This month in crypto: Three banks collapse… then Bitcoin hits its highest price since June 2022

Until about a week ago, things were looking pretty quiet in crypto.

Then a major crypto-friendly bank (Silvergate) collapsed, and things got a little crazy.

Then the bank for Silicon Valley startups (Silicon Valley Bank) collapsed, and things got real crazy.

Then another US bank (Signature bank) collapsed, and all hell broke loose.

The second and third banks to collapse were the second and third biggest bank collapses in US history, behind Washington Mutual, which collapsed during the 2008 financial crisis.

Stock markets tanked, and crypto. Well, crypto did this:

At first, as you’d expect, crypto prices capitulated.

Bitcoin fell from around $21,700 to $19,700 on the news of Silvergate’s collapse. And as news rolled in about the next two banking collapses, the S&P 500 fell about 3.5%, giving up almost all this year’s gains.

But then something strange happened.

Crypto prices rebounded, hard.

In fact, they more than rebounded. They rose to their highest levels since June 2022, with Bitcoin getting as high as $26,533.

So, what’s going on?

There are a couple of reasons for crypto’s rally, amid the global market chaos.

Number one is that during all the furore, the US inflation figures came in, and they were down.

As I’m sure you know by now, when rates go up, stock prices tend to come down. Especially tech and growth stock prices.

And as crypto behaves like an even riskier tech stock, its prices tend to plummet, too. Which also means that when interest rates drop, prices tend to go up.

A few weeks ago investors were hopeful the Federal Reserve might be able to engineer a “soft landing” where it managed to curb inflation without causing a recession.

Then last week, things changed. Inflation seemed to be sticking around and the Federal Reserve looked set to “increase the pace of interest rate rises”.

From Bloomberg via investing.com:

A hawkish warning from Federal Reserve Chair Jerome Powell that the central bank could speed up interest rate hikes upended Wall Street recent thinking that inflation would be tamed with more modest measures.

Treasuries sank to fresh lows after Powell said in prepared remarks that to battle persistent inflation the Fed was “prepared to increase the pace of rate hikes” and that the terminal rate “is likely to be higher than previously anticipated.” Swaps bets shifted to show traders now expect the Fed will be slightly more likely to announce a half-point hike rather than a quarter point move at their March meeting. The S&P 500 Index fell almost 1% before paring loses.

That happened on the 7th of March, right at the start of all this price turmoil, just days before those three banks collapsed.

But then, one week later, on the 14th of March, inflation figures came in, and they were down, which means the Federal Reserve probably won’t start hiking rates more aggressively after all.

From U.Today:

The recent [Bitcoin] gains follow the latest Consumer Price Index (CPI) release for February, which saw inflation fall to 0.4% from 0.5% in January, in line with economists' estimates. In line with expectations, inflation decreased from 6.4% to 6.0% on the year-over-year basis from the previous month. Markets had anticipated that the Fed would approve an additional 0.25 percentage point hike to its rate benchmark going into the announcement. With the CPI report, that likelihood grew, and traders are now estimating that there are higher chances that the Fed will raise interest rates by a quarter point.

That’s reason number one.

Reason number two is that Bitcoin was literally a reaction to the 2008 financial crisis and the banking bailouts that followed.

It was designed to be the antidote to bank bailouts.

For more on that, see my everything you need to know about crypto essay.

So, although, yes, Bitcoin does act like a risky tech stock. It is also theoretically the safest thing you can hold during a real financial collapse.

From Coin Telegraph:

According to Trezor Bitcoin analyst Josef Tětek, the current sharp rise of Bitcoin’s price — which is the fastest rise in price so far in 2023 — appears to be a direct result of the “apparent fragility of the banking system.”

Tětek said that the current banking crisis could potentially make Bitcoin emerge as a safe haven and risk-off asset. He emphasized that Bitcoin was created soon after the world encountered the financial crisis of 2008 and was “likely a response to the unfairness of bailouts.”

“The current events are a timely reminder of why we need Bitcoin,” Tětek said, adding that the current events are not so good for many crypto businesses and assets that are centralized, referring to Circle’s USD Coin (USDC). The analyst stated:

“The current demise of certain banks is definitely good for Bitcoin as such, but not a good environment for custodians of any kind, and once again we reiterate that one the safest environments is to self-custody assets.”

