This month in crypto: nothing is real and everything is possible

There is an absolute ton to cover this month: the great crypto crash, ark’s $1m Bitcoin prediction, new US and UK regulations, stablecoins killing traditional banks, a $300m hack and the most viral story in crypto history.

In 2014, a book came out promising a secret view into “the glittering, surreal heart of twenty-first-century Russia.”

It didn’t disappoint.

The most interesting parts were about a man named Vladislav Surkov.

From the book, which you can read an extract of here on The Atlantic:

One of Surkov’s many nicknames is the “political technologist of all of Rus.” Political technologists are the new Russian name for a very old profession: viziers, gray cardinals, wizards of Oz. They first emerged in the mid-1990s, knocking on the gates of power like pied pipers, bowing low and offering their services to explain the world and whispering that they could reinvent it.

Surkov used confusing and contradictory methods to keep control of the country and keep everyone on their toes.

Again, from the book:

The brilliance of this new type of authoritarianism is that instead of simply oppressing opposition, as had been the case with 20th-century strains, it climbs inside all ideologies and movements, exploiting and rendering them absurd.

One moment Surkov would fund civic forums and human-rights NGOs, the next he would quietly support nationalist movements that accuse the NGOs of being tools of the West.

With a flourish he sponsored lavish arts festivals for the most provocative modern artists in Moscow, then supported Orthodox fundamentalists, dressed all in black and carrying crosses, who in turn attacked the modern-art exhibitions.

The Kremlin’s idea is to own all forms of political discourse, to not let any independent movements develop outside of its walls. Its Moscow can feel like an oligarchy in the morning and a democracy in the afternoon, a monarchy for dinner and a totalitarian state by bedtime.

The reason I’m bringing this up today isn’t anything to do with Russia’s possible imminent invasion of Ukraine.

(Although, I guess it might give some insight into why no one seems to be able to work out if Russia is actually planning to invade or not. Confusion is the theme.)

No, the reason I’m bringing it up is because a lot of it rings true in the world of crypto right now.

Companies, regulators, governments and nations are flip flopping on their stances towards crypto. No one seems to know anything. No one seems to be communicating with each other. And different parts of the same machine are constantly contradicting each other.

The FCA vs crypto vs (some) politicians

In the UK, on one hand we have the Financial Conduct Authority (FCA).

The FCA has just taken over the regulation of crypto advertising, and it’s using it as a way to regulate the entire crypto industry by stealth.

Under the guise of banning misleading crypto advertising (which most people will cheer on – no more scam and memecoin ads plastering busses) it’s effectively banning ALL crypto advertising.

All crypto advertising will have to be “authorised by the FCA or the PRA, or the content of the promotion is approved by a firm which is.”

So, if you’re a DeFi project or an exchange, or business involved in crypto, you need to be regulated by the FCA to advertise.

Essentially, if you want to promote your crypto-related company or project in any way you need to be from the world of traditional finance so you can be regulated by the FCA.

Or you need to get an FCA-regulated business to sign your work off for you (for a reasonable price, I’m sure).

In other words, you need to be part of the “old boys’ club.

But wait, there’s more!

On top of that, the FCA is planning to make it illegal to promote crypto, and crypto-related businesses to anyone except high net-worth or sophisticated investors.

From the FCA:

The FCA’s draft rules include proposed restrictions on the marketing of cryptoassets, in preparation for the Government bringing the promotion of these high-risk investments under the FCA’s remit. When it does, the FCA plans to categorise qualifying cryptoassets as ‘Restricted Mass Market Investments’, meaning consumers would only be able to respond to cryptoasset financial promotions if they are classed as restricted, high net worth or sophisticated investors.

(And “qualifying crypto assets” includes essentially everything in the world of crypto. Except, weirdly, NFTs.)

So, unless you get certified as a “sophisticated investor”, you earn over £100,000 a year, or you have over £250,000 in assets (not including your house), you won’t be allowed to hear about crypto. Well, you won’t be able to see any crypto promotions, at least.

I’m sure that’s going to lead to many new crypto start-ups in the UK.

