The bitcoin halving happens in less than one month, but will it change anything?

I’m changing things up on our format this week.

Instead of the usual narrative-style article, I’m going to give you a round up of some recent crypto-related stories I’ve been following.

Every time I see an interesting article or comment thread, I save it into my notes to use in an upcoming issue.

However, a lot of these discoveries don’t really fit together in a nice, narrative way, so they end up being left out of my usual issues… which is why today, we’re having a bit of a mashup.

So let’s get on with it.

T-minus 24 days to the bitcoin halving

In all the furore of recent weeks, the Bitcoin halving has hardly made any headlines.

But, it’s fast approaching. And the jury is still out on what effect it will have on Bitcoin’s price.

I’ve written before about how this could affect Bitcoin’s price. But to summarise: if the supply decreases and demand stays the same, you would expect prices to rise.

However, that’s assuming the halving hasn’t already been priced in, which it may well be.

So… Bitcoin’s price may go up, down or stay the same. No one really knows.

But whatever happens, it will have a big impact on how Bitcoin is viewed as an investment going forward – for better or worse.

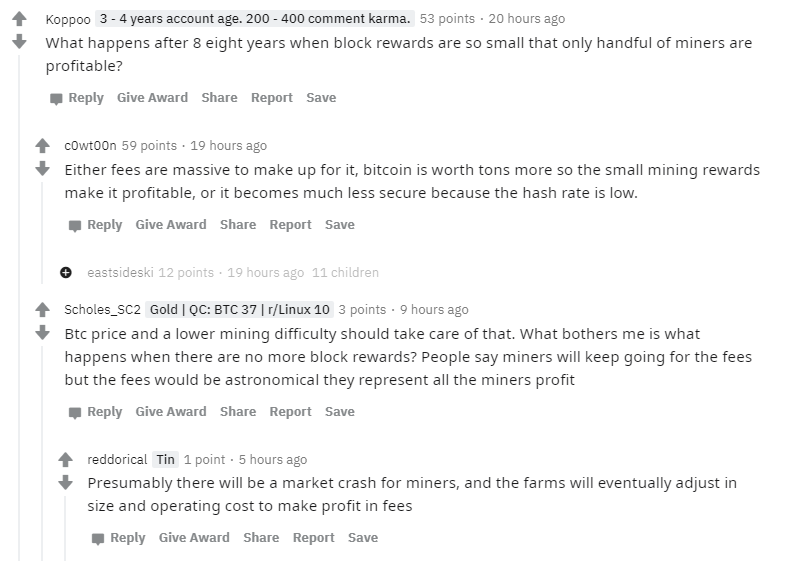

However, there is something else to consider.

When Bitcoin’s block rewards halve on the 12th of May… what if its price or network activity doesn’t increase enough to make mining profitable?

I thought this was an interesting thread exploring that idea:

Blockchain may provide the answer to coronavirus “immunity passports”

As much as I try to avoid commenting on the coronapocalypse, it’s pretty hard to completely ignore it.

A few weeks ago – near the beginning of the frenzy – I read an article in The Economist which summed up the entire situation extremely well, and without the usual hype or sensationalism we see in the media.

As I said to some friends at the time, you could basically just read this article and then ignore all the other news stories until the world returns to normal.

(Which I would love to do, but that’s proving to be near impossible. It’s a golden age for groupthink and media hysteria… which is then endlessly forwarded around every social circle you’ve ever had contact with.)

If you’re interested in the full Economist article, you can read it here.

Here’s its conclusion paragraph:

Suppression strategies may work for a while. But there needs to be an exit strategy—be it surveillance, improved treatment, vaccination or whatever. If governments impose huge social and economic costs and the virus cuts a swathe through the population a little later, they will discover that when politicians disappoint the people over something this serious there is hell to pay.

Basically what it was saying was that without “surveillance, improved treatment, vaccination or whatever” some form of lockdown will continue indefinitely – or at least until society shuns it.

Clearly a vaccine would be the best way to do this. But as I’m sure you’ve heard repeated ad nauseam, that is likely “12 to 18 months away”.

So the next best solution is immunity passports. If you can prove you’ve had the virus, you can regain your freedom.

But how can you create a program like this while maintaining some semblance of privacy and ensuring authenticity of the passports?

Sounds like the perfect application for a blockchain solution. And that’s exactly what’s happening.

From CoinDesk:

The COVID-19 Credentials Initiative (CCI) is working on a digital certificate, using the recently approved World Wide Web Consortium (W3C) Verifiable Credentials standard. The certificate lets individuals prove (and request proof from others) they’ve recovered from the novel coronavirus, have tested positive for antibodies or have received a vaccination, once one is available.

Over 60 organizations in the SSI space are participating, such as Evernym, Streetcred, esatus, TNO, Georgetown University and others. The initiative also has a global spread including Consulcesi in Italy, DIDx in South Africa, TrustNet in Pakistan and Northern Block in Canada.

These digital certificates would be issued by health care institutions but controlled by the user and shared in a peer-to-peer manner. (A common misconception is that self-sovereign means self-attested, which removes the need for governments and other authorities; trust in the issuer of the credential is critical, said a spokesman for Evernym.)

…

It’s a system that puts the holder at the center of things, rather than (an often tedious) back-and-forth directly between the issuer and verifier. It also gives the holder power to choose what they want to share and with whom.

Whether it will amount to anything or not, I guess we’ll have to wait and see.

Ethereum now transfers just as much value as Bitcoin – could the flippering be back on the cards?

