This week in crypto: Ethereum finally flips Bitcoin (in Tether), Coinbase staking sends Tezos price soaring, Coca-Cola's $21bn blockchain

The big day has finally come. The flippening is upon us. But not in the way it was foretold.

If you’re not familiar with “the flippening”, don’t worry. The term hasn’t been popular in crypto for a while.

What it refers to is the day Ethereum overtakes Bitcoin in market cap, and becomes the world’s most valuable crypto.

Right now, that idea might seem laughable. But in 2017 and early 2018, it certainly wasn’t.

The flippening was a daily debate in most Ethereum communities. But that was before the crypto winter, and Bitcoin’s return to absolute dominance.

You can see just how unlikely it now is in the calculation below:

As you can see above, Ethereum’s total market cap now stands at just 12.7% of Bitcoin’s.

It has many times the daily transaction volume. But come on, who cares about that, it’s all about the market cap, right?

Well, it turns out that at some point in the last two weeks, Ethereum really did flip Bitcoin’s market cap – but not in real life, in Tether.

What is Tether and why does it matter?

Tether, for the uninitiated, is both the most important and the most hated player in crypto trading.

As you can see from the screenshot below, it actually has higher trading volumes than Bitcoin.

Tether is a “stablecoin”.

In fact, it’s currently THE stablecoin – much to the distain of most crypto communities.

A stablecoin is a cryptocurrency that remains price stable. Its price is usually pegged to a fiat currency or an established commodity.

Most stablecoins are pegged to the US dollar because the US dollar is the world’s reserve currency.

Because they are price stable, stablecoins are pretty essential to crypto trading. And really, they are the only type of crypto that works as a crypto-currency.

Buying and selling things with most cryptocurrencies means you are paying a huge opportunity cost. And for many, that opportunity cost simply isn’t worth it.

We all remember the cautionary tale of “Bitcoin pizza guy”, who paid 10,000 Bitcoin for two Papa John’s pizzas back in 2010.

No one wants to be that guy.

Although, as a side note, Bitcoin pizza guy – real name Laszlo Hanyecz – is still part of the community and surprisingly doesn’t have any regrets.

Here’s what he said about the incident in a 2018 interview with coin telegraph:

“You know, I don’t regret it. I think that it’s great that I got to be part of the early history of Bitcoin in that way, and people know about the pizza and it’s an interesting story because everybody can kind of relate to that and be [like] – “Oh my God, you spent all of that money!”

But to get back to our story, stablecoins like tether are essential to crypto trading.

They allow traders to cut losses or take profits without having to go back into fiat, which could take days and usually incurs high fees.

So you would think Tether would be pretty popular among crypto enthusiasts, right? Wrong.

Remember, a lot of people got into crypto because they don’t like or trust their country’s monetary policy.

Case in point – fractional reserve banking and money printing. Or Quantitative easing if you want to get technical about it.

Basically people don’t like that a lot of our money is printed out of thin air and not backed by any real-world assets.

Most money today is simply backed by a country’s word, or decree, hence the term “fiat” money. And when a country needs more money, it simply prints it… because it can.

After the financial crisis of 2008, the US printed over $4 trillion out of thin air, to get the economy going again.

But they weren’t the only ones. The UK and EU have their own multi-billion pound and euro money printing programs.

Many people see Bitcoin as a reaction to that very crisis and the corruption which led to it.

As you probably know, Bitcoin has a finite supply (21 million). And that supply is enshrined in its code. There will never be more than 21 million Bitcoin in existence.

Bitcoin’s genesis block even referenced the UK’s money printing.

The following text could be found in its code: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”.

Tether’s money printing fails to bring down crypto

The reason people don’t like Tether is because it also has a history of printing money, seemingly out of nowhere.

Each Tether is supposed to represent $1, locked up in a secure account somewhere by Tether’s owners iFinex.

But Tether has yet to show any real proof that’s the case.

And every so often, Tether’s supply increases by millions of dollars overnight.

People refer to this is printing Tethers.

Tether has now printed so much money that its market cap is sitting around $4 billion. Making it the 5th largest crypto in the world.

If it turned out Tether didn’t really have $4 billion sitting in a vault somewhere – as many suspect – it could decimate the crypto trading industry and send crypto prices into a death spiral.

Well, it turns out Tether was lying about holding all that money.

