’s because it hasn’t really been around since 2017.

The flippening is an event in which Ethereum overtakes Bitcoin by market cap to become the world’s number one crypto.

It used to be talked about a lot in the last bull run, but then things changed and Bitcoin gained huge institutional interest.

Things seem to be turning around again now, as we saw with Goldman Sachs’ comments about Ethereum overtaking Bitcoin earlier in this issue… and now even a mention in UK parliament.

You can watch a short clip of it below:

👀

— Bankless 🏴 (@BanklessHQ) May 20, 2021

“The flippening” just mentioned on the UK parliament floor

Watch the video https://t.co/QWEI2dhpNs

Tezos wins the Monaco Grand Prix

Earlier this month Red Bull racing announced an official partnership with Tezos.

Teaming up with the world’s most advanced blockchain 👊 Announcing a new multi-year technical partnership with @Tezos as our Official Blockchain Partner.

— Red Bull Racing Honda (@redbullracing) May 20, 2021

From Red Bull:

Red Bull Racing Honda today confirms a new multi-year technical partnership with Tezos, the world’s most advanced blockchain, as the Team’s Official Blockchain Partner. The energy efficient blockchain Tezos has been selected by the Team to build its first ever NFT fan experience.

Then the very next week, Red Bull Racing won the Monaco Grand Prix… with Tezos branding on the car.

And a few days after the Grand Prix win, a big music NFT company announced it was launching on Tezos.

From CoinDesk:

Music-focused non-fungible token (NFT) platform OneOf has raised $63 million to support what it calls its mission to become a more environmentally sustainable marketplace for artists and fans.

…

OneOf’s platform, which is built on the Tezos blockchain, will launch next month. Its first set of collectible releases is said to include music by the late Whitney Houston, Doja Cat, Quincy Jones, Jacob Collier and G-Eazy. Fans will be able to use credit or debit cards in over 135 fiat currencies, as well as cryptocurrencies and stablecoins, to purchase NFTs, said the firm.

Usually, you’d expect news like this to bring massive attention to Tezos and a bump in price.

Instead, Tezos is down 50% in the last 14 days. But that’s more to do with the market conditions than Tezos itself.

However, Tezos is also only up 15% over the last 12 months.

To put that into perspective:

Cardano is down 27% in the last 14 days, but up 2,220% over the last 12 months.

Polkadot is down 56% in the last 14 days, but up 600% since it launched last September.

And Ethereum is down 41% in the last 14 days, but up 991% in the last 12 months.

I honestly can’t believe how undervalued Tezos is compared to its competitors. But as the saying goes, “the market can remain irrational longer than you can remain solvent”.

Okay, that’s it for this month’s free issue.

Wow, that was another long one. I hope you found it useful… or at least entertaining.

In the next premium issue I’ll be reviewing Algorand. You can join coin confidential premium here if you’d like to get that. Or just if you’d like to support the site in general.

Thanks for reading.

Harry

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).