This month in crypto: absolute madness

All-time highs, all-time lows and the biggest scam in financial history all happened this month… and a lot more besides.

Something I wrote last month struck a chord.

A fair number of you emailed in to say you enjoyed the issue, which is always good. And apparently I only had one typo, which I think might be a new record.

So given how well received last month’s issue is… this month’s will be nothing like it.

Bet you didn’t see that coming, did you?

There’s been too much going on this month to delve into any one story too deeply.

There are so many developments this month that it’s like we’re back in 2017 again.

And just like in 2017, Bitcoin and Ethereum are hitting all-time highs.

But unlike in 2017, they’re actually holding them.

Whenever the major cryptos hit all-time highs, people always like to make the point that everyone who ever bought and held up to that point is now in profit.

That probably isn’t much consolation to all the people who panic sold back in May. Remember what was happening back then?

Here are just a handful of people’s posts from the May crash:

Looking at these posts today, they almost seem to come from an alternative reality.

But right now, people are putting more money into crypto than they can comfortably lose.

And when the next crash happens (and we all know it will happen, that’s half the fun of crypto) those people will be having mental breakdowns and writing posts like the above.

Learn from these people’s mistakes, and you’ll always have fun in crypto. Get in too deep, and you’re guaranteed to have a bad time.

Or, to put it another way:

If you only invest money you are comfortable losing, you’ll be able to hold through the crash and ride out the next wave of euphoria with sizable (unrealised) profits.

I think that’s always worth keeping in mind, especially at times like these.

And on that note…

People are still buying into the biggest scam in crypto – maybe even world – history

Did you hear about Squid Game?

No not the Netflix show.

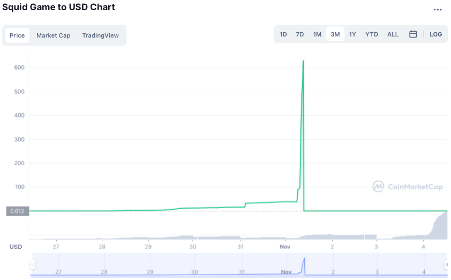

The scam crypto project that went from around $0.01236 to $2,861 in the space of six days.

That – in theory – is a 23,147,149% gain… in six days.

So, again, in theory, every £10 you invested in it could have grown to £2,314,720.

£2.3 million from a £10 investment? Maybe we really are living in an alternative reality.

Unfortunately for Squid Game investors, we’re not. Far from it.

Because although Squid Game attracted a whole lot of investors, went up millions of percent and gained a market cap of $2.28 trillion… the developers had other plans.

(That $2.28 trillion market cap, by the way, would make it the third most valuable company in the world (if it were a company not a crypto), just behind Apple and Microsoft.)

Squid Game was (is) programmed in such a way that allows people to invest in it, but not trade it. So you can buy, but you can’t cash out.

Many people saw this as a good thing. Just like many people see Safe Moon’s Ponzi tokenomics as a good thing. I’d imagine many of these are the same people.

So what happened was, people kept buying in as the price (in theory) went up and up…

More people saw how fast the price was going up and YOLO’d in, too…

And, of course, it was guaranteed to stay up because no one could sell it. Amazing!

The price started going up so fast it was practically vertical…

Then the developers pulled the rug, cashed out themselves, and it went to zero in seconds.

It just so happened that a “crypto bro” was livestreaming his trading on twitch at the exact moment this happened and created a video that will go down in history.

Watch it for at least 10 seconds:

The developers got away with around $3.38 million. A far cry from the $2 trillion+ it was worth in theory. But not exactly a bad haul for a few days’ work.

Now here’s where the story gets even crazier…

Even after the exit scam, people are still guying into the “project”.

Coin Telegraph reported on Thursday the 4th of November:

Remarkably, people are still buying the tokens. At the time of writing, SQUID was trading up 600% over the past 24 hours at $0.038 according to CoinMarketCap.