In April the New York Attorney General announced an investigation into Tether’s owner iFinex for fraud.

Some $850 million had “gone missing” from iFinex’s the New York Attorney General decided to investigate.

As a result of the investigation iFinex admitted that Tether was actually only 74% backed by real dollars. So they had been lying.

How did markets react? Well, as I reported at the time – Bitcoin prices actually went up.

At this point, we’d do well to remember that famous line: “The market can stay irrational a lot longer than you can stay solvent.”

Fast-forward to this Friday and Tether announces it is once again 100% backed by US dollars.

Although, if you read that statement, you’ll see it’s written as though the court case never happened and Tether didn’t have to admit in court that it was only 74% backed. That’s the magic of PR.

Not the flippening we asked for, but the one we deserve

As a result of all these accusations and legal issues, Tether created a live transparency page, listing its total supply.

Since 2014, Tether was solely created on top of the Bitcoin blockchain, using the Omni layer protocol.

But then in September 2017 things changed.

Tether began issuing Tether tokens on top of Ethereum’s blockchain, using the ERC-20 token standard.

You might remember from my opening this was right around the time the flippening idea was gaining ground.

Well, just over two years later, and there are now more Ethereum Tethers than Bitcoin ones.

You can see how many Tethers are currently in circulation on each platform in the screenshot below. (I’ve highlighted the key numbers.)

This may seem like a fairly trivial story. But it does illustrate that Ethereum is far more useful than Bitcoin for a wide range of applications.

Given a long enough timeline, the real flippening is inevitable.

However, it may not be Ethereum that eventually topples Bitcoin’s crown.

There is a lot more reputable competition in the smart contract crypto space now than there was back in 2017.

So Ethereum is going to have to watch its back if it wants to one day become top dog.

Coinbase announces Tezos staking – price jumps 25% in minutes and stays up

“The Coinbase pump” was a phenomenon during the last crypto bull run.

As the name suggests, when a particular crypto was listed on Coinbase, it would experience a massive surge in price.

The phenomenon came to a sudden halt – along with crypto prices – during the crypto winter.

But it seems it might be back. At least going from what happened with Tezos’ price this week.

If you don’t know a lot about Tezos, you can read last week’s article here.

But to recap, Tezos is a smart contract crypto similar to Ethereum. But it has some major differences.

For one, its users can vote on network updates. So it means its own network participants have a significant say over its future.

But more importantly than that, for crypto investors at least, is the fact that is uses a liquid proof of stake protocol.

I won’t go into what that means here. A topic that big needs its own article (which I will write in the coming months).

But the main takeaway – again from an investment point of view – is that you can earn interest simply by holding it. Or more accurately, staking it.

In fact, you can easily earn around 7%-9% interest a year by staking Tezos.

Of course, if Tezos price drops, that isn’t going to do you much good. But if Tezos price also increases over that year, then you’ll have made a significant profit.

And, it also means that you could potentially earn a decent passive income simply by staking Tezos.

Now, until this week, earning that interest wasn’t super straightforward for the uninitiated.

(Although, if you’ve read this far, I’m sure it wouldn’t be too hard for you to work out how to do it. It takes about 20 minutes of research and the tiniest bit of technical knowhow.)

But then Coinbase – which already supports Tezos trading – announced Tezos staking.

And to stake your Tezos on Coinbase requires no technical knowhow whatsoever. It’s all done automatically.

The downside, of course, is that in return Coinbase claims a significant amount of your earned interest for itself.

However, even after Coinbase’s fees, you can expect to get between 5% and 6% interest. And this is much, much more than you could get in a bank.

But then, in a bank, you’re earning interest on a stable currency, not a volatile crypto.

However, if you were planning to hold that crypto anyway, it’s a great way to increase your stack.

And it could also be a great way for institutions to earn money on their crypto investments, too.

Given all this, it should be no surprise that Tezos’ price shot up on the Coinbase news.