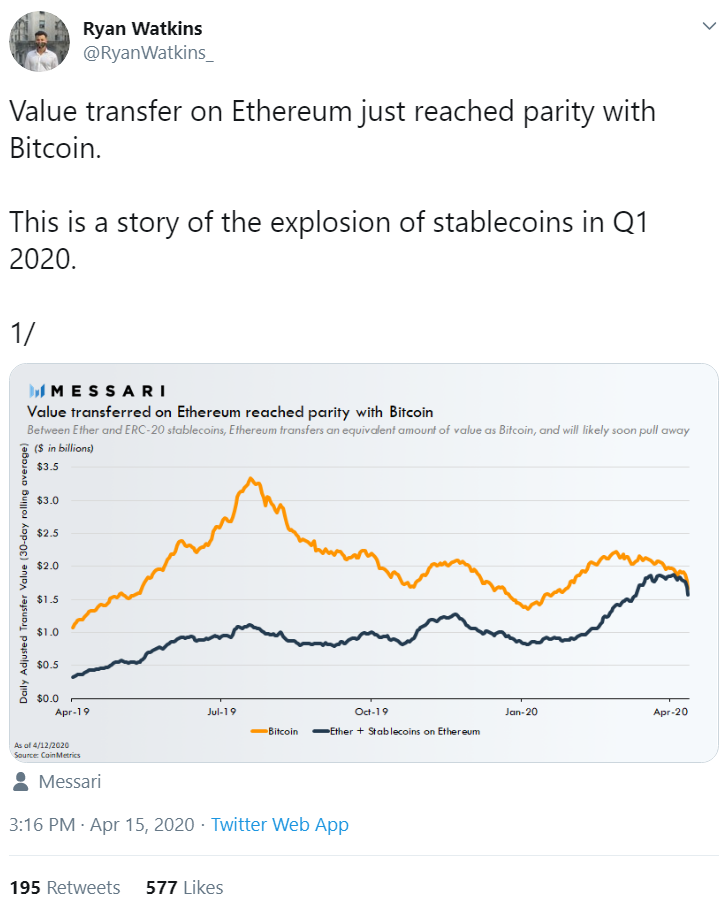

Well, the inevitable finally happened. Ethereum’s network is now moving around

just as much money as Bitcoin’s.

Given how many more applications can be built on Ethereum, it’s no surprise this has happened. It’s just, no one really expected it to happen so soon.

The reason for this move is mainly down to… yes, you guessed it… coronavirus. (Really not doing well avoiding coronavirus in this week’s issue am I?)

As Ryan Watkins explains in a series of tweets:

Driven by a global flight to safety amidst the coronavirus pandemic, stablecoin issuance ballooned over $8 billion in the quarter.

Stablecoins added nearly as much market cap in Q1 2020 as they did in all of 2019.

The action this quarter was so dramatic it shook the prevailing order in cryptocurrencies.

- Ethereum is becoming the dominant value transfer layer in crypto

- Tether cracked the top 3 cryptocurrencies by market cap

- Stablecoin challengers have gained serious momentum

So we now have another important metric for which Ethereum has equalled Bitcoin.

I wrote about another, much smaller “flippering” event late last year: Ethereum finally flips Bitcoin. And if you’re not familiar with the idea of the flippering, I can recommend reading that article.

When will Ethereum complete the actual flippering? That’s anyone’s guess. But I’m convinced it will happen eventually… given how much more can be build on Ethereum than Bitcoin. Especially once Ethereum 2.0 launches.

The US was on the cusp of creating a digital dollar to combat the coronavirus recession

Okay, now my attempts to avoid mentioning coronavirus are completely out of the window. I’ve accepted that.

So on to our last story of the week.

Actually, this story isn’t all that new. It’s just I couldn’t find an article to fit it into up until now. But it made some pretty big waves at the time.

When the US first proposed its economic measures against the coronavirus, they first included a recommendation to create a digital dollar.

From CoinDesk:

Proposed legislation meant to shore up the U.S. economy during the coronavirus pandemic includes a recommendation to create a digital dollar.

This virtual greenback would help individuals and families survive the shutdown of businesses and series of “shelter-in-place” orders which resulted in skyrocketing unemployment claims and a potential severe recession.

Under the draft bills shared last week, dubbed the “Take Responsibility for Workers and Families Act” and the “Financial Protections and Assistance for America’s Consumers, States, Businesses, and Vulnerable Populations Act,” the Federal Reserve – the nation’s central bank – could use a “digital dollar” and digital wallets to send payments to “qualified individuals,” consisting of $1,000 for minors and $2,000 to legal adults.

Both bills employ identical language around the digital dollar suggestion.

“The term ‘digital dollar’ shall mean a balance expressed as a dollar value consisting of digital ledger entries that are recorded as liabilities in the accounts of any Federal Reserve bank; or an electronic unit of value, redeemable by an eligible financial institution (as determined by the Board of Governors of the Federal Reserve System),” the bills read.

In the end the US decided not to go this route and later versions of the “Take Responsibility for Workers and Families Act” had the “digital dollar” section removed.

But either way, that was major news from a crypto point of view.

Of course, the digital dollar wouldn’t be a true cryptocurrency, just like the other Central Bank Digital Currency (CBDC) programs around the world won’t be.

But it shows how seriously CBDCs are now being taken by even the United States.

And eventually, it seems, all currencies will become digitised.

For more on what that will look like, and what it will mean for us, check out my article: Central Bank Digital Currencies are set to shake up the financial world in 2020.

Okay, that’s all for this week.

If you liked this article, you can buy me a pot of tea here.

Thanks for reading.

Harry

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).