As I type this, the price is at $0.0714… that’s 8,900% up from where it was on the day of the exit scam.

I imagine a lot of the trading is being done by bots. But there must still be a good number of people buying into this thing.

Only in crypto…

And to wrap up this story, I don’t think there’s ever been a scam in history that’s stolen so much (theoretical) money.

Squid Game’s market cap went from around $2.28 trillion to around $634,000 in minutes. Surely that makes it the biggest financial crime of all time.

Given how market caps work (the latest price an asset sold for x its total supply) it was never really worth $2.28 trillion. But it was in theory.

I know I say this a lot. But it really is like something out of a sci-fi novel.

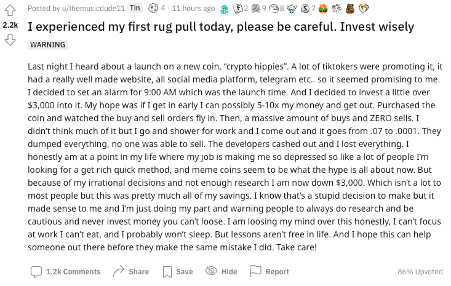

Oh, and just as I’m about to set this issue up to go out, we have another big rug pull. This time the scam is called crypto hippies.

The reason I’m including it here is someone who was caught in the scam made this poignant post about it:

There is so much to unpack in that post I could write a whole issue about it. But let’s break down the big ones:

Don’t invest more than you can comfortably lose.

Don’t invest on the advice of social media influencers, especially TikTok influencers.

Don’t invest in something you hope to get in early, 5-10x your money and get out.

Don’t invest in something you haven’t researched, a lot. Having a “slick website” and social media doesn’t mean anything.

Look, it’s easy to point out all the mistakes this person made. But people keep on making these same mistakes in crypto every single day.

So I think they did a great thing by admitting it and posting about it in the hope it might save someone else. But they are taking a lot of flak for it in the comments.

The lower leagues of crypto are at war

While Bitcoin and Ethereum remain untouchable as the king and queen of crypto, the rest of the royal family is at war.

This month we’ve seen Cardano flipped by Solana, Dogecoin flipped by Shiba Inu, and Polkadot hitting all-time highs and climbing the ladder.

Every day the top 3-100 cryptos by market cap looks completely different. And with so much money sloshing around, who will be first and who will be last is anyone’s guess.

Case in point, Solana.

I gave Solana a very favourable review in coin confidential premium on the 24th of August.

(Shameless plug: subscribe to coin confidential premium here and you’ll get instant access to my Solana, Polkadot, Algorand, Radix, Mina Protocol reviews, and more. One very kind subscriber recently called it, “the best ten quid a month read, by far!”)

Back then it had already been making big progress up the rankings and had just hit 10th place.

This week it overtook Cardano and Tether to take 4th.

And in the process, it’s grown from $75.51 (£55.43) to $238.14 (£185.45).

That’s a 215% gain in just over two months, or around 3X.

And Solana wasn’t some tiny moonshot crypto with a market cap in the millions. It was already worth more than $20 billion. Today it’s sitting at $71 billion.

But those gains are nothing compared to its year to date (YTD) gains.

Solana started off the year in 120th place, with a sickeningly low price of $1.84.

Today it’s the 4th most dominant player in crypto. And its price has gained 12,842% in the process. Around 129X.

So every £500 invested in Solana in January would be worth around £64,500 today.

This goes to show just want can happen when a solid crypto catches the zeitgeist.

Of course, it can happen with much less solid cryptos, too…

Random investor makes $5.7 billion investing in Shiba Inu

While Solana was slaying its competitors and moving up the ranks, so was memecoin Shiba Inu (SHIB).

Shiba Inu was created because Dogecoin’s logo – and the famous doge meme itself – is a Shiba Inu breed of dog.

It’s effectively a meme of a meme of a meme.

But in the 15 months since its inception, it’s gained an eye-watering 89,142,757% (and eight days ago it was 42% higher than that).