According to Tětek, the recent events with Silvergate and SVB clearly show that counterparty risk in the banking system is a “serious problem,” though it is sometimes well hidden. He added:

“Banks no longer actually hold our money, but lend it out and buy volatile assets with it. Depositors are, in fact, the banks’ creditors. Understandably, people are looking for alternatives such as Bitcoin.”

But things are never that simple

As compelling as those narratives are, things are never that simple, are they?

Because two of those bank collapses had a lot to do with those banks’ exposures to failed crypto businesses.

And when Silicon Valley Bank (SVB) collapsed, US regulators worked extremely quickly to make sure no depositors actually lost any money. Investors in the bank did. But customers didn’t.

From the Economist:

On March 12th a joint response by America’s Treasury, the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) helped take concerns about depositors off the table, while revealing another banking casualty.

Their action had two prongs. The first was to fully repay depositors in SVB and Signature Bank, a New York based lender with $110bn in assets which was shuttered by state authorities on Sunday. Signature was closed to protect consumers and the financial system “in light of market events” and after “collaborating closely with other state and federal regulators”, the authorities said. In neither case will taxpayers have to foot the bill. Equity holders and many bondholders in both banks will be wiped out and the FDIC’s deposit insurance fund, which all American banks pay into, will bear any residual costs. Depositors in both banks will have full access to their money on Monday morning.

The second was to set up a new lending facility, called the bank term funding programme, at the Fed. This will allow banks to pledge Treasuries, mortgage-backed securities (MBSs) and other qualifying assets as collateral. Banks will receive the face value of the debt in exchange for a cash advance. The borrowing rate on that cash will be fixed at the “one-year overnight index swap”, a market interest rate, plus 0.1%. These are generous terms. Treasuries and MBSs often trade below their par value, especially when interest rates rise. The rate that is being offered to banks closely tracks that of the Fed funds; 0.1% is not much of a penalty for accessing the facility.

That action smothered a lot of the panic and smoothed things over.

And that was extremely important for crypto because the most reputable stablecoin in crypto, USDC, held billions of dollars of its reserves with SVB.

This led to the world of crypto freaking out over the thought that USDC might collapse. And given that the collapse of Terra Luna’s UST basically bankrupt the entire world of crypto, the freakout was well-founded…

Especially as USDC did de-peg drastically over the weekend:

However, USDC soon (mostly) regained its peg when the news came out that SVB depositors wouldn’t be losing their money.

Now politicians are fighting over what caused these banks to collapse. Was it their exposure to failed crypto companies? Was it their vulnerability to interest rate hikes? Or was it the relaxing of banking regulations during Trump’s presidency?

Probably all three. Although, not in SVB’s case. That one, at least, was nothing to do with crypto and everything to do with its vulnerability to interest rate hikes, as the Economist explained:

Svb is a bank for startups. It opened accounts for them, often before larger lenders would bother. It also lent to them, which other banks are reluctant to do because few startups have assets for collateral. As Silicon Valley boomed over the past five years, so did svb. Its clients were flush with cash. They needed to store money more than to borrow.

Thus svb’s deposits more than quadrupled—from $44bn at the end of 2017 to $189bn at the end of 2021—while its loan book grew only from $23bn to $66bn. Since banks make money on the spread between the interest rate they pay on deposits (often nothing) and the rate they are paid by borrowers, having a far larger deposit base than loan book is a problem. svb needed to acquire other interest-bearing assets. By the end of 2021, the bank had made $128bn of investments, mostly into mortgage bonds and Treasuries.

Then the world changed. Interest rates soared as inflation became entrenched. This killed off the bonanza in venture capital and caused bond prices to plummet, leaving svb uniquely exposed. Its deposits had swollen when interest rates were low and its clients were flush with cash. Since the bank made investments during this time, it purchased bonds at their peak price. As venture-capital fundraising dried up, svb’s clients ran down their deposits: they fell from $189bn at the end of 2021 to $173bn at the end of 2022. svb was forced to sell off its entire liquid bond portfolio at lower prices than it paid. The losses it took on these sales, some $1.8bn, left a hole it tried to plug with the capital raise. When it went under the bank held some $91bn of investments, valued at their cost at the end of last year.

