This month in crypto: the spectre of debt

What happens when a “too big to fail” company… fails? Last month we nearly found out. This month we might just do so.

Of all the many stories that sailed by this month, one of them was so big it threatened to disrupt the entire financial system with its wake.

(Can you tell I watched a lot of boats bobbing about on the med last week?)

And that story was the impending collapse of China’s second biggest property developer, Evergrande.

Three years ago Evergrande became the “most valuable real estate company in the world” and is ranked 122 on the Global Fortune 500, according to Wikipedia.

So what if some property developer in China goes bust? You might think. Why should we care?

Well, because it’s not really so much about the company going bust. It’s about its debt obligations.

You see, Evergrande has around $300 billion of debt…

And this massive pile of debt isn’t just owed to its customers. It isn’t even just owed in China. It’s been packaged up and sold as investment products (bonds) to businesses all over the planet…

Including (allegedly) Tether – the world’s biggest stablecoin and subject of endless controversy, murky dealings and lawsuits – and maybe even the far more reputable stablecoin, USDC. (Source: Coin Telegraph)

So it wasn’t just the regular financial world that got spooked, it was crypto, too.

From Reuters:

Evergrande bondholders also include some of the world's biggest asset managers, according to the latest data published by Morningstar Direct on holdings of U.S. and cross border funds, as well as Asian bond funds.

The debt is held by funds run by asset managers such as UBS, Fidelity, PIMCO as well as emerging markets focused asset manager Ashmore Group, the data showed.

And its shares are also held by various funds and ETFs around the world.

Again, from Reuters:

On the equities side, various Vanguard funds held a combined $40 million or so worth of shares as of August, Refinitiv Eikon, data showed, while BlackRock held at least $13 million across its iShare MSCI emerging market ETFs.

So when the news surfaced Evergrande was about to default on its $300 billion of debt, its share price tanked and it set off a shockwave of panic around the financial world.

Reuters, again:

Shares in Evergrande, which has been scrambling to raise funds to pay its many lenders, suppliers and investors, closed down 10.2% at HK$2.28 on Monday, after earlier plummeting 19% to its weakest level since May 2010.

Regulators have warned that its $305 billion of liabilities could spark broader risks to China's financial system if its debts are not stabilised.

World shares skidded and the dollar firmed as investors fretted about the spillover risk to the global economy. U.S. stocks were sharply lower, with the S&P 500 down nearly 2%.

The financial world held its breath as the 23rdof September – the deadline day for Evergrande’s payment – approached… and went by.

“‘Eerie silence’ as Evergrande misses payment deadline”, wrote the Guardian.

But for some reason, no one really seemed to care. By this point the deadline to increase the US debt ceiling was taking centre stage.

“Fed official warns of ‘extreme’ market reaction unless debt ceiling raised”, wrote the Financial Times on the 28th of September.

(The debt ceiling did get temporarily raised this week, like it always was going to.)

And the whole Evergrande fiasco just sort of faded into the background.

But nothing actually changed. And now two weeks on, things are coming to a head.

On the 3rd of October, Evergrande shares stopped trading.

From the New York Times:

Shares of China Evergrande were halted on Hong Kong’s stock exchange on Monday pending a deal, as doubts swirled over whether the struggling property giant would be able to meet its immense financial obligations.

Evergrande said in a filing that its shares were halted ahead of an announcement about a “major transaction.” It gave no additional details.

The real estate developer — once China’s most prolific — has been under close watch by foreign investors and local regulators after it missed two important interest payments on U.S. dollar bonds. The missed payments may not necessarily trigger a default because they each have a 30-day grace period before the missing payment would be considered a default.

The big question now is will Evergrande miss that 30-day grace period deadline? Which I calculate expires on the 30th of October. Just in time for Halloween.

And if it does, what will happen?

Well, it looks like we’re going to find out.

From the Wall Street Journal on the 8th of October:

Advisers to China Evergrande Group’s international bondholders have made little progress in their efforts to engage with the embattled property developer, as the clock ticks toward a likely default.

The Chinese real-estate giant skipped interest payments on $1 billion in U.S. dollar bonds on Sept. 23, and has a 30-day grace period before its bondholders can call a default. Evergrande also didn’t pay the coupon on another set of dollar bonds last week. The 25-year-old company is China’s largest issuer of junk bonds, with more than $19 billion in dollar debt outstanding.

