What is the “magazine cover indicator” telling us about crypto prices?

Well, it’s been another great week for crypto.

After last week’s surge, shortly after I posted last week’s article, a news alert popped up on my phone saying, “Biggest Bitcoin Bull Trap In The Making”.

Whenever I see a publication leading with a bold prediction like this, I can’t help but think of the “Magazine Cover Indicator.”

This basically says that when a magazine leads with a cover story saying something will do well, it will usually do badly, and vice versa.

From Wikipedia:

“In 2016, Gregory Marks and Brent Donnelly of Citigroup looked at The Economist and ‘selected 44 cover images from between 1998 and 2016 that seemed to make an optimistic or pessimistic point.’ They found that impactful covers with a strong visual bias tended to be contrarian 68% of the time after 1 year.”

In other words, if you’d done the opposite of what the cover was suggesting you should, you’d have made money 68% of the time.

But it’s not just the Economist. All the financial publications tend to get their big predictions wrong.

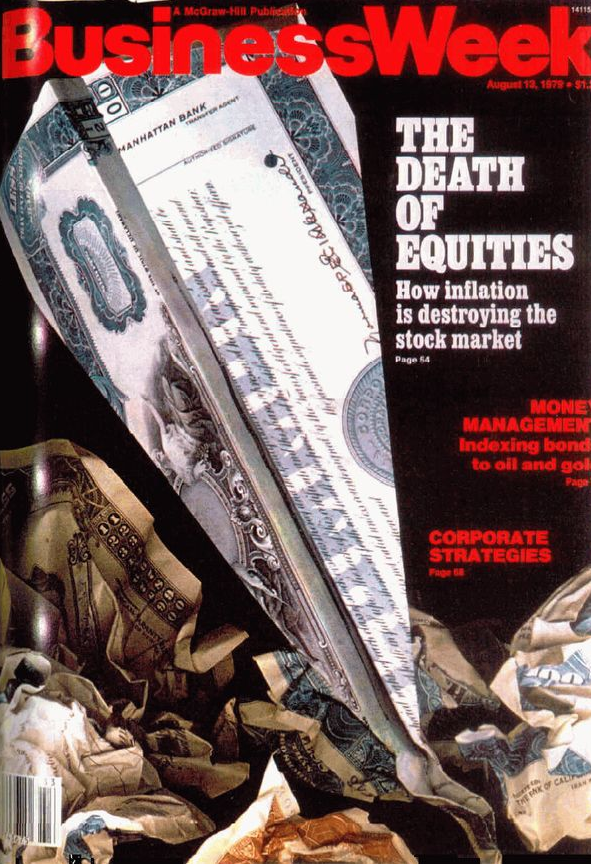

The most famous example is this one from BusinessWeek in August 1979:

Following that cover story, the S&P 500 did this:

So, when I saw the headline “Biggest Bitcoin Bull Trap In The Making” last Friday, I thought it would be interesting to see what actually happened to Bitcoin prices.

(Oh, and don’t worry, I do appreciate the irony of writing about this effect in a publication myself.)

Of course, you know by now that this week’s price surge was even bigger than last week’s. So the magazine cover indicator got it right again… at least for now.

I guess if Bitcoin prices fall again soon, the headline will sort of be proved right. But that’s the same with any prediction of crypto prices… wait long enough and it will probably come true, if only for a minute.

Crypto is still crushing the stockmarket

Since the start of the corona panic, we’ve been keeping tabs on which asset is weathering the storm the best.

And surprisingly, crypto is doing the best by far – at least for now.

After a 16% jump in less than 24 hours on Thursday, crypto is now 31% up Year to Date (YTD).

- The S&P 500 is now down 11% YTD.

- The FTSE 100 is now down 24% YTD.

- Oil is now down 60% YTD.

- And gold is up 8% YTD.

(All prices correct as of 1pm on Friday the 1st of May)

So a mythical £1,000 investment in each of these assets at the beginning of the year would have left you with:

- S&P 500: £890

- FTSE 100: £760

- Oil (not that you’d really want to invest directly in oil): £400

- Gold: £1,080

- Crypto (not that you can really invest in the whole market): £1,310

We’ll check back on these figures throughout the rest of the year as I think it’s a fairly interesting thought experiment.

It’s also interesting just how well one of our ol’ favourites Tezos has been doing, even compared to the rest of the crypto market.

“Tezos (XTZ), one of the largest and most prominent among a fast-growing roster of digital coins known as “staking tokens,” jumped 83% in April, the most among cryptocurrencies with a market value of at least $1 billion, based on data from Messari.”

They attribute this to the popularity of staking, which if you’ve read this article I wrote about Tezos staking back in November, you’ll know is drawing a lot of interest from retail and institutional investors alike.

A mythical investment in Tezos on the 1st of January would now be worth around £2,120.

And if you want to know the fastest, cheapest and safest way to buy Bitcoin, Ethereum, Tezos or most any other crypto in the UK, you can read my free guide here.

T-minus 11 days to the Bitcoin Halving

The Bitcoin halving is fast approaching, and it’s probably one of the main reasons for Bitcoin’s latest price jumps.

If you’re not sure what the halving is, or why it’s such a big deal, you can read #2 in this article: The three major developments coming to crypto in 2020 – and what they mean for your money.

I don’t necessarily think these price jumps are coming from people making calculated buys into Bitcoin as the halving approaches, but more due to the amount of attention the halving is drawing.

Either way, it’s making for some big price moves. And I would expect Bitcoin volatility to increase as the day itself approaches.

In reality, no one knows or can accurately predict what effect this is going to have on crypto prices.

Logically, it should drive up prices. But then investments, and crypto in particular, rarely follows logic.

I would also expect “whales” and institutions with big stacks to manipulate the price both up and down in order to increase those stacks and take advantage of the situation.

So I think we could see a number of double digit gains followed by double digit losses as the day itself approaches.

Whatever happened to Facebook’s Libra?

Remember when you couldn’t go more than a day without being bombarded by news about Facebook’s Libra?

Remember how it was such a big deal governments and central banks around the world united to denounce it and try get it banned?

And then remember how it just sort of… faded away?

Yeah… what happened with that?

Basically, most of its backers eventually cowed to the pressure and backed… out.

Mastercard, Visa, PayPal and Stripe all pulled out towards the end of last year and left the project kind of dead-in-the-water.

As one of my readers put it in March: “Big money players do not pull out of projects that are going to succeed.”

Since then Facebook has scaled back its grand plans and is now planning to offer digital versions of traditional currencies instead, including the US dollar and the Euro.[i]

So Libra is now nothing more than Tether or USDC or any other currency-backed stablecoin.

The whole debacle just shows how strong decentralised entities can be compared to traditional companies and organisations.

Decentralisation has proven itself to be more powerful than even the most powerful governments and armies in the world.

Governments all around the world have tried to kill or regulate bitcoin out of existence.

All have failed.

Then, when a cabal of the most powerful companies in the world tried to do something similar… governments were able to slap it down within a few months.

Decentralisation is like democracy. It’s the will of the people. And it has the potential to be bigger and more powerful than any central authority could dream of being.

Okay, that’s all for this week,

If you liked this article, you can buy me a pot of tea here.

Thanks for reading.

Harry

[i] https://www.theinformation.com/articles/facebook-scales-back-libra-plans-bowing-to-regulators

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).