Or maybe it’ll just send even more of them overseas, as we’ve already seen with Celsius ($19.7 billion in assets), Wirex ($3 billion worth of transactions) and the myriad crypto ETFs and ETPs we see launching in the US, Canada and Europe.

(Remember the FCA banned crypto derivatives in the UK in 2020, so all those Bitcoin ETFs from global asset managers like Fidelity are illegal in the UK.)

Meanwhile, on the other hand, Matt Hancock (yes, that Matt Hancock in those pictures) is now telling Parliament that the UK can be the home of crypto.

Here’s what he said:

Will the minister ensure that the UK is also home to new innovations like fintech, like the extraordinary growth of cryptocurrencies.

These innovations have the potential to disrupt finance just as social media disrupted communications or online shopping has changed retail.

And post-Brexit the UK has the chance to be the home of fintech, which can not only be an economic driver, but also help to cut fraud and financial crime because of the transparency that it brings.

So will he make sure that we get this right and make sure new legislation is fit for the future, so that Britain can be the home of this revolution.

Here’s a twitter clip of it:

The UK can be the home of new innovations like FinTech and Cryptocurrency.

— Matt Hancock (@MattHancock) January 26, 2022

Done right we can increase transparency and lead in new world-changing technology.

My question in the Commons earlier ⬇️ pic.twitter.com/Hsr8QtLxqB

I don’t really know how effectively banning all promotion of crypto companies will lead to Britain becoming the home of crypto. But what do I know?

And then there’s the former Chancellor of the Exchequer, Philip Hammond, who’s gone full crypto.

From Bloomberg (also non-paywalled on Yahoo! Finance):

The U.K. has less than 12 months to regain its footing on crypto or face a loss of talent and even its status as a global financial-services leader, the country’s former Chancellor of the Exchequer Philip Hammond warned.

It’s “frankly quite shocking” that Britain has fallen behind other finance hubs such as the European Union in setting clear regulation on the burgeoning crypto industry, Hammond said in an interview. “This is not the natural order of things,” said the former politician, who stepped down in 2019 and is now a senior adviser to Copper.co, a London-based crypto custodian and trading services provider.

The Financial Conduct Authority issued a proposal to restrict cryptoasset marketing to experienced investors this month, a day after the UK Treasury said it planned to tighten rules on crypto advertising. Other rules remain at the planning stages and a program to register crypto companies has faced delays.

“It’s credible that 2022 is available as a catch-up period,” Hammond said. But if the UK appears “manifestly behind the curve” next year, digital-asset businesses are considering relocating their headquarters to jurisdictions which are further ahead with regulation, such as Switzerland, Monaco and Germany, he added.

He’s saying exactly what I’ve been writing for the last three years!

And here’s something telling:

“Copper will prosper whatever,” Hammond said. “Copper’s strong and publicly expressed preference is to do that from its UK base, but if it can’t – if it’s not able to because UK regulation doesn’t keep pace, if permissions and authorizations are not forthcoming in the UK – that isn’t going to stop Copper moving at pace to exploit this emerging technology.”

That’s the thing about crypto, it’s global. If one country is hostile, then crypto businesses will just move to less hostile countries. It’s very easy to do. It’s not like there’s even anything physical to move.

I guess at least we should be happy there are people in positions of power in the UK that are coming round to crypto.

We even have a crypto lobbying group in the UK now:

From the Financial Times last month:

The UK’s crypto lobby has stepped up its influence in Westminster with the launch of a cross-party group of lawmakers, as politicians on both sides of the Atlantic intensify efforts to regulate growing digital asset markets.

The Crypto and Digital Assets Group, composed of UK MPs and members of the House of Lords, will work to make sure that new rules for the digital asset industry “support innovation”, according to SNP MP Lisa Cameron, who will chair the group.

They have their work cut out for them though.

Let’s not forget that, as the FCA spokesperson says in that Bloomberg piece, “more than 80%” of crypto firms that have applied for FCA regulation have either withdrawn their application or been rejected.

Game over for crypto in the UK?