It’s also worth noting that Evergrande is just the most prominent in a long line of Chinese property developers that are struggling.

From the Financial Times on the 8th of October:

Almost half of China’s 30 biggest developers were in breach of at least one of Beijing’s recently introduced rules on property sector leverage, according to a Financial Times analysis of the latest available data.

And, as the Economist writes, if China’s property sector goes down, it’s going to take everything down along with it:

The property market is probably the single largest driver of [China’s] economy. Urban Chinese have flocked to it as a haven. House prices have soared over the past 15 years, often by more than 10% a year in large cities. Yet developers have borrowed huge amounts in the process. The industry’s total debt is about 18.4trn yuan ($2.8trn, equivalent to 18% of gdp), according to Morgan Stanley, a bank. Housing costs, relative to incomes, now make large Chinese cities some of the least affordable places in the world.

These trends have collided with officials’ goals of reducing corporate indebtedness and inequality, which lie at the heart of Mr Xi’s mission to bring “common prosperity” to China. The campaign has already brought down several large real-estate companies as regulators have tightened their access to credit. The latest is Evergrande, a developer with about $300bn in liabilities that has started to miss payments on dollar bonds. (As The Economist went to press Evergrande seemed to have missed another offshore-bond payment, due on September 29th.) The fear for officials is not just that the unwinding of the group will unleash systemic financial risks. If the property sector were to tip into a correction, everything from local-government and household finances to the country’s growth model would be imperilled.

So, yeah… it’s going to be an interesting month in finance, that’s for sure.

And as I’m sure you know, what happens in the wider world of finance directly affects the world of crypto.

How is all this going to affect crypto?

As we saw during the coronapocalypse, crypto tends to fall much further and much faster than traditional markets do during crises.

But it also tends to rebound much faster and further, too.

Remember those tallies I used to run last year with crypto vs traditional stocks during the coronapocalypse?

I think the last time we checked in on the numbers was May 2020 when I wrote this:

Since the start of the corona panic, we’ve been keeping tabs on which asset is weathering the storm the best.

And surprisingly, crypto is doing the best by far – at least for now.

After a 16% jump in less than 24 hours on Thursday, crypto is now 31% up Year to Date (YTD).

- The S&P 500 is now down 11% YTD.

- The FTSE 100 is now down 24% YTD.

- Oil is now down 60% YTD.

- And gold is up 8% YTD.

(All prices correct as of 1pm on Friday the 1st of May)

So a mythical £1,000 investment in each of these assets at the beginning of the year would have left you with:

- S&P 500: £890

- FTSE 100: £760

- Oil (not that you’d really want to invest directly in oil): £400

- Gold: £1,080

- Crypto (not that you can really invest in the whole market): £1,310

Just for fun, let’s take a look at how those numbers stand now.

So since the 1st of January 2020:

- The S&P 500 is up 35%

- The FTSE 100 is down 7%

- Oil is up 25%

- Gold is up 16%

- And Crypto is up… 1,165%

(All prices correct as of 9th of October 2021)

So a mythical £1,000 investment in each of these assets at the beginning of 2020 would have left you with:

- S&P 500: £1,350

- FTSE 100: £930

- Oil (not that you’d really want to invest directly in oil): £1,250

- Gold: £1,160

- Crypto (not that you can really invest in the whole market): £12,650

Wow! That’s insane. Maybe I should have kept reporting those numbers every month.

For fun, let’s break it down even further, with the figures for the two most popular crypto assets.

Bitcoin is up 666% turning £1,000 into £7,660.

And Ethereum is up 2,705%, turning £1,000 into £28,050.

Ridiculous. Absolutely ridiculous.

Although…

As I looked back to find the last time I wrote about this. I discovered I did already imagine these ridiculous price rises. (But I definitely wouldn’t go as far as to say as I predicted them. I try not to “predict” anything to do with prices).

Take a look.

Here’s what I wrote back in April 2020 (I’ve bolded the important part):

Crypto’s weakness is also its strength

Well here’s the thing, which is also what makes crypto such an exciting investment to follow.

A comparatively small amount of money moving in or out of the crypto market will have a colossal impact on prices.

That 43% drop I circled on the chart above was caused by $97 billion fleeing the market.

By comparison, on the 16th of March “Black Monday” the S&P 500 lost $2.69 trillion and dropped only 12%.

So by the same token, it doesn’t take nearly as much money to come back into crypto for prices to get back up to where they were.