In short, it’s been a crazy time in both crypto and traditional finance. But – for now at least – crypto seems to be faring a lot better. Although, I’m sure things will change again by the time you read this.

And all of this goes to show that in the short term, no one really knows what’s going to happen with crypto prices, no matter how much they will try to convince you otherwise.

How many people saw USDC depegging… of Bitcoin going on an absolute rocket ride right after?

Okay with all that crazy market stuff out of the way, let’s take a look at what else has happened this month in crypto.

UK Financial conduct Authority doesn’t decry crypto at House of Commons’ Treasury Committee?

On the 8th of March there was a Treasury Committee meeting with the Financial Conduct Authority (FCA). And the last 10 minutes or so were dedicated to crypto.

The questions started with a statement by the former head of the FCA that said: “speculative crypto is gambling pure and simple and it should be regulated and taxed as such.”

Which is interesting because in the UK there is no tax on gambling and banks don’t block transactions to and from gambling companies.

Gambling operators are taxed, but gamblers themselves are not.

Honestly, if crypto was regulated like gambling, I think the average crypto investor would be extremely happy.

The new chair of the FCA, Ashley Alder, who was previously CEO of the Securities and Futures Commission of Hong Kong, then went on to talk about his predecessor’s comments.

I’ve transcribed most of it below.

(And here’s a link to the official video of the session if you want to watch it for yourself. The part about crypto starts at 16:17:50 and lasts about eight minutes.)

What I noticed was that the most negative comments come from a letter Alder’s predecessor wrote when he left, which basically says how much he hates crypto and how bad it is for society.

Alder seems a lot more open to crypto than the guy who just left. Take a look at the transcript below and see what you think.

Alder:

Charles [previous FCA chair] is basically saying, this is not fit for financial regulation because it’s not financial services, it’s gambling.

That’s not an uncommon view. And I’m not just talking about the UK, but globally.

My view is basically that the reality is that the international trend is same activity same risk same rules.

It’s a realisation that, globally, this is not going to be looked at from a regulation perspective other than by financial regulators.

That’s proposition one.

Number two, the content of that regulation needs to be appropriately tough. Because if you just take one element of crypto, which is crypto platforms, where the public interacts with unbacked crypto assets… the way in which they have acted traditionally, they are evasive. There are multiple, multiple conflicts of interest. There are huge issues around safety, safeguarding client assets. There are underlying issues around the intrinsic value of tokens, which Charles points to in his letter.

Questioner:

Yeah, he says that “the social purpose of regulated financial markets is to facilitate economic growth by enabling people’s savings to the be channelled to productive business ventures.” So, do you see crypto as fitting that role?

Alder:

Well, arguably, some aspects of the financialised world don’t fit it either.

It’s an ideal world that every piece of financial activity is basically involved directly in converting savings into productive investment. If only it was, but it’s not.

But I think the issue with crypto… my view is that the regulatory regime should be appropriately tough. In the sense that when it comes to, for example, platforms, the inherent conflicts of interest, which are close to deliberate, and evasiveness, needs to be dealt with.

Now, if that happens… now, I did some work 1bout 18 months ago with John Cunliffe [Deputy Governor for Financial Stability at the Bank of England] around stablecoins on an international basis.

And one of the conclusions we came to was that if you put together a regulatory regime that basically amalgamated components of the expectations we’d have of conventional financial services and applied them to a crypto business model, those models would have to change radically.

So when you put a regulatory framework around crypto, the interesting aspect of this is the degree to which crypto will need to adapt and effectively detoxify in order to fit within that regime.

Nikhil Rathi [FCA CEO]:

I want to make it clear that whatever we do on regulation, we are not going to put in place, be able to put in place, a framework that protects consumers from losses. And under no circumstances whatsoever should consumers expect compensation through this.

Questioner:

Should a consumer buy a crypto coin?

Nikhil Rathi [FCA CEO]:

That… I think that there’s also the question of free choice. And what we would say is that they should not be bu—

Questioner cuts him off:

Would you?

Nikhil Rathi [FCA CEO]:

I personally don’t. It’s not something that I have considered desirable to do, so I don’t invest in crypto, but I don’t think it’s for me to dictate to everybody else what they should or shouldn’t do.

What I would say though, it is profoundly inadvisable to put your entire life savings in.