I’d already scheduled this issue to publish when another big story came out about the UK vs crypto. And after reading it, I knew I had to add it in.

From The Block Crypto:

The fate of the ability for 96 crypto firms to operate in the UK hangs in the balance, as new data highlights a backlog of anti-money laundering applications that must be dealt with by the Financial Conduct Authority (FCA) in less than two months.

More specifically, 27 firms [including $33 billion neobank Revolut] remain in limbo on the temporary register, while 69 “new entrant” applications also hang in the balance.

Without approval before a March 31 deadline, the future of these crypto firms’ UK operations — including exchanges, wallets and an array of other businesses — is uncertain.

As we know, Celsius and Wirex already withdrew their applications and moved to the US. I can’t see Revolut leaving the UK. And I can’t see the FCA barring it from operating, surely?

But who knows? That article also points out that Bitpanda – one of the most trusted exchanges in Europe – missed the deadline and is also now at risk.

Here’s what Bitpanda had to say about the situation:

Overseas-based firms offering their services directly to UK customers from locations outside the UK are currently not captured by the UK’s MLRS and therefore these firms do not need to register with the FCA. This raises the question whether the current regulatory landscape ensures a national level-playing field for cryptoasset services providers in the UK.

So what are the tens, maybe even hundreds, of billions of pounds worth of crypto businesses planning to do?

That’s easy. Leave the UK.

Again from the article:

Ian Taylor, executive director at trade group CryptoUK believes that, judging by past experience, a small number of new firms will be admitted to the register in the coming months. Among officials in the UK Treasury there is not much appetite for the deadline to be extended a third time, he said.

“Lawyers for UK firms are coming up with a plan B – which would be to domicile elsewhere,” Taylor told The Block. …

“It doesn’t seem fair to UK businesses that are trying to do the right thing,” Taylor added.

Home of crypto indeed.

Things are just as confusing in the US

At the end of January, the Federal Reserve released its paper on the pros and cons of a US central bank digital currency (CBDC).

(Read my CBDC explainer here.)

Here’s Axios’ take on the paper:

Around the world, there are now 23 CBDCs either in pilot or formally launched. They have morphed from a theoretical concept into real-world digital cash, changing the way governments and millions of people use money — but not in the U.S.

Although the Fed's paper doesn't advocate one way or another on whether the U.S. should begin development, the language used in the paper indicates that it’s very open to the idea. …

But the ball is effectively in Congress' court: the Fed said unequivocally that it wouldn't move forward on any CBDC development without legislative action granting it authority.

It’s been a busy month for Fed papers on crypto. In January it also released its report on stablecoins.

And the most interesting thing about that paper is that it’s concerned that stablecoins might be too safe.

Yes, not too risky (which it is obviously also concerned with) but too safe!

From the paper:

While a narrow bank framework would guarantee the stability of a stablecoin’s peg as it is effectively a pass-through central bank digital currency (CBDC), this reserve framework poses the largest risk of credit disintermediation. Periods of financial stress or panic could lead to large migrations of regular commercial bank deposits into narrow bank stablecoins, which could disrupt credit provision. Though this credit disruption effect could be mitigated by limits on stablecoin holdings and differential reserve interest rates, the overall structure of the narrow bank approach to stablecoin reserves is potentially destabilizing for the banking system.

So basically, people might start shunning traditional banks and using stablecoins instead.

Why? Because traditional banks don’t actually hold their assets in reserve, they use “fractional reserve banking”. So they only have to have a fraction of customers’ actual deposits held in reserve. The rest they lend out to make money, or make into complicated financial products to earn more money.

And what fraction do they have to hold in reserve? Well in the UK and US it’s zero percent.

So if people could instead hold their money in a stablecoin that’s provably backed 1:1 by actual dollars or pounds… and earn 100x more interest at the same time… you can see how it could spell disaster for traditional banks.

Matt Levine had a good take on this weird situation, as he tends to do on all weird financial situations:

If people get nervous about banks and pull out all their money to put it in safer stablecoins, then (1) that will probably happen at a time when the economy is shaky and (2) that will definitely make the economy shakier. The bulk of the response to the 2008 financial crisis involved preventing runs on banks, because those would have made all of the problems of the crisis much worse.