And earlier this month it briefly flipped dogecoin in the rankings. Which, when you think about it is bizarre.

Even more bizarre is that £10 invested in SHIB at its inception would be worth £8.9 million today.

So what about if you’d invested $8,000... how much would it be worth today?

$5.7 billion.

Oh, and someone did.

From Morning Brew:

This wallet bought roughly $8,000 of $SHIB last August.

— Morning Brew ☕️ (@MorningBrew) October 27, 2021

It's now worth $5.7 billion.

From $8,000 to $5.7 billion in roughly 400 days.

We may actually be looking at the greatest individual trade of all time. pic.twitter.com/LtdgQ83bKP

When this news surfaced, most people thought whoever owned the wallet had probably lost their keys and the tokens were gone forever.

But then around a week ago, they moved their SHIB tokens.

You can see the actual wallet transactions here on Etherscan.

Many people are pointing to all of this madness indicating the top of the market. Could be. Or it could just be the start. Who knows?

Well, one very powerful organisation certainly doesn’t find any of this fun. And they’re about to do their best to shut the party down.

US financial regulators want US banks to take over entire stablecoin industry

Earlier this week the President’s Working Group on Financial Markets, Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency quietly released its long-awaited report on stablecoins.

You can read it here.

I say quietly because it was released five days ago and there really hasn’t been much debate about it online.

Matt Levine wrote a good piece about it in his column. But barely anyone else seemed to mention it.

(Looking again today (Friday evening) it seems people are finally starting to pay attention. So by the time you read this there probably will be a lot of commentary on it.)

And this report could end up being a very big deal.

As Levine pointed out, regulators killed the ICO and now they’re coming after stablecoins.

The crux of the report is that US regulators only want banks to issue stablecoins. So you could soon see more fake cryptos like JPMorgan’s JPM coin and Wells Fargo’s Wells Fargo Digital Cash popping up.

It also means that current stablecoin issuers would need to either effectively become banks or hand over the reins of their products to a bank.

Without getting too ideological here, let’s remember that crypto was arguably created in order to do away with the corrupt banking system.

I wrote about that, and fake crypto created by banks, in a lot of detail in Everything you need to know about crypto in one essay.

From that essay:

Written into Bitcoin’s first ever transaction and preserved for all eternity was the following string of text: “The times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

This was no accident. It was a statement of intent.

Bitcoin was created by a mysterious figure using the pseudonym Satoshi Nakamoto.

Over the years, many people have claimed to know who Nakamoto is. Some even claim to be Nakamoto themselves.

But Nakamoto’s true identity remains a mystery. And the most likely candidate (Hal Finney) is now deceased. So we may never actually know with certainty who Nakamoto really is or was.

However, given that Nakamoto was a fairly prolific poster on various platforms, we do know something of their values.

And it’s clear that Nakamoto wasn’t a fan of traditional currency, central banks or banking in general.

From Nakamoto:

The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.

The core idea behind Bitcoin is that it allows people to send money safely, over the internet, without the need for any central authority to guarantee or oversee their transactions.

Bitcoin does away with the need for central banks to create money and national banks to move it around.

And perhaps most importantly, its supply can never be artificially inflated. There will never be more than 21 million Bitcoin in existence.

So no more Cantillon effect and no more reverse-Robin-Hood economics, with the rich getting richer at the expense of the poor.

At least, that’s the idea.

With that being said, I guess you could argue that safe, regulated stablecoins may actually be good for crypto in the long run.

Imagine being able to earn up to 10% interest on a stablecoin that you know is legit and just as secure as the money in your bank.

Because stablecoins are only one aspect of crypto. Bitcoin, Ethereum et al will still be around.

But instead of a shady organisation issuing stablecoins that you absolutely cannot trust (Tether), you’d have a bank doing it.

So, although at the beginning it will almost definitely “stifle innovation” (people love that phrase), over the long run it could be a good thing.

Which may be why the crypto industry hasn’t really pushed back against this report at all so far.

