This month in crypto: hope returns?

As I write this, we’ve seen the first sustained rally in crypto for a very long time.

Over the last 30 days, here’s how the top 10 non-stablecoins are doing:

- Bitcoin is up 26.8%

- Ethereum is up 32.8%

- BNB is up 19.4%

- Ripple is up 10.8%

- Cardano is up 30%

- Dogecoin is up 8.8%

- Polygon is up 21.3%

- Solana is up 80.4%

- OKB is up 48.7%

- Shiba Inu is up 40.9%

(Source: CoinGecko)

Of course, I’m writing this on Wednesday morning. So by the time you read this on Sunday, things could have changed. But that’s not really the point here.

The point is that we’re seeing more signs of hope in crypto in the first month of 2023 than we saw in the entire year of 2022.

I’ve seen a lot of commentators saying this rally is likely to collapse at any minute. Short-term traders are way up, so it makes sense for them to take some profits, which would lead to another drop.

(See my “Why are crypto prices falling?” piece for more on that.)

But that’s just par for the cause in any market environment. The interesting thing about this latest rally is why it happened.

Crypto doesn’t operate in a bubble

Okay, maybe I should avoid using the word “bubble” when talking about crypto. But this idea relates to the main idea behind this month’s deep dive into Cosmos.

If you’re a premium subscriber, you can read the whole thing. But even if you’re not, you can still read the 1,000-word intro, which talks about this idea.

(And – shameless plug – if you want to become a premium subscriber and get full access to all my deep dives and premium content, you can join here. It’s £10 a month and you can cancel at any time.)

I start all my deep dives with a long intro, which usually explores a major issue in crypto or the world and explains how the crypto I’m writing about aims to solve it.

So, like I said, even if you’re not a premium subscriber it might be worth checking them out.

In last month’s Aptos deep dive, for example, I wrote 2,000 words on what could be seen as the biggest issue crypto faces today: Venture Capitalists vs Cypherpunks.

The intros do fade out as they get closer to the actual deep dive, so if the last 100 words or so are too hard to read, you could always just copy and paste it into a text editor.

But to get back to the point…

In my Cosmos deep dive I talked about the maximalism vs multi-chain vision for crypto. And I said, “no blockchain is an island”.

I obviously stole adapted that idea from John Donne’s famous line, “no man is an island”.

(And to go way off track here, while looking into the origins of that phrase, I discovered it comes from the same piece of writing that originated the phrase “for whom the bell tolls.

Here’s the piece in full:

No man is an island, entire of itself; every man is a piece of the continent, a part of the main; if a clod be washed away by the sea, Europe is the less, as well as if a promontory were, as well as if a manor of thy friend’s or of thine own were; any man’s death diminishes me, because I am involved in mankind, and therefore never send to know for whom the bell tolls; it tolls for thee.

And here’s some more information on it, if you’re interested.)

But it isn’t just true for cryptos within cryptoland, it’s also true for cryptoland itself within the wider world.

And over the last few months, US inflation has been trending downwards. It’s now at its lowest level in more than a year.

The lower inflation gets, the smaller the Federal Reserve’s rate rises should become. Eventually, those smaller rises will turn into cuts.

And as we know, lower interest rates tend to lead to higher stock prices (as the cost of borrowing and doing business drops).

The mere expectation that this will happen is enough to move markets. And that’s essentially what we’ve seen since the start of this year. The S&P 500, for example is up about 4.8% year to date (YTD).

And because crypto is like the stock market with a 10x multiplier on it (for both up and down moves) that’s why we’re seeing those huge crypto gains YTD.

One day crypto might break away from the world of traditional finance, but for now it basically acts like a hugely volatile tech stock.

So what else has been going on?

Bored of the FTX unwinding yet? I sure am

Every single day a new story comes out about FTX, SBF or something related to that whole disaster.

Honestly, it’s beyond boring hearing about all this stuff now.

And the court case is set to last years.

Surely it can’t go on like this. Anytime anyone with any authority weighs in on the case, it’s front page news.