Remember, at its absolute peak, on the 7th of January 2020, when Bitcoin was over $17,000, Ethereum was over $1,000 and IOTA was over $4… the entire crypto market was only worth $830 billion.

The S&P 500 alone lost more than three times that amount on “Black Monday” and only dropped 12%.

And just for a fun yet completely unrealistic thought experiment… how much would Bitcoin, Ethereum and IOTA be worth with a $2.69 trillion crypto market cap?

(The same amount the S&P 500 lost on “Black Monday”)

Well, if we ignore all the other variables and just extrapolate from the previous high:

- Bitcoin: $55,096 – 629% up from today. Turning every £1,000 into £7,290.

- Ethereum: $3,253 – 1,630% up from today. Turning every £1,000 into £17,300.

- IOTA: $12.96 – 1,866% up from today. Turning every £1,000 into £19,660.

The thing is… many crypto investors do think about scenarios like that. And many have also seen the worst that the market can throw at them… and still have money in it.

So when crypto suffers another big drop, quite a few crypto investors inevitably see it as a buying opportunity.

And as long as you’re sticking to the three golden rules of crypto investing, then why not take advantage of those opportunities?

Admittedly my IOTA numbers are way off… by a factor of 10. But the Bitcoin and Ethereum ones are eerily close.

As I write, Bitcoin’s price is $55,339 and Ethereum is $3,632.

I actually can’t get over how close those numbers are. Spooky… and just in time for Halloween.

But to go back to the original point…

If Evergrande really does cause another major crash, it could create a huge crypto buying opportunity.

So long as you can see past the inevitable onslaught of panic-stricken headlines and financial commentators.

And so long as you don’t end up with bigger things to worry about.

Other things that happened

Right, that whole Evergrande section was pretty long. So I’m just going to summarise the rest of this month’s stories and give you some links if you want to read up on them.

But first, here’s my favourite meme from the Evergrande fallout:

Bonus points if you recognise the scene.

I’ll give you a clue. The guy on the left is Ed Norton, or is he?

Bitcoin breaks $55k on ETF approval rumours

Bitcoin jumped 15% this week… just in time for this month’s issue.

Why? If the rumours are true, we’re only a couple of weeks from the US approving its first ever Bitcoin (futures) ETF.

Source: Coin Telegraph.

China bans crypto… again *yawn*

The media went mad over China’s umpteenth ban of crypto on the 24th of September and prices took a hit. But they’re now right back where they were again. Actually, they’re higher.

If you’ve followed Crypto for a while you’ll know that China has banned crypto pretty much every year since its inception.

But every time it does the media goes crazy about it and prices take a tumble before rebounding back even higher.

Source: Reuters.

SEC cancels Coinbase lending

Coinbase was due to launch a savings account that paid 4% interest on the USDC stablecoin.

The product would have worked just like the ones from Celsius, BlockFi and Nexo that I wrote about in this premium issue: How to earn 10% interest on your savings in £ (GBP) or $ (USD) using crypto

But the Securities Exchange Commission (SEC) said that if it launched the product it would sue… because in its opinion it would be a security.

Coinbase’s CEO made a lot of noise about the situation…

1/ Some really sketchy behavior coming out of the SEC recently.

— Brian Armstrong (@brian_armstrong) September 8, 2021

Story time…

And then eventually caved and cancelled the product.

Given the super high inflation rates and record low interest rates in the US (and most of the rest of the world, including the UK) you’d have thought the US might have seen Coinbase’s 4% interest as a positive thing for its citizens.

But apparently not.

People should be happy to lose 5% a year to inflation while earning 0.1% interest in their bank account.

Cronyism at its finest.

Tech Crunch covered the story here.

Does this mean the SEC is going to come after all of the other centralised crypto lending platforms? Probably. But who can say?

Looks like DeFi is going to prove its worth when that battle comes to a head.

Another fun meme about the state of NFTs

Back when NFTs started blowing up I wrote a feature on them, which I think is definitely worth reading: The one thing everyone is missing in all this NFT hype… will be “so obvious” in hindsight

But then, I would thing that, wouldn’t I?

Crypto investors better looking than regular people

Here’s a fun chart that popped up in The Economist this month:

The Economist puts DeFi on its cover

And speaking of The Economist, earlier this month it dedicated its weekly issue to DeFi… well the cover story at least.

And it ran a very decent – by mainstream media standards – feature about the world of DeFi.