It also means that the US recognises that crypto and stablecoins are here to stay (and isn’t intending to ban them) which is also very positive.

Oh, and there is another possibility that could happen if the recommendations of this report get enacted: crypto exchanges could become legitimate banks.

I know this is a route that Nexo and Celsius have been pursuing.

And let’s not forget that Kraken – probably the most reputable exchange on the planet behind Coinbase – already has a banking charter.

Imagine a legit crypto bank that paid you 5%-10% interest on your savings. That is something I would jump at the chance to use.

And I guess this report paves the way for it.

Meanwhile UK regulators seem to be either trying to ignore crypto and hoping it goes away or stamping it out wherever they can. More on that in June’s issue.

And on that note, as we’ll see in just a second, it’s actually illegal for anyone in the UK to invest in the new Bitcoin ETFs that launched this month… or any of the European crypto funds… or any of the Canadian ones.

Gotta love Britain’s old boys’ club, haven’t you.

The UK is not a place for financial innovation, that’s for damn sure.

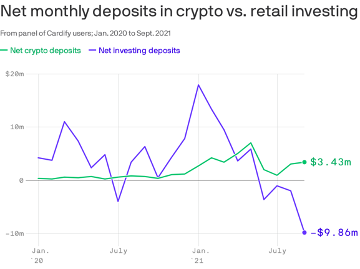

Crypto investing overtakes stock market investing

Here’s a fun chart from Axios:

It shows that retail investors (ordinary people) now put more money into crypto than they do stocks.

In fact, it shows that since the start of this year people have been taking money out of the stock market but putting it into crypto.

From Axios:

Market research firm Cardify has a panel of roughly 500,000 users who let it see the monies flowing in and out of their bank account. Out of those users, 30% have put money into places like Robinhood or Fidelity that facilitate stock market investing, while 4.6% have put money into crypto companies like Coinbase.

In January, those investors put $37 million into the stock market, while withdrawing just $19 million. In September, by contrast, investments totaled $16 million but withdrawals reached a record $26 million.

Crypto investments peaked at $10 million in May, when there were $3 million of withdrawals. As of the fall, the money continues to pour into the asset class, with $5 million of inflows against $2 million of outflows in September.

This pattern will likely change after the next crypto shakeout or major stock market crash. But what if it doesn’t?

I guess that’s another thing regulators will be worrying about.

First US Bitcoin ETFs launch and break records

In a move that will make future versions of the chart we just looked at a lot more complicated, the first US-listed Bitcoin ETFs launched this month.

And as Bloomberg reports on the first one:

The debut could not be more successful: after a mere two days of trading, the ETF had $1.1 billion under management and its trading volume topped $1.2 billion. According to Bloomberg Intelligence data, no ETF has reached the $1 billion mark this quickly. In fact, it is close to reaching the upper limit of monthly contracts allowed to be held by one actor at the CME.

It's worth noting that the only Bitcoin ETFs to be approved in the US so far are based on Bitcoin futures, not real Bitcoin. But it’s a big step towards getting a real (spot) Bitcoin ETF approved in the near future.

But if you live in the UK and you’re thinking of putting one of these into your ISA, SIPP or general investment account, you’re out of luck.

The UK Financial Conduct Authority (FCA) – aka God – has banned all crypto related financial products outright.

As the (notoriously anti-crypto) Financial Times writes:

Almost 50 exchange-traded products linked to crypto assets are on offer globally, with combined assets of $14bn, according to data from TrackInsight. The largest Canadian fund, the Purpose Bitcoin ETF listed in Toronto, has grown to $1.7bn since its launch in February.

The ProShares Bitcoin Strategy ETF, which launched in New York on Tuesday, drew significant early demand from investors.

But despite the appetite for these funds, the FCA remains opposed to letting UK retail investors join in on the global craze.

As the top-rated comment on that article puts it:

And another good comment a bit lower down put it even better:

I guess there’s no point getting annoyed about it though. There’s nothing you, I or the public as a whole can do about it.

