This month in crypto: living in the past

I bet you can’t guess what percentage of crypto transaction volume is related to crime. Clue: it’s lower than the number you just came up with in your head.

Ever notice how at the beginning of the year, you end up reading the same article over and over again?

They’re all variations on the same theme: here are the biggest things that happened last year, and here’s what we expect to happen this year.

I’m going to avoid doing that with this month’s article. As much for my sanity as for yours.

However… I will take a quick look at how crypto performed vs other assets over 2021. It’s always fun to do.

So, here’s how the major asset classes and commodities performed from the 1st of January 2021 to the 31st of December 2021:

S&P 500: +27%

FTSE 100: +14%

Gold: -4%

Oil: +55%

Total crypto market: +199%

(Source: Yahoo! Finance, Coin Gecko)

And here’s how the four biggest cryptos performed:

Bitcoin: +60%

Ethereum: +399%

Binance Coin: +1,269%

Solana: +11,171% (read my Solana review here)

(Source: Yahoo! Finance)

Wow.

Stocks had an amazing year. But crypto absolutely killed it. Solana went up by a ridiculous 112X.

And while it would have been very hard to spot Solana’s potential back in January 2021, everyone in crypto knew about Ethereum… which went up 5X.

So, in terms of price action, it was a fantastic year, even as crypto started to crash towards the end.

Congratulations if you were there for the ride. You’re probably pretty happy right now.

Or are you?

Because the 2021 rollercoaster is well and truly over. Now we’re all strapped in for the 2022 edition. And so far, this ride is a lot scarier.

Therein lies the problem with the “here’s what happened last year, here’s what we expect this year” articles.

We live in the present. Not the past. Not the possible future.

So I’d actually imagine that right now, most readers aren’t feeling too happy with the state of crypto. Or at least its price movements.

The crypto market – and much of the stockmarket – has been dropping since November.

Bitcoin is down 39% from its November highs, Ethereum is down 34%. And neither is showing any sign of stopping.

Why is this happening?

Well, aside from the usual reasons – which I covered in detail in this essay: why are crypto prices falling? The definitive guide – there are bigger forces at play.

Over the last few months we’ve had omicron, crazy-high inflation, a Chinese debt crisis (which is only now coming to ahead), and, most importantly, a change in Central Bank behaviour.

Add it all together and what do you get? Uncertainty, and lots of it.

And what do financial markets hate more than anything else? You guessed it, uncertainty.

There’s a saying that gets repeated a lot in crypto: “No one knows sh*t about f*ck.”

Or, as Plato less-offensively quoted Socrates as saying: “I know that I know nothing.”

Everything could rebound tomorrow and we could have another golden bull run that mints a record number of crypto millionaires.

Or everything could keep crashing, and we could have another crypto winter, like the lost years of 2018-2020.

Or maybe both will happen. But who knows in which order?

All I know is, no matter what happens, I’ll be along for the ride.

DeFi is just getting started

There is, however, another major reason to be hopeful about crypto in 2022.

Decentralised Finance (DeFi) is killing it.

(If you don’t know what DeFi is, or why it’s important, read my explainer here.)

Most of today’s biggest cryptos: Ethereum, Binance Coin, Solana, Polkadot, Avalanche, Terra Luna etc. got so big because of their DeFi ecosystems.

These projects are creating real value, rebuilding the traditional financial system in a new, fairer way.

And, as a result, over the course of 2021, the total value locked in DeFi grew from around $19 billion to around $244 billion.

(Source: DeFi Llama)

No matter what happens in the wider world, in the wider financial markets, and in the wider crypto markets, DeFi will continue to grow.

Maybe not always in monetary value. But the ecosystems and dApps will continue to improve.

So when crypto does inevitably bounce back. It will bounce back hard, from a solid foundation of DeFi innovation.

And on that note, The Economist recently wrote a great article about DeFi and its benefits. It’s definitely worth reading.

But even more than that, it’s definitely worth giving to crypto doubters to read, when they tell you crypto is just a Ponzi with no benefit to humanity. Hopefully it will at least begin to open their eyes.

(And if you don’t subscribe to The Economist, you can just copy and paste the url into outline.com to get past the paywall. Or just use this link.)

Now, with all that out of the way, let’s take a quick look at some stories.

“Crypto is mainly used for crime” myth busted

Chainalysis has made a highly successful business out of doing… blockchain analysis.

It’s used by governments, law enforcement, financial institutions, you name it. And it also produces a lot of interesting research.

A few days ago it released its “crypto crime trends for 2022” report.

It showed an interesting dynamic: in 2021 crypto crime hit both an all-time high and an all-time low.

Over $14 billion of crime took place using crypto in 2021.

But that represented just 0.15% of crypto transaction volume.

From Chainalysis:

Cryptocurrency usage is growing faster than ever before. Across all cryptocurrencies tracked by Chainalysis, total transaction volume grew to $15.8 trillion in 2021, up 567% from 2020’s totals. Given that roaring adoption, it’s no surprise that more cybercriminals are using cryptocurrency. But the fact that the increase was just 79% — nearly an order of magnitude lower than overall adoption — might be the biggest surprise of all.

Transactions involving illicit addresses represented just 0.15% of cryptocurrency transaction volume in 2021 despite the raw value of illicit transaction volume reaching its highest level ever.

US regulators continue debating crypto pros and cons, UK regulators continue trying to shut it all down

I was planning to write a big section about how crypto regulation is going around the world, but mainly in the US.

However, although there has been a ton of talk, papers and proposals… nothing much has changed. So I won’t bore you with all the details until something does.

That being said… there is one short video that came out of all the crypto debates in Congress that I think is worth a watch.

It’s great to see people in power getting good information about the benefits of crypto.