What is at least encouraging – at least in terms of the data we have in the UK – is that while millions of consumers are investing, very often it’s several hundred pounds. It’s less than a thousand pounds.

Different questioner:

But isn’t the issue with this that you start off with a little bit and then you see some of the theoretical returns, which are in your crypto wallet and then you get drawn in more?

There are cases like that, and that is gambling. That is precisely what happens when you’re at the roulette wheel.

Nikhil Rathi [FCA CEO]:

Which is why we want to make it 100% clear – and people get a bit fed up with this because we keep saying it in all of our statements and in all of our documents – that you need to be prepared to lose all your money if you go down this route.

Weirdly, the FCA guys seemed like the most reasonable people in the room there. So maybe there’s hope for the UK’s “crypto hub” status after all.

I like the part where the FCA CEO said it’s not for him to dictate to everybody else what they should or shouldn’t do.

And I also liked the part where the new Chair of the FCA said “It’s an ideal world that every piece of financial activity is basically involved directly in converting savings into productive investment. If only it was, but it’s not.”

This is a stark contrast to the old FCA chair who seemed to think that all traditional investing did convert savings into productive activity and all crypto wasted it.

Meanwhile the New York Attorney General says Ethereum is a security

Up until now, US regulators have operated under the assumption that Bitcoin and Ethereum are not securities, but most other crypto projects are.

The head of the Securities and Exchange Commission (SEC) Gary Gensler is on record saying that Bitcoin is not a security. And previous SEC directors have also declared that Ethereum is not a security.

However, with Ethereum’s change from Proof of Work to Proof of Stake, regulators may be changing their tunes.

Namely, the UK Attorney General. From CoinDesk:

In a lawsuit filed against Seychelles-based crypto-exchange KuCoin on Thursday, New York Attorney General (NYAG) Letitia James alleged the firm broke the law by selling unregistered securities. Among the unregistered securities listed in the suit was ether.

Ether has long been treated as a commodity by state and federal regulators, including the Commodity Futures Trading Commission (CFTC). Designating it as a security would have a massive impact on crypto markets, drastically changing how (and whether) the currency and others like it are traded in the U.S. …

“By shifting to proof-of-stake, ETH no longer relies upon competition between computers, but instead now relies on a pooling method that incentivizes users to own and stake ETH,” the suit explained. “The shift to proof-of-stake significantly impacted the core functionality and incentives for owning ETH, because ETH holders now can profit merely by participating in staking.”

In short, this case is going to be one to watch. Although, as CoinDesk points out, it’s unlikely that the main US regulator, the SEC, will declare Ethereum a security:

It is not, however, a foregone conclusion that the SEC will seek to classify ETH as a security. "From a practical standpoint I still think it is very unlikely that the SEC is going to declare the current offer and sale of ETH to involve unregistered securities transactions," said Gulovsen [an attorney that specializes in the crypto industry], because "the impact of doing so would be devastating to a large number of American investors" and "the amount of resources necessary to properly enforce that declaration" would be "far beyond what the SEC is probably willing" to allocate.

So I guess we’ll have to wait and see.

Okay, that’s most of the major news out of the way. There were also hacks on both Algorand and Hedera, and trials for a Brazilian Central Bank Digital Currency. But I’ll cover those stories next month.

Now, to end this month’s issue, let’s get some extreme hopium from Ark Invest’s annual Big Ideas report.

And now for some class-A hopium from Ark Invest’s annual Big Ideas report

Let’s go!

Ark invest on the long-term value of crypto:

In 2022, the contagion from Terra/LUNA, Three Arrows Capital, Celsius, and FTX/Alameda wiped out ~$1.5 Trillion in crypto market capitalization.

Despite the severe downturn, public blockchains continue to foster The Monetary, Financial, And Internet Revolutions. The long-term opportunity for Bitcoin, DeFi, and Web3 is strengthening.