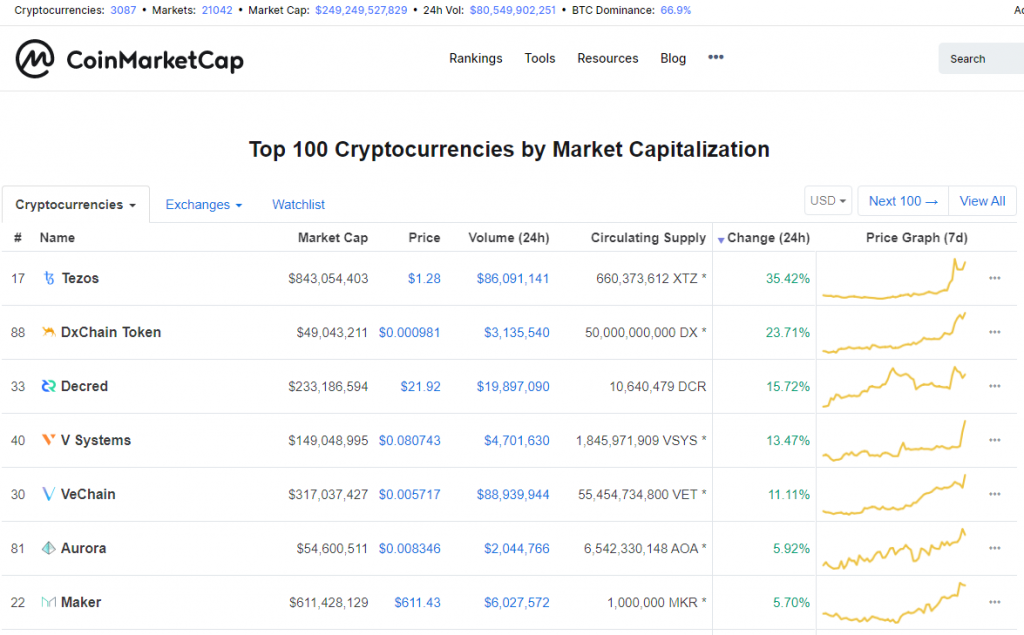

It was by far the biggest gainer in the top 100 on Thursday, as you can see below.

And the unusual thing about this pump is Tezos is still riding high today.

As I type this on Sunday evening, it’s still sitting at $1.23. That’s 45% up from when I reported on it this time last week.

It will be interesting to see what happens to its price over the next week.

Stellar Lumens burns half its token supply – price obviously jumps

Another big crypto that saw a major price spike this week was Stellar Lumens.

Between the 4th and 5th of November, it jumped 20%.

Why?

Well, on the 4th of November its foundation burned over 55 billion Stellar Lumens tokens, worth $4.7 billion.

To put that into perspective, it’s more than half of Stellar Lumens’ total token supply.

Why did they do it? In their own words, because they aren’t getting as much attention anymore (emphasis mine):

“SDF [Stellar Development Foundation] can be leaner and do the work it was created to do using fewer lumens. Over the years we’ve also seen that giveaways and airdrops have diminishing effects, especially in the outsized amounts our original plan was designed to support. So a smaller public-facing program would have just as much impact.”

You would have thought that burning this much of their supply would have had a bigger effect on the price.

But the tokens they burned weren’t circulating. They were locked up by the foundation. So it didn’t really affect Stellar Lumens’ supply/demand relationship. At least not in the short term.

But it certainly got them a lot of attention. And a pretty significant price bump.

Coca-Cola using blockchain for “$21 billion per year network”

And finally this week (I’m saving the EU creating its own cryptocurrency story for next week) we have Coca-Cola.

Who doesn’t love Coca-Cola? Especially at this time of year.

Aside from basically inventing Santa Claus as we know him today, Coca-Cola has also been busy with blockchain.

It is moving its $21 billion-a-year supply chain operation onto blockchain.

Basically, Coca-Cola is so big, and deals with so many different suppliers and brands that it is a nightmare for it to keep track of its supply chain.

Well, supply chain is one if the areas crypto is really making a difference, and it hasn’t gone unnoticed by Coca-Cola.

“There are a number of transactions that are cross-companies and multi-party that are inefficient, they go through intermediaries, they are very slow. And we felt that we could improve this and save some money,” Andrei Semenov, senior manager at Coke One North America, told Business Insider.

According to Business Insider, Coca-Cola is working with German blockchain company SAP to create a blockchain solution that improves its supply chain.

More and more major companies are working with crypto and blockchain all the time.

It’s just most media outlets don’t think that side of crypto is interesting enough to report on.

Okay, that’s all for this week. It’s time I did something more productive, like watching TV. Any suggestions?

Thanks for reading.

Harry

***

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).