I suspect that this worry — that stablecoins might be too safe — is not at the top of most people’s minds. This is not the main problem with actually existing stablecoins! It sounds a bit silly, as I type it. But it does seem to be top of mind for U.S. banking regulators, particularly for the Federal Reserve. …

When U.S. financial regulators put out proposals on stablecoin regulation, they were ostensibly focused on safety, but the proposals also very quietly called for banning ultra-safe Fed-backed stablecoins and requiring stablecoins to be issued through regular banks. …

I should say here that my sympathies are with the Fed researchers: I think that fractional reserve banking and credit intermediation are good, and accidentally getting rid of them would be bad. But I am also aware that lots of crypto people disagree; they got into crypto specifically because they are suspicious of the existing financial system and of fractional reserve banking. And while “U.S. regulators want to crack down on crypto to protect banks” sounds a bit like a conspiracy theory, it has some truth to it.

This month, well actually as I type this, the US House Committee on Financial Services is debating stablecoins.

And later this month, the Whitehouse is expected to make its voice heard on crypto. There’ll be an executive order and everything.

From Bloomberg:

The Biden administration is preparing to release an initial government-wide strategy for digital assets as soon as [February] and task federal agencies with assessing the risks and opportunities that they pose, according to people familiar with the matter.

Senior administration officials have held multiple meetings on the plan, which is being drafted as an executive order, said the people. The directive, which would be presented to President Joe Biden in the coming weeks, puts the White House at the center of Washington’s efforts to deal with cryptocurrencies.

Federal agencies have taken a scatter-shot approach to digital assets over the past several years and Biden’s team is facing pressure to lead on the issue. Industry executives often bemoan what they say is a lack of clarity on U.S. rules and others worry that an embrace by China and other nations of government-backed coins could threaten the dollar’s dominance.

It's going to be a big year for crypto in the US (and by proxy the rest of the world, too) that’s for sure.

I mean, we’re still waiting to see what happens with the epic court battle between the Securities Exchange Commission (SEC) and Ripple.

The latest turn on the 8th of February has seen “XRP Climb 22% Amid Developments in Ripple v. SEC Case” and shoot past Cardano and Solana in market cap, according to CoinDesk.

Will arch crypto-villain, SEC chair, Gary Gensler triumph and continue to crush as many crypto projects as he can, or will the court take Ripple’s side and bolster the crypto world?

Who knows? But we should (hopefully) find out at some point this year.

And to round off the US regulatory news, we have something potentially very, very good for crypto investors: the IRS will not tax unsold staked crypto as income.

Or at least, a precedent has just been set that the IRS can’t tax unsold crypto staking rewards.

From Forbes:

In court filings expected to be made public Thursday, the IRS declared it would refund $3,293 in income tax (plus statutory interest) to a Nashville couple who had paid the amount on 8,876 Tezos tokens they had obtained through staking.

According to a May 2021 civil lawsuit filed by the couple, Joshua and Jessica Jarrett, any tokens gained through proof-of-stake should be considered “new property” created by the taxpayer—and therefore not income which “comes in” to the taxpayer. In order to be taxed, tokens gained through staking (or any other newly created property) must be first converted into a “readily accessible form of wealth”.

Thus, the lawsuit claims, until the tokens are sold, no taxable event has occurred.

According to the article the couple in question plan to pursue the case further and hopefully set a precedent that crypto staking rewards aren’t taxable until they’re sold.

Hopefully this will encourage crypto investors in the UK to bring similar suits against HMRC, where staking rewards are currently taxed as income.

Over in India…

India, the only country that flip flops more than China on whether it’s banning crypto or not is now apparently definitely not banning crypto.

It’s going to tax it at 30% instead… and launch a CBDC next year.

From Bloomberg:

The Reserve Bank of India will launch its digital currency in the year starting April 1, Finance Minister Nirmala Sitharaman said in her budget speech on Tuesday. The nation also plans to tax the income from the transfer of virtual assets at 30%, she said, effectively removing uncertainties about the legal status of such transactions.