You can read it here if you’re interested.

If that article was written a year or two ago it would have been bang on. But a lot has happened in the last year that makes many of the issues it brings up kind of irrelevant.

Still, it was one of the only balanced pieces I’ve seen written about DeFi from a major financial publisher.

It’s definitely worth reading. And it’s worlds ahead of anything you’d find in the Financial Times or the Guardian when it comes to crypto.

UK hires financial BIG SHOTS to consult on its CBDC

From Coin Telegraph:

The United Kingdom’s central bank is ramping up its research into a central bank digital currency (CBDC) with the selection of a long list of banking and fintech experts to assist it.

On Thursday, the Bank of England announced the membership of its CBDC Engagement and Technology Forums and they include some big names in technology and finance including Google, Mastercard, Consensys — and even Spotify.

Thankfully there are some crypto people on the forum. Apparently there’s someone from Consensys there.

The rest are just random tech companies, old money financial firms and a couple of startup banks and payment services. It’s a strange mix.

It’s actually astounding that there is only one crypto person on in the entire forum. Oh and someone from PayPal.

But they did make room for the Director of Operations at John Lewis, for some reason.

And for Citizens Advice Scotland.

And the head of technology at ASOS (the clothing website).

And for… oh wow they have someone from Facebook’s failed Libra Diem project there too! Amazing.

(Especially amazing given that Facebook’s failed Libra project was what set the whole ball rolling on CBDCs in the first place. We’ve come full circle.)

So I count maybe three crypto people in the whole group of 58 people… to consult about making what is essentially a national cryptocurrency.

IOTA may have genuine “bigger than Coinbase” development

(If you don’t get the “bigger than Coinbase” reference, see last month’s issue.)

From IOTA:

The IOTA Foundation has been selected as one of seven projects from 30+ applications, to participate in the first phase of the EU blockchain pre-commercial procurement process. This aims to design new DLT solutions to improve the scalability, energy efficiency and security of EBSI, a network of blockchain nodes across Europe. If selected for the next phase, IOTA could be one of the technologies that will be developed and tested with core European services.

This development could be one of the biggest in all of crypto. There’s a good reddit post that breaks it down here.

From that post:

The European Commission (EC) and all EU Member States recently announced a new three-phase initiative aimed at delivering cross-border blockchain services to the EU "as soon as possible."

This announcement openly acknowledges that traditional blockchain technologies are inappropriate for the immediate needs of the EU:

"It is clear that there are gaps in existing blockchain solutions to enable the delivery of more demanding cross-border blockchain services (e.g. regarding full compliance with the EU legal framework, security, interoperability, robustness, sustainability). The future evolution of the EBSI thus requires new, improved blockchain solutions."

In light of the EC's desire to expedite a solution "relatively easily by using existing blockchain technology," seven contractors are currently under consideration for providing the infrastructure within the next three years:

If IOTA beats out the rest and gets chosen… it would be, well… much bigger and more important than a Coinbase listing, that’s for sure.

But it’s a big “if”.

I’ll keep you posted with developments.

Cardano launches smart contracts

Cardano is starting to deliver on all its hype.

It launched smart contracts this month, to much fanfare (and some contention).

From Coin Telegraph:

Cardano has announced the completion of its Alonzo hard fork, ushering in its long-awaited smart contract functionality.

On Monday, IOHK tweeted that the upgrade had been completed successfully at epoch 290, facilitating the creation and execution of smart contracts on the public blockchain for the first time.

Despite celebrating the milestone, Cardano notes that it is still in the “early days for the project,” asserting that now is when “the mission truly begins” in a blog post published on the same day:

“This is where the mission truly begins as we – the whole community – start delivering on the vision we have all been working towards for so long. Building a decentralized system that extends economic identity and opportunity to everyone, everywhere.”

The contention came about because apparently the way Cardano’s smart contracts work means they will have issues scaling DeFi dApps.

From Crypto Briefing:

Cardano is facing a major scalability hurdle.

Input Output, the development company behind Cardano, announced the launch of the Plutus smart contract functionality on testnet last Thursday. Since the update went live, Minswap, the first decentralized exchange to launch on testnet, has run into severe scaling issues, raising concerns about Cardano’s capability to run smart contracts.