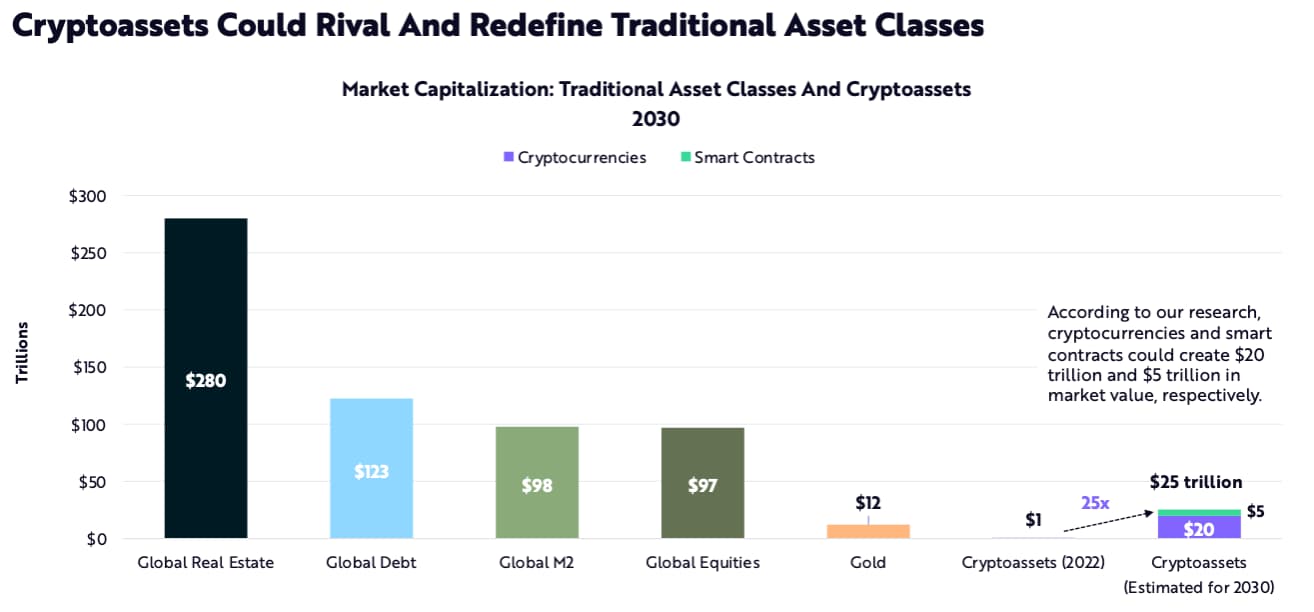

Cryptocurrencies and smart contracts could command $20 trillion and $5 trillion in market value, respectively, during the next ten years.

The case for DeFi from Ark Invest (which is basically the same argument I made in this this feature: in defence of DeFi)

In the aftermath of catastrophic failures of centralized crypto intermediaries last year, automated self-executing contracts on decentralized public blockchains offer the alternative of transparent and non-custodial financial services.

Decentralization is proving more critical to maintaining the original value proposition of public blockchain infrastructure.

According to ARK’s research, as the value of tokenized financial assets grows on- chain, decentralized applications and the smart contract networks that power them could generate $450 billion in annual revenue and reach $5.3 trillion in market value by 2030. …

As insolvencies mounted across crypto lending businesses like Celsius and Voyager, decentralized lending markets like Aave continued to operate as designed. They processed deposits, withdrawals, originations, and liquidations without service interruption.

Since November 2020, Aave has processed more than $75 billion in inflows and $66 billion in outflows, all autonomously via smart contracts.

Risk controls and full transparency of deposits, loans, and collateralization ratios have contributed to DeFi’s stability.

Ark Invest on the lack of decentralisation in newer crypto projects (as I talked about in my Polygon (Matic) deep dive this month):