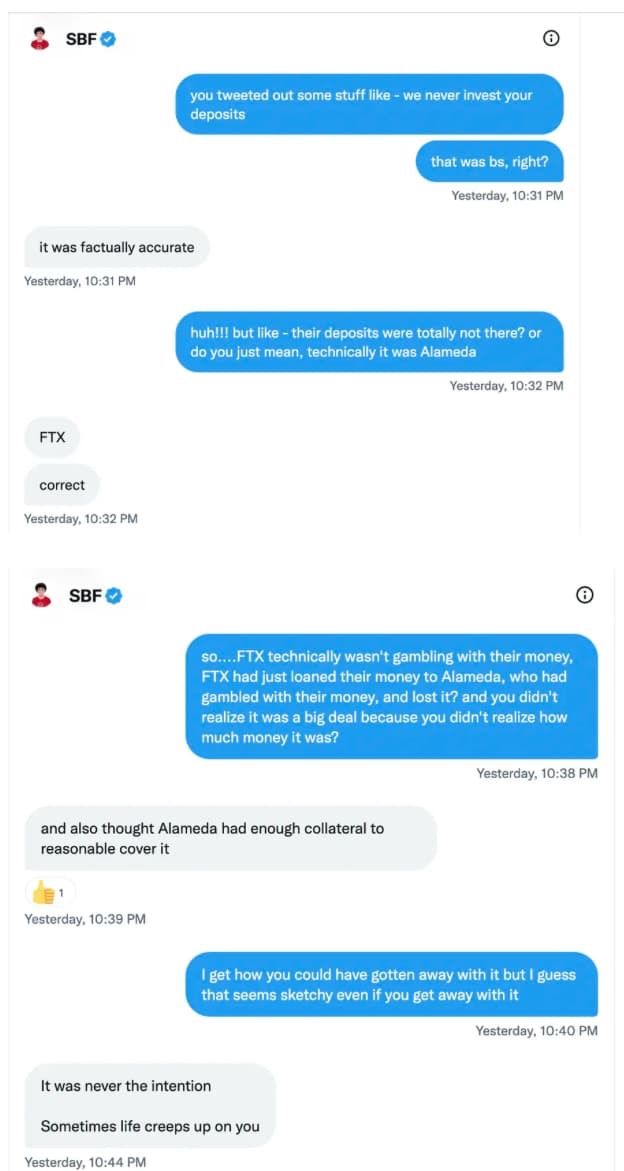

SBF even started a substack to proclaim his innocence ahead of the court battle. It reads like a man losing his mind and repeating himself over and over again. And it includes nothing about stealing customer funds to prop up Alameda research – which he’s already admitted to!

The most interesting thing about this situation is that SBF allegedly also used those stolen customer funds to pay for millions of dollars of political donations.

If the prosecutors are right, you now have a huge number of politicians (unwittingly) using stolen customer money to further their political careers.

Okay, I guess that isn’t that boring. But still, there’s only so much FTX drama the world can take.

GTX drama is taking over where FTX left off

Oh, come on!

This week, news surfaced that Su Zhu – the guy who ran Three Arrows Capital (3AC) into the ground and triggered the mass crypto meltdown of basically every crypto lender (because they were extending uncollateralised loans to 3AC. More on that in last month’s issue) – is raising $25 million to start a new crypto exchange called GTX.

Yes, really.

Oh, and he’s also teaming up with Mark Lamb, the founder of CoinFlex. Yes, that same CoinFlex that halted withdrawals last year and is currently restructuring because of its massive, unpayable debts.

But it gets even better.

GTX’s pitch is that it will trade the creditors’ claims on insolvent crypto firms… including the claims on 3AC.

You can read their pitch deck here, if you’re interested.

And why is it called GTX? Because G comes after F, of course.

After a lot of mocking from, well, everyone, CoinFlex put out a statement saying that GTX is actually just a placeholder name. Sure it was.

Here’s a great slide from the pitch deck:

It seems more than a little ironic that no former employees of listed bankrupt firms will qualify… even though it’s being created by former employees of those same bankrupt firms.

Also, just the idea itself is mad. Two companies lose millions in customer funds and create a cascade of crypto company bankruptcies in their wake… then their founders try to convince people to invest in their new exchange that will trade claims on those bankruptcies… that they themselves caused!

Only in crypto.

In more positive news…

The UK is still going full crypto – this could be the start of something BIG

Remember when the UK decided to go full crypto?

If you do, you’ll probably also remember that then the “onmishambles” happened and all previous plans went out the window.

Well, now “laser-eyes” Rishi is somehow the only one left standing, and it seems like he’s still on board the crypto train.

From CoinDesk:

The U.K. government is “fully behind” a stablecoin for wholesale settlements that occur between banks, Andrew Griffith, the economic secretary, said in a meeting in Parliament on Tuesday.

The stablecoin – a digital asset backed by fiat currency – wouldn't be issued by the government, but instead by a third-party provider, Griffith told the Treasury Committee.

"I want to see us establish a regime, and this is within the FSMB (Financial Services and Markets Bill) for the wholesale use for payment purposes of stablecoins," Griffith said, adding that the government is "a long way down the road with" the plan.

The wide-ranging FSMB, which is being debated in Parliament, would give regulators more power over crypto, including stablecoins. The bill should be ready for passage by Easter, Griffith said previously. …

Despite the FTX debacle, the U.K. government still wants to establish the country as a crypto hub, said Griffith, and wants to allow space for this “potentially disruptive game-changing technology that can challenge but also turbocharge all of those (financial) industries."

And there’s more on the story from the BBC. Most notably this:

The EU has set out the world's first comprehensive set of rules for regulating crypto markets.

They are due to receive final approval in the coming weeks and come into effect in 2024.

Mr Griffith said the UK rules could be broader, to include decentralised finance, and everyone would benefit from greater transparency.