Meanwhile the UK Advertising Standards Agency (ASA) has decided to join the UK Financial Conduct Authority in banning as much crypto-related activity as it has the power to.

As The Block Crypto writes:

Earlier in December, the ASA also published a volley of rulings against cryptocurrency advertising on London's transport network, calling crypto assets a "red alert priority".

The seven companies whose ads were deemed to have broken the ASA rules included trading platforms eToro and Coinburp; exchanges EXMO, Luno, Kraken and Coinbase; as well as a promotion from pizza chain Papa John's.

Will the UK’s attitude of stifling innovation and protecting the old boys’ club pay off? Not according to the Financial Times.

The City of London is in danger of becoming a sort of Jurassic Park where fund managers dedicate themselves to clipping coupons rather than encouraging growth and innovation. It is time the income fund sector was phased out and replaced with funds that are more focused on growth than dividends, on the future rather than the past.

Of course, this wasn’t in relation to crypto, but the point remains. For some reason the UK financial sector has become anti-innovation, anti-future and pro-past.

As the Financial Times put it in an even more recent article:

The $3tn valuation Apple reached this week is not just a striking milestone. The tech company is worth more than the entire FTSE 100 index — highlighting the malaise of what was long one of the world’s leading stock markets. In 15 years, the London Stock Exchange’s share of global equity values has fallen from 8.5 per cent to 3.6 per cent. Though 2021 was its strongest year for IPO capital raising since 2007, between 2015 and 2020 London accounted for only 5 per cent of IPOs globally. Since January 2015, the FTSE 100 has gained about 13 per cent. America’s S&P 500 has risen about 130 per cent.

The good thing about crypto is it’s truly global. If the UK powers that be shun it, it’ll just flourish elsewhere (as they have done and as it has done). But it’s kind of a shame all the same.

CBDCs are going (even more) mainstream

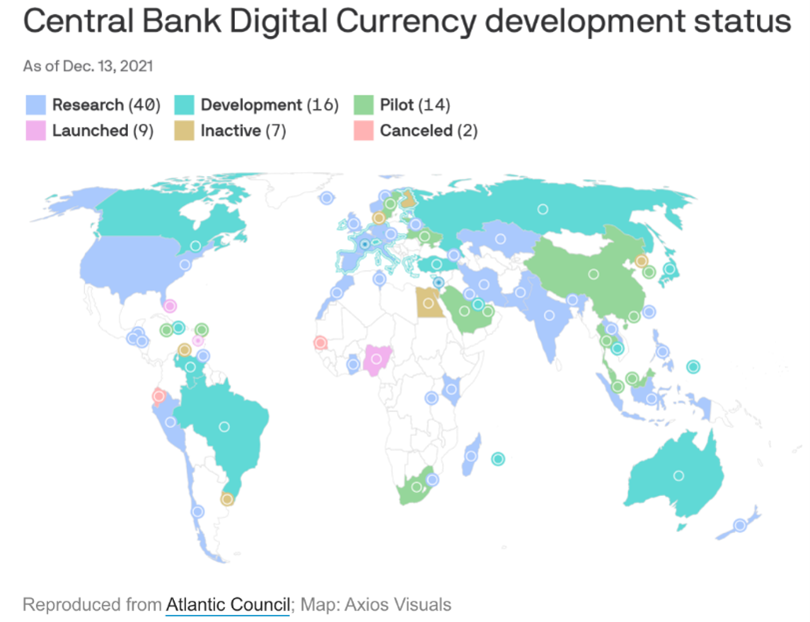

Here’s an infographic of all the countries currently working on their own Central Bank Digital Currencies (CBDCs):

So, basically... all of them.

The big question is, what platforms will they eventually launch on?

No doubt most of them will be created and controlled entirely in-house. But I’m sure some will build on top of public cryptos.

And, as always, if the words Central Bank Digital Currency leave you scratching your head, you can read my explainer here: Everything you need to know about Central Bank Digital Currencies.

Evergrande (almost) topples

The slow-motion disaster that is Evergrande, has been taking a very long time to fall over.

You might remember I dedicated most of an issue to Evergrande in October: the spectre of debt.

Well, it looks like Evergrande has now reached its tipping point. From here on out things could get very real very fast.

As the old saying goes: “how did you go broke? Slowly at first, then all at once.”

Evergrande might just be nearing the “all at once” stage.

How will this affect China and the rest of the world? The Financial Times wrote a really good analysis on it here.

The conclusion: it’s probably not going to go very well.

But as usual, it’s going to take a while to see what effect it will have on the world.

As usual, we’ll know a lot more by next month.

What, no specific crypto news this month?

I was planning to write about the launch of IOTA staking this month, as well as Algorand’s missed deadlines and Solana’s latest network slowdown.

But I’m writing to you from a hotel room right now. And I really need to go outside and be in the world for a bit. I’ve been in this room for far too long.

So I’ll just link you to the Algorand and Solana stories instead:

Algorand fails to upgrade to 46,000 TPS and then decides it’s not a priority at all.

Solana hit with another network incident causing degraded performance

As for IOTA, well, I released my in-depth IOTA review on Boxing day.

If you’re a premium subscriber you can read it here.

And if you’re not, you can subscribe here, and get full access to all these in-depth reviews, too.

I covered all the latest developments in IOTA, including the new Assembly and Shimmer projects. And I gave it the usual in-depth review treatment and ranking.

If you’re a premium subscriber, later this month you’ll learn about how you can make a ridiculous 19.5% interest on stablecoins through DeFi, using Anchor Protocol.

And more importantly, you’ll learn about the potential pitfalls, too.

And if you’re a regular subscriber, you’ll get the next “this month in crypto” on the first weekend in February.

Thanks for reading.

Harry

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).