It’s entirely up to the old boys’ club what we are and aren’t allowed to put our money into.

Although, you’re free to take your next mortgage payment and bet it all on the football if you like. So long as you don’t try put any money into fully-regulated crypto ETFs you’re all good.

And thankfully you can still invest in crypto directly as that isn’t regulated by the FCA (yet).

Meanwhile, New York and Miami mayors are taking their salaries in Bitcoin

I told you there was a lot going on this month, didn’t I?

Right now, a number of US mayors are trying to prove which one of them is the most pro-crypto by taking their salaries in Bitcoin.

It started with the mayor of Miami, then the mayor of New York joined in..

In New York we always go big, so I’m going to take my first THREE paychecks in Bitcoin when I become mayor. NYC is going to be the center of the cryptocurrency industry and other fast-growing, innovative industries! Just wait!

— Eric Adams (@ericadamsfornyc) November 4, 2021

And on Friday the mayor of Tampa Bay, Florida reportedly got on board, too.

The New York one is kind of strange, given how hard it is to do anything crypto-related in New York, thanks to its BitLicense.

As Vice (wow, Vice is still a thing) reports:

Introduced in 2015, the Bitlicense is a requirement for any entity that wants to carry out cryptocurrency-related transactions. Crypto advocates bemoaned the regulation as too cumbersome and overly restrictive for an otherwise unregulated industry fueled by speculation, leading to an exodus of crypto companies, eventually pressuring the state into issuing new guidance limiting the scope of the license and barriers to acquiring it.

But the mayor there is brand new, and looking to shake things up.

From the block crypto (quoting a paywalled Bloomberg article):

In an interview with Bloomberg, the NYC Mayor-Elect said he's committed to looking into "what's preventing the growth of Bitcoin and cryptocurrency" in New York. That's part of a larger push to become a "business-friendly" city.

"We're too bureaucratic, too expensive and too difficult to do business," he said. "Our agencies, they go into businesses looking for ways to penalize or fine them. We're changing that atmosphere altogether, we're going to become a business-friendly city."

If New York can do it, maybe the UK can too… eventually.

Here’s hoping.

Other things that happened (some of them very big if you’re invested in Radix, IOTA or Polkadot)

Okay, aside from China wanting a permissioned “decentralised” blockchain standard – which has so many issues I don’t even know where to start – that’s it for this month’s general crypto news.

I would like to stop here, but there have been some big developments with Radix, IOTA and Polkadot this month, which I should highlight.

Polkadot parachain actions and crowdloans are now live

On the 4th of November, Polkadot holders voted to open up parachain auctions and crowdloans.

Referendum 42, the motion to enable parachain registration and crowdloans, has passed the community vote and been enacted. Parachain teams are now able to register their parachain and open their crowdloan ahead of the first auction on November 11, 2021. https://t.co/zFSxsozsSF

— Polkadot (@Polkadot) November 4, 2021

This is a very big deal for Polkadot. It means it can start making and funding its own ecosystem.

If you read my Polkadot review, you’ll know this is basically Polkadot’s main selling point. And it’s now live.

So unsurprisingly, Polkadot’s price has shot up past its previous ATH. As I type this (on Friday evening) it’s up 23% in the last seven days.

If you want to know what I think of Polkadot, you can read my review here.

Radix gets snapped up by Coinbase Custody – gains 138% in a week

Coinbase Custody is a way for big financial institutions to hold crypto. The minimum balance you can hold with it is $500,000.

And this week it announced it would start supporting Radix.

#Coinbase Custody now supports deposits and withdrawals for $eXRD! 🚀

— Radix - Layer 1 DeFi done right (@radixdlt) November 1, 2021

Coinbase Custody is an independent, NYDFS-regulated entity offering the most sophisticated and reliable custody solution in the world.

Details: https://t.co/fAsWJw0req$XRD 📈

This is a huge endorsement from arguably the biggest company in crypto. And it also paves the way for Coinbase to list Radix on its main exchange.