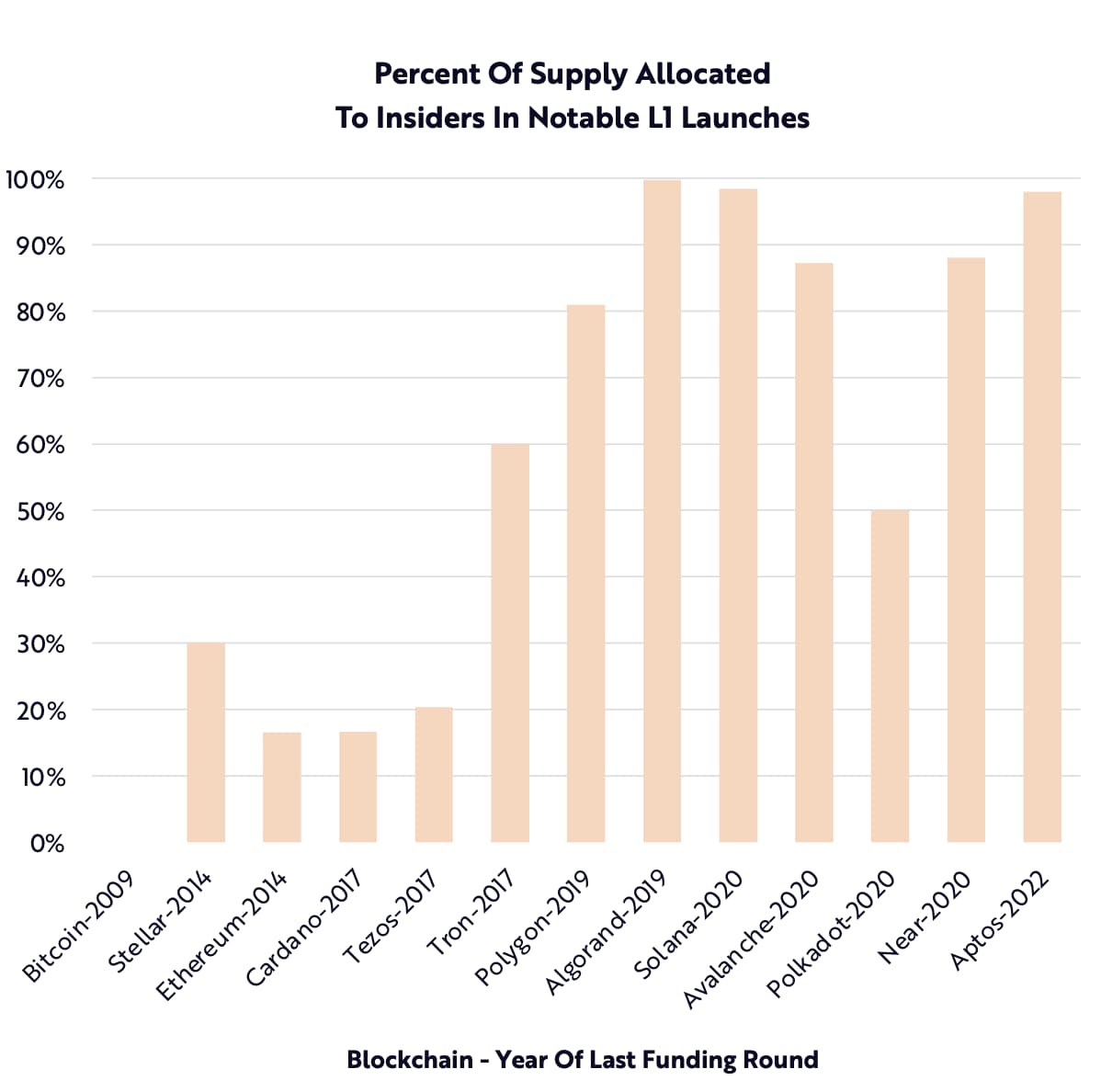

On layer 1 blockchains, the percentage of token supply allocated to insiders—founding teams, private investors, and privately controlled foundations and ecosystem funds—has been increasing.

Since 2017, founders have been increasing war chests to compete with incumbents, and venture capital has been investing aggressively in base layer protocols. Additionally, regulatory concerns have hindered the Initial Coin Offering as an open distribution model.

Consequently, new networks cannot claim they are sufficiently decentralized on a token holder basis and could be susceptible to pressure by insiders.