"We want the right regime, operated in the right way, that has the right balances in it," he told the committee.

He also committed to hold "at least" six roundtables with those in the crypto industry, to "expose us as regulators and decision makers".

Those new crypto rules and regulations will be make or break for the UK.

Get it right, and the UK could potentially become the leading crypto jurisdiction in the world, which would have a profound impact on the UK economy going forward.

Imagine if the UK became the place to found and run a crypto company. It would be absolutely amazing.

However, if those new rules and regulations miss the mark, it could be the final nail in the coffin for the UK crypto industry.

Although, if the recent past is anything to go by, we’ll have another government implosion long before any of it is enacted.

But there are certainly reasons to be optimistic.

Ethereum’s Shanghai upgrade will finally enable staking withdrawals

Staking on Ethereum has been live for a while now.

“The merge” successfully merged Ethereum’s Proof of Work and Proof of Stake chains into one Proof of Stake chain back in September 2022.

But, although users can currently stake their Ethereum to help secure the network and collect rewards (basically interest), they can’t stop staking and move/trade/sell that staked Ethereum yet.

That will all change when Ethereum’s Shanghai upgrade goes live – likely in mid-March.

From Decrypt:

The validator milestone comes as Ethereum’s core developers look to implement the so-called Shanghai update, scheduled for some time in March.

After this update, validators will finally be able to withdraw their staked ETH and the rewards earned from having staked thus far.

Withdrawal amounts will, however, be capped at 43,200 ETH per day out of the total amount of staked ETH in existence. That total currently hovers at around 16 million ETH, per Etherscan.

Facebook twins vs Digital Currency Group vs the SEC

In another multi-part saga, the Facebook twins – and their customers – are having a very bad time of it.

Gemini – the Facebook twins’ exchange – is owed $900 million by Digital Currency Group’s Genesis trading firm.

Gemini was using Genesis to handle its lending activities. So that $900 million is really owed to Gemini’s customers.

And the Facebook twins have been very vocal about wanting that money back. You can read Cameron Facebook’s open letter here.

This situation has been escalating over the last few weeks. But it really went up to 11 when the Securities and Exchange Commission (SEC) announced it was suing both firms for securities fraud this week.

From Coin Telegraph:

In a statement, the SEC said its complaint alleges that the Gemini Earn program constitutes an offer and sale of securities and should have been registered with the commission.

“We allege that Genesis and Gemini offered unregistered securities to the public, bypassing disclosure requirements designed to protect investors,” SEC Chair Gary Gensler said in a statement.

Gensler added the charges “build on previous actions to make clear to the marketplace and the investing public that crypto lending platforms and other intermediaries need to comply with our time-tested securities laws.”

The last big crypto firm the SEC sued for securities fraud was the now bankrupt BlockFi, which was ordered to pay $100 million in penalties.

In conclusion, it’s another big mess.

And speaking of big messes…

Bitcooooooneeeeeeeeeeeeect victims to get $17 million

If you’ve been in crypto a while, you’ll have seen the famous wasa wasa wasuuuuup bitconeeeeeeeect video countless times.

It was the meme of the 2017 bull run and the crypto winter that followed.

Bitconnect was a pure ponzi scheme that completely blew up. And the reason that meme is so big is that 99% of people in crypto at the time knew bitconnect was a scam and treated it as such.

Back when Bitconnect blew up, people didn’t take crypto as seriously as they do today. And everyone in crypto was a lot less trusting of all crypto projects and companies in general.

So it was a lot more fun.

Bitconnect also didn’t take the entire industry down with it, unlike the collapses we’ve seen in crypto over the last year or so.

It obviously still did sucker in a number of victims though. So it’s nice that 800 of those victims from 40 different countries are now set to receive $17 million in restitution, according to a Department of Justice statement released this week.

And it’s also nice that it gives me the excuse to post that famous video again:

Carlos, you will always be in our hearts.

Okay, that’s all for today.

Thanks for reading.

Harry

PS This month’s premium issue is a deep dive into Filecoin, which was one of the biggest hypecoins of 2020. Filecoin, along with IPFS, is aiming to decentralise the web and bring web3 to fruition. So it’s got a very bold vision.

If you’re a premium subscriber that deep dive will hit your inbox on the 5th of January. And if you’re not yet a premium subscriber, you can join here and get full access to every deep dive I’ve ever written.

Full disclosure: At time of writing, I held the following cryptos: Ethereum, IOTA, Radix, Mina Protocol, Aleph Zero.

Disclaimer: This content does not constitute financial advice, tax advice or legal advice. Your money and how you choose to spend it is your responsibility. Nothing that appears here should be construed as investment advice or recommendations to buy or sell any securities, cryptos or investments. coin confidential does not offer investment advice. We merely provide information. Crypto investing is highly risky. You should not base any investment decision solely on information we publish. We believe all information we publish to be accurate, but we cannot guarantee it. Always do your own research before making any decisions about your money. See the full disclaimer for more.

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).