…

The big question is whether Cardano—given its EUTXO-based design choice—can support scalable and capital-efficient decentralized exchanges built fully on-chain. While Maladex claims [the issue] is “complete and utter FUD,” Eric Wall argues that it’s unlikely Cardano dApps will solve concurrency without making significant security or centralization sacrifices. He told Crypto Briefing that while dApp developers could find workarounds, they may involve “significant development challenges, UX challenges, or centralization.”

The Cardano community has hailed Alonzo as a major new step for the blockchain’s DeFi capabilities. However, the testnet results suggest that it could be at least a few more years until it lives up to its promise. Once the upgrade ships, there won’t be an explosion of DeFi protocols. Instead, Nguyen thinks it will look like Ethereum did in 2018. “The good and best dApps will slowly appear over the years to come,” he said.

Solana goes down

Solana went down for about 17 hours earlier this month – an eternity in terms of crypto – and somehow its price barely moved.

From Solana:

On September 14th, the Solana network was offline for 17 hours. No funds were lost, and the network returned to full functionality in under 24 hours. Solana is designed for adversarial conditions. Over the years the community has developed robust tools and processes for trustless recovery, and has had several practice runs.

During the outage there was a whole world of FUD going out about Solana and when it finally fixed the issue there was another wave of FUD claiming it fixed the issue through centralisation. (Which isn’t true).

Here’s what actually happened, from Solana:

Once the situation was diagnosed, the community proposed a hard fork of the network from the last confirmed slot, which requires at least 80% of active stake to come to consensus. Over the next 14 hours, engineers from across the globe worked together to write code to mitigate the issue, and coordinate an upgrade-and-restart of the network among 1000+ validators. This effort was led by the community, using the restart framework outlined in the protocol documentation. Validators opted to apply the upgrade locally, verify the ledger, and continue producing blocks. Consensus was reached, and the network was upgraded within two and a half hours of the patch being released. The validator network restored full functionality at 05:30 UTC, under 18 hours after the network stalled.

One of the biggest benefits of blockchains is that, even in complete liveness failure for any reason, the validators are individually responsible for recovering the state and continuing the chain without relying on a trusted third party. On a decentralized network, each validator works to bring it back and has their work guaranteed and verified by everyone else. This was a coordinated effort by the community, not only in creating a patch, but in getting 80% of the network to come to consensus. There’s a big difference between an outage like this happening on a centralized network (like Amazon Web Services) and a decentralized network like Solana. If AWS crashes, users have to trust Amazon to bring it back to the right state. The credit and obligation for restoring network operations on any blockchain is in the hands of the community. Operators across the world worked together to reach a solution and restored functionality.

If you want to know what I think of Solana, if you’re a premium member, you can read my ridiculously in-depth review of it here.

If not, you can become a premium member here.

Radix token unlock goes off without a hitch

I covered the Radix token unlock herein last month’s issue.

But at the time no one knew how the unlock would affect Radix’s price.

Well, now we do…

Not a lot – which is very good news.

The token unlock was announced on the 30th of August and took place on the 15th of September.

As you can see below the price dropped to about $0.075 on the day of the unlock and then more than doubled over the next 48 hours.

Right now the Radix Price is roughly where it was before the unlock was announced.

If you want to read up on the token unlock and what it means you can read Radix’s blog on it here.

And if you’re a premium member you can read my extensive Radix review here.

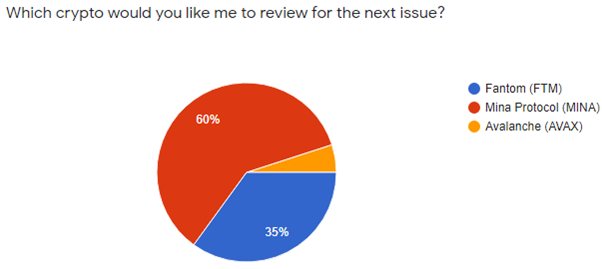

In this month’s premium issue I’m reviewing Mina Protocol, then next month it’s Fantom

The results are in…

In this month’s premium issue (which comes out on the last weekend of this month) I’ll be reviewing Mina Protocol.

Then next month I’ll be reviewing Fantom.

I’m super excited to look at both of these projects, and Fantom in particular has been gaining a lot of popularity lately.

If you want to get access to the reviews as soon as I publish them, you can join coin confidential premium here.

If you do, you’ll also get instant access to my Radix, Solana, Polkadot and Algorand reviews, too.

Okay, that’s it for this month.

Thanks for reading,

Harry

PS the scene in the meme is from… Fight Club, of course.

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).