I’ve seen a lot of criticism of that high 30% tax rate. There’s even a change.org petition with more than 70,000 signatures calling for it to be reduced.

Meanwhile here in the UK crypto staking rewards are taxed the same as income.

So for basic rate taxpayers, that’s 20%, for higher rate taxpayers, that’s 40% and for additional rate taxpayers, that’s 45%.

In that context, maybe India’s proposed blanket 30% doesn’t seem so bad?

And to bring it full circle back to Russia

In a series of events that would make Surkov proud…

First Russia’s Central Bank proposed a ban on crypto. Then Russia’s Finance Ministry said there shouldn’t be a ban. Then Putin said Russia has a competitive advantage in crypto mining.

So, which is it? No one really knows. And I guess that’s probably the point.

Stop Press:

“Russian government and central bank agree to treat Bitcoin as currency” – Coin Telegraph.

Okay, so now it seems Russia is going to class cryptocurrencies as actual currencies.

From Coin Telegraph:

The government and central bank in Russia have reached an agreement on how to regulate cryptocurrencies, according to a Tuesday announcement.

Russia’s government and central bank are now working on a draft law that will define crypto as an “analogue of currencies” rather than digital financial assets set to be launched on Feb. 18. …

While it is still unclear what this decision will mean for businesses and citizens in Russia, it seems that the country is slowly warming up to the idea of cryptocurrencies.

I wonder how long this stance will last.

That’s all the big picture stuff. What about those falling prices?

Have you heard? Crypto prices are down. Like really down. Like 50% down. I’m sure you’ve heard.

Most of the crypto market has been falling since it hit all-time highs in November.

As I write this:

- Bitcoin is down 37% from its all-time high (ATH).

- Ethereum is down 36% from its ATH.

- And the overall crypto market is down about 33% from its ATH.

As usual, those crashing prices led to some great memes. This one has to be my favourite though:

I saw it posted on the 24th of January. The same day this happened:

If you’re reading this newsletter, you probably know that 50% (and greater) crashes are par for the course in crypto.

But I know that doesn’t make them any less stressful for most people.

But this time it’s different!

Isn’t it always?

To be fair, this time the stockmarket is also struggling.

As Axois wrote at the end of January, “2022 is now, officially, the worst-ever start in the history of the S&P 500.” And that data goes all the way back to 1929.

Falling stockmarkets may or may not be the main driver behind falling crypto prices.

Logically you’d think they would be. As economic conditions and “tightening monetary policy” make, growth, tech and risky stocks less attractive, they also make crypto look less attractive.

But if things were that simple to predict and account for, everyone would be an investment genius.

In the wider world, we still have covid, supply chain issues, a possible war in Ukraine, insane energy prices… and a million other major stories that can impact asset prices.

And if inflation continues to get out of hand, the Fed may have to tighten its monetary policy so much that it causes a recession. And recessions are bad for everything, especially asset prices.

From Axios:

In the decades after World War II, episodes of inflation have ended when the Fed took steps to tighten the money supply, causing recessions.

In other words, companies can't hike prices and workers can't demand higher pay if the economy is contracting and more people are out of work.

In the most extreme example, Fed chair Paul Volcker engineered a steep downturn in the early 1980s that ended the double-digit inflation of that era — but at the cost of double-digit unemployment that pummeled President Reagan's popularity.

This time around, the goal is a soft landing. The Fed is looking to move toward higher interest rates gradually, not with the kind of shock Volcker engineered.

Through all of this, just like with the mega crypto crash in May (which didn’t stop crypto hitting ATHs in November), I’m reminded of a key phrase:

“Same volatility, different narratives.”

Wild price swings have always and will always happen in crypto. That’s half the fun.

And people will always come up with plausible narratives for why those wild price swings happen.

Whether those narratives are actually true or not will always be unknowable.

But they’re interesting to hear, all the same. Afterall, humans can’t resist a compelling narrative.

