What is DeFi and why is it such a big deal?

Just as Bitcoin allows you to make payments without a bank, DeFi allows you to create an entire financial system without banks or central authorities.

Back in January, we covered the three biggest crypto events to watch out for in 2020.

If you’d like a reminder, they were:

- The Bitcoin halving

- Ethereum 2.0 (which the Ethereum developers now have “95% confidence[i]” will happen this year and is being pencilled in for July)

- IOTA’s coordicide (which has already begun, even though IOTA’s mainnet is currently down)

They may be the three biggest crypto-specific events, but there are three more movements underway, which will ultimately be much bigger than any one crypto.

They are:

- Central Bank digital currencies – which I covered here.

- Security Token Offerings (STOs) (basically merging the stock and property markets with crypto) – which I’ll cover in an upcoming issue.

- And Decentralised Finance (DeFi) – which we’re looking at today.

So let’s get started.

Subscribe for exclusive content

As a free subscriber, you’ll get coin confidential’s newsletter and access to new articles, weeks before they open to the public.

What is Decentralised Finance (DeFi)?

You can’t go more than five minutes in crypto without hearing the word decentralisation.

But there’s a good reason for this.

Although it gets bandied around like an empty buzz word, it forms the foundation of everything in crypto.

The idea you don’t need to rely on a central authority to make things work – be they financial transactions, data transactions, contracts, proof of ownership, proof of identity… anything – is what crypto is all about.

To go back to basics, Bitcoin allows two people to exchange money without the need to trust each other.

In traditional finance, you need to either trust the person you’re exchanging money with, or you need to trust in a central authority to oversee the transaction.

For example, if you send money to someone through your bank, you’re trusting your bank to make sure the money gets there.

If the person denies the money reached them, your bank can step in and prove it did.

With Bitcoin, you can prove the money reached them without any need for a bank. You simply look up the transaction on the Bitcoin network, and there it is, for anyone to see.

This is fine for basic transactions. But our financial world is much more complicated than simply sending set amounts of money from one person to another.

And this is where DeFi comes in.

Just as Bitcoin allows you to make payments without a bank, DeFi allows you to create an entire financial system without banks or central authorities.

Currently, the biggest application of this is in DeFi lending. But eventually, DeFi will overtake every area of traditional finance.

Why?

Because it makes things cheaper (and fairer) for everyone involved.

The reason I put fairer in brackets there is most businesses don’t really care about fairness.

Of course they claim to, as being seen to be caring is good for their image. But at the end of they day, money is the motivation.

And the great thing about DeFi and decentralisation in general is that it makes the fairer way the cheaper and more efficient way.

So businesses get to boost profits and, as a by-product, make the world a fairer place. It’s a win-win.

But back to the topic at hand.

How does DeFi work?

Right now, the biggest branch of DeFi is lending.

Which I guess is apt, as this is also how the world of traditional banking first got going.

At its most basic level, a bank takes money from person A and then lends that money out to person B.

It pays parson A interest for using their money, and person B pays the bank interest for lending out person A’s money.

The bank makes money because it pays person A less interest than it collects from person B. A lot less.

For example, a typical savings account with NatWest currently pays out 0.1% interest[ii]. Whereas a typical loan with the same bank charges 7.9% interest.

So NatWest will gladly borrow £5,000 off you, and then charge someone else 79 times what it’s paying you to lend your money out. 79 times!

Why do people put up with this? Because that’s just the way things are done.

At least, that’s just the way things were done.

Now we have DeFi lending.

The main idea of DeFi lending is you cut out the bank – and its ridiculous cut – and match lenders directly with borrowers.

For example, on what’s probably the most well-known DeFi platform, compound, you can currently lend out your money using the DAI stablecoin at 8.07% interest, or borrow against it at 8.48% interest.

You can see the different rates for lending and borrowing on compound below.

So, instead of getting 0.1% interest with a bank, you could be getting over 8% with DeFi.

The reason DeFi rates can be so much better than banks is because lenders are matched directly with borrowers. There is no bank taking a ridiculous cut.

But is DeFi lending safe?

The main reason people put up with the lousy deal they get from banks is because banks are “safe”.

If you put your money in a bank, it’s highly unlikely you’ll lose it. Of course, it is possible… such as in a bank run or a Greek-style debt crisis. But it is extremely rare.

In DeFi lending, you’re not relying on anything other than computer code. So long as the computer code is written right, there can’t be a DeFi banking run or debt crisis.

The way DeFi lending works, is you have to put up collateral if you want to borrow. With Compound, for instance, you can only borrow up to 75% of your collateral.

This means there is always money in the system if the lenders ask for it back.

This is great for lenders. They can get more than 80 times the interest they could in a traditional savings account.

But what about DeFi borrowers?

Why would you need to take out a loan if you already had the money in the first place?

Leverage.

If you look in that chart of lending and borrowing rates again, you’ll see that you can also lend out and borrow against an array of different cryptos.

Some, like DAI an USDC are stablecoins – their value will remain stable against a fiat pair, in this case the US dollar.

But some are not.

For example, you can borrow against Ethereum at 2.08% per year.

So, if you hold Ethereum and think Ethereum will go up by more than 2.08% in the next year, you could make money by borrowing against it.

I’ll show you how with a very basic example.

Say you had 10 Ethereum, worth £100 each. So £1,000 of Ethereum.