So it’s no wonder Radix is up 138% this week.

And on top of that, Radix will be previewing its big network upgrade to Alexandria on the 12th of November, which will enable smart contracts and get its DeFi ecosystem going.

So right now there is a lot of excitement around the project.

If you’re a premium subscriber, you’ll know my thoughts on Radix. I’ve never seen a project with so much potential.

Go here to read my review on Radix.

IOTA launches smart contracts beta and tokenisation framework

IOTA has been busy this month. To be fair, IOTA is busy every month. But it’s been busy this month in particular.

This month IOTA released its smart contracts beta and its tokenisation framework.

Before we get ahead of ourselves, I should point out that neither of these are on the mainnet yet. But they are fully working on testnets.

Here are IOTA’s TL;DRs on those.

IOTA enters Web3. With the beta release of IOTA Smart Contracts, IOTA offers programmable smart contracts on the IOTA 2.0 DevNet, including early support for the Ethereum Virtual Machine (EVM) and smart contracts written in Solidity, Go (TinyGo) and Rust. We are currently working on extended EVM support, further optimization and porting smart contracts to the IOTA mainnet. Together with the integration of the Tokenization framework, it will offer a powerful solution for seamless, trustless and feeless interoperability and composability between smart contracts on IOTA. Follow the instructions below and let’s BUIDL!

Today we release specifications for the new Tokenization Framework for the IOTA mainnet. This future upgrade will transform the mainnet protocol to a multi-asset ledger with smart contracts and seamless cross-chain asset transfers. Native tokens and NFTs live inside the Tangle and inherit the feeless and scalable nature of the base currency, the IOTA coin. A trustless bridge mechanism of the Native Tokenization Framework ensures that smart contract tokens can be effortlessly wrapped into and unwrapped from native tokens. The protocol specifications are undergoing public review and work has been started on the testnet implementation.

With these developments IOTA can basically do everything Ethereum can do… but for free.

So instead of paying £50 in gas fees to use a DeFi app, you could pay £0.

Instead of spending £200 on gas fees to make a trade on uniswap… you could make that trade for free.

Instead of paying God knows how much to mint a whole new crypto on Ethereum… you could do it for free.

It’s hard to overstate how major this could be, not only for IOTA, but for the whole crypto ecosystem.

And yet, IOTA’s price has barely moved. It’s up 12% in the last 30 days. And its total market cap is still just $3.8 billion.

That’s about 17-times less than Cardano’s, about 19-times less than Solana’s and about 140-times less than Ethereum’s.

I guess the market is waiting to see if/when IOTA can successfully pull off coordicide. But even then, IOTA seems way undervalued compared to just about every other coin in the top 50.

I mean Shiba Inu is currently worth more than 7-times as much as IOTA.

Oh well.

I guess that’s why people love that quote: “the market can stay irrational longer than you can stay solvent”.

Okay, that’s it for this month’s issue.

In this month’s premium issue I’ll be reviewing Fantom, which I’m pretty excited about.

That review will be released on the last weekend of this month.

If you want to read it, or any of my other in-depth crypto reviews – including Radix, Solana and Polkadot – you can get a premium subscription here for £10 a month.

Thanks for reading.

Harry

PS what happened with Evergrande? It didn’t miss the deadline! But there’s no telling what will happen with the next one… and the one after that… and the one after that.

And meanwhile, as The Economist reported on Friday morning:

China’s property-debt crisis escalated as shares of Kaisa Group, a property developer, were suspended on Hong Kong’s stock exchange after one of its units missed a payment on a wealth-management product. After Evergrande, Kaisa has the heaviest offshore debt burden in China’s property sector. Reuters reported that Kaisa plans to sell assets worth $13bn by the end of 2022 to stay afloat.

PPS Looks like the “DeFi killing” infrastructure bill is about to be signed into law. That will definitely be something to keep an eye on in November.

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).