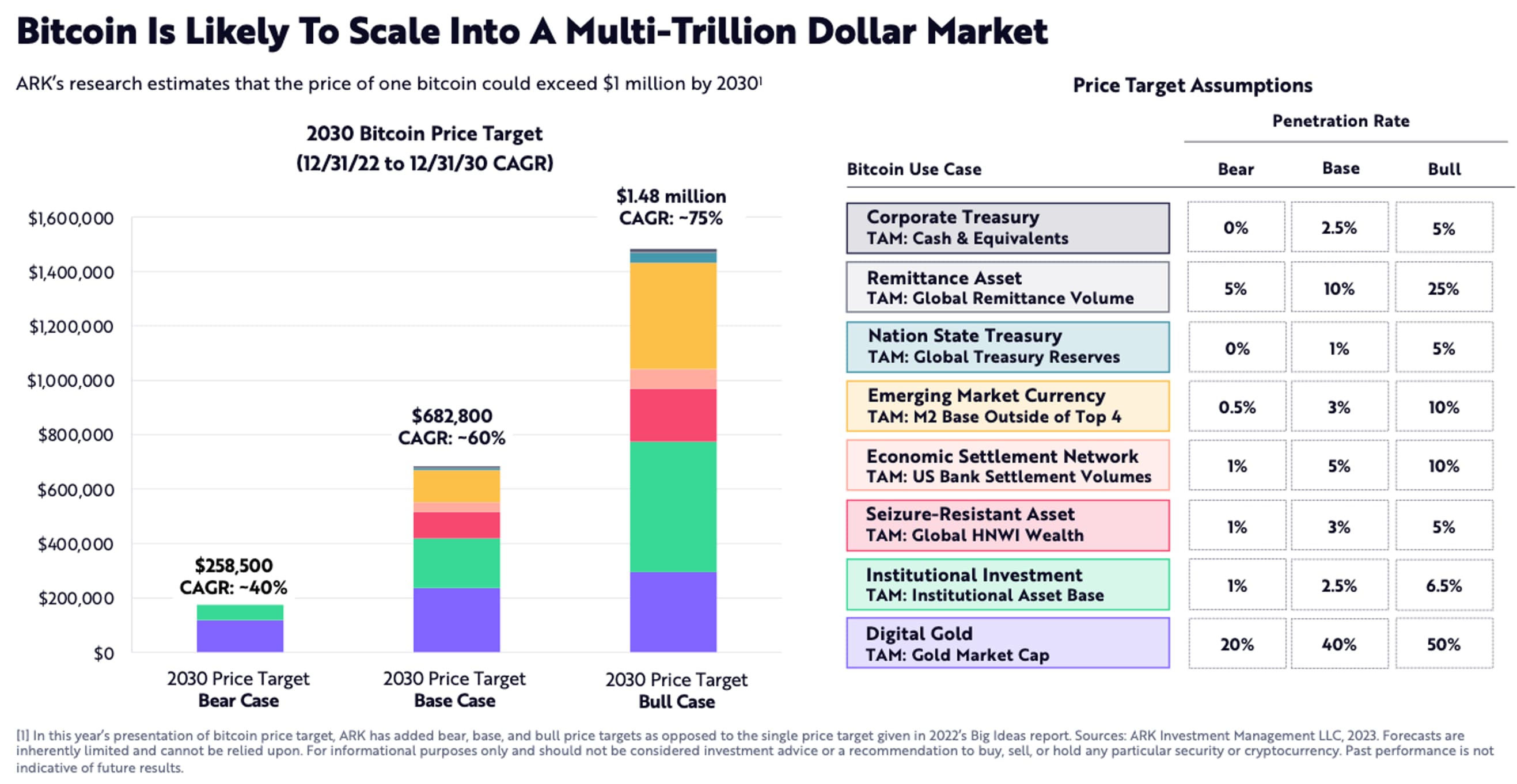

And finally, Ark Invest on Bitcoin hitting $1m by 2030:

We believe Bitcoin’s long-term opportunity is strengthening. Despite a turbulent year, Bitcoin has not skipped a beat. Its network fundamentals have strengthened and its holder base has become more long-term focused.

Contagion caused by centralized counterparties has elevated Bitcoin’s value propositions: decentralization, auditability, and transparency.

The price of one bitcoin could exceed $1 million in the next decade.

Okay, that’s all for today.

Thanks for reading.

Harry

Full disclosure: At time of writing, I held the following cryptos: Ethereum, IOTA, Radix, Mina Protocol, Aleph Zero.

Disclaimer: This content does not constitute financial advice, tax advice or legal advice. Your money and how you choose to spend it is your responsibility. Nothing that appears here should be construed as investment advice or recommendations to buy or sell any securities, cryptos or investments. coin confidential does not offer investment advice. We merely provide information. Crypto investing is highly risky. You should not base any investment decision solely on information we publish. We believe all information we publish to be accurate, but we cannot guarantee it. Always do your own research before making any decisions about your money. See the full disclaimer for more.

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).