You could lock up your 10 Ethereum in compound and get £750 back for it.

You could then go buy another 7.5 Ethereum for £750 with that money.

Then if Ethereum doubles in price, you can trade 3.75 of your new Ethereum for £750 and use that money to get back your original 10 Ethereum that’s locked up.

So, in the end you would have 13.75 Ethereum, worth £2,750.

If you’d just held your 10 Ethereum over that time, you’d only have the same 10 Ethereum, now worth £2,000.

So by using leverage, you’ve gained 3.75 Ethereum, or £750.

And it cost you nothing.

Sounds great, right?

But don’t get too excited. This isn’t a magical money-printing machine.

Let’s say if in that example the price of Ethereum dropped by 50% instead of doubling.

If you didn’t add any money into your loan, you would get liquidated. Your Ethereum would be returned to you, minus what you borrowed and minus a liquidation fee.

To avoid being liquidated, you would need to keep adding Ethereum back into your loan, as the price dropped.

So if the Ethereum price dropped, you could end up very out of pocket.

This is why most people won’t borrow anywhere near the maximum 75% amount.

The less you borrow against your money, the more Ethereum has to drop before you need to top up your loan. And the less at risk of liquidation you are.

It’s a balancing act.

How big could DeFi get?

As you can probably imagine, the possibilities for this kind of transaction are endless. That’s why it’s got so many people so excited.

And given that the actual money you’re using for this – most of DeFi is built on top of Ethereum – is programmable itself, it means you can create any financial instrument you want on top of it.

As well as loans, DeFi will eventually be used for everything the legacy financial system is… Mortgages, bank accounts, savings accounts, stocks and shares, insurance… you name it.

In fact, as you’ll see in my upcoming articles, it already is.

I have no doubt that eventually many major financial systems will move over to DeFi. It’s a much more efficient, cost-effective (and fairer) way to do things.

And that transition period is going to create many new household names and make a lot of people a lot of money.

But don’t just take my word for it. Let’s look at some figures.

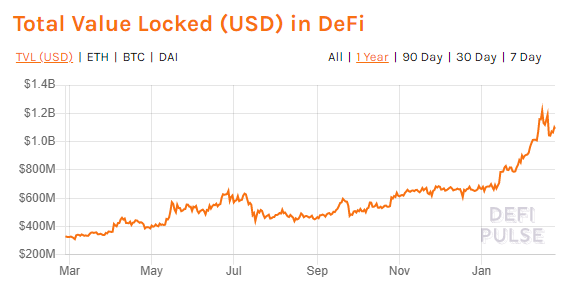

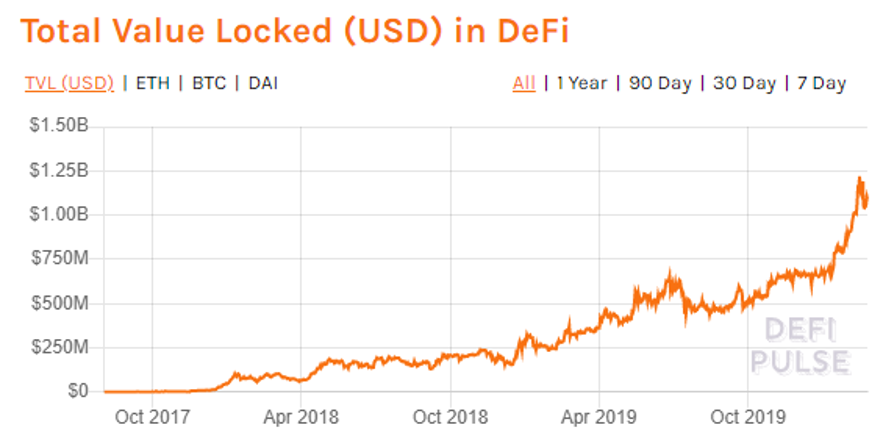

As you can see below, in the last 12 months, the total amount of money locked up in DeFi has ballooned from $330 million to over $1 billion.

Compound alone has over $223 million of assets in its system.

And, let’s not forget, DeFi didn’t even exist three years ago…

And perhaps one of the biggest uses of DeFi, the one that’s really going to shake up the traditional financial world, is the tokenisation of real-world assets, like property, stocks and bonds.

That’s what Security Token Offerings (STOs) are all about.

And that’s what next week’s issue will be on… so long as nothing crazy happens to the crypto markets in the meantime.

Thanks for reading.

Harry

PS What about the IOTA debacle?

If you read last week’s issue, you’ll know IOTA’s mainnet is currently down due to a hack of its Trinity wallet.

I was planning to cover what’s happening there in this week’s issue. But, as you may already know, the situation hasn’t really moved on yet.

Basically, if you use a hardware wallet, you’re unaffected.

And if you didn’t log into your desktop Trinity wallet between the 17th of December 2019 and the 18th of February 2020, you’re unaffected.

If you do happen to use the Trinity wallet without a hardware wallet, and you logged into it between those dates, then you need to follow the instructions IOTA lays out here.

The whole episode just goes to prove how important it is to always follow the three golden rules of crypto, which you’ll find about two thirds of the way into this article.

[i] https://www.coindesk.com/95-confidence-ethereum-developers-pencil-in-july-2020-for-eth-2-0-launch

[ii] https://personal.natwest.com/personal/savings/instant-saver.html

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).