If you want to know why crypto prices are so volatile (and how you can, to some extent, protect yourself from that volatility) then you should check out what’s turned out to be my most popular article of all time: Why are crypto prices falling? The definitive guide.

What else has been happening?

Libra ❌ Diem ❌ Nothing ✔️

The project that put crypto on the map (in a bad way) is no more.

Libra was the coin that launched a thousand ships.

As I wrote in my everything you need to know about CBDCs feature:

Why are so many countries rushing to create their own Central Bank Digital Currencies?

One word: Libra.

This all started when Facebook and its cabal announced plans for its own stablecoin cryptocurrency called Libra.

As I wrote at the time in Exponential Investor:

Libra will be pegged to a basket of currencies and assets. Which currencies it includes in this basket and in what proportions will have huge political consequences.

Think about it, right now the US dollar is essentially the world’s reserve currency. Well what if Libra really takes off, and becomes commonly used by Facebook’s 2.3 billion customers?

All of a sudden Libra is a very important currency, and what it is backed by becomes very important.

Libra really took the political and financial elite by surprise.

Up until its announcement, crypto was seen as something inconsequential.

Sure, some people talked about how it was going to “revolutionise” the financial system. But that revolution always seemed a long way off, and most of the elite didn’t take the people saying those things very seriously.

Then along came Libra, with 2.3 billion Facebook users, ready for adoption and the backing and investment of Visa, MasterCard, Uber, Spotify, eBay, PayPal, stripe and more.

Suddenly, crypto – or more accurately Libra – was legit… and it was gunning for prime position as a world currency.

Again, as I wrote at the time:

Within 24 hours of the Libra announcement, political elites all around the world had decried it:

France’s finance minister Bruno Le Maire proclaimed it to be “out of the question” that Libra “become a sovereign currency”. “It can’t and it must not happen,” he said.

The Bank of England governor, Mark Carney, said: “Anything that works in this world will become instantly systemic and will have to be subject to the highest standards of regulation.”

Markus Ferber, a German member of the European Parliament, said Facebook could become “a shadow bank” and regulators should be on high alert.

While the chairwoman of the House Financial Services Committee “requested” that Facebook “agree to a moratorium on any movement forward on developing a crypto-currency until Congress and regulators have the opportunity to examine these issues and take action.”

And US Senator Sherrod Brown, who sits on the Senate Banking Committee, said: “We cannot allow Facebook to run a risky new crypto-currency out of a Swiss bank account without oversight.”

And the G7 nations are setting up a working group to “evaluate the risks of currencies like Libra,” according to the Financial Times.

Six months later, and Central Banks around the world are rushing to create their own national cryptocurrencies… while still trying to stop Libra from ever seeing the light of day.

Shortly after that Libra changed its name to Diem, in an attempt to distance itself from the angry situation it had created. It didn’t work.

(Kind of like how Libra’s parent company, Facebook has just changed its name to Meta, in an attempt to distance itself from the angry situation it has created. Will it work?)

And now, finally, the whole sorry saga has drawn to a close. Zuckerberg lost.

From cnet:

Diem, the cryptocurrency project backed byMeta[Facebook] CEO Mark Zuckerberg, is shutting down. Diem's CEO Stuart Levey announced on Monday the sale of Diem's assets, citing continuing resistance from federal regulators.

Diem's intellectual property and other assets related to the running of the Diem Payment Network were sold to Silvergate Capital, according to a news release issued by the Diem Association, which oversees the digital currency.

So now there is no Facebook coin, and a ton of CBDCs in progress. What a turn up for the books.

Boston Fed and MIT trial potential US CBDC with 1.7 million transactions per second

Before we get into this story, I should point out the reason this project boasts such a high number of transactions per second is because it’s centralised, not decentralised. So it’s not really a real crypto.

But if you’re building a CBDC you probably want it to be centralised. So that’s not exactly a bad thing in this case.

From Reuters:

The Federal Reserve Bank of Boston and the Massachusetts Institute of Technology (MIT) unveiled on Thursday long-awaited technical research and open-source code that could be used as the groundwork for a potential central bank digital currency.

The research does not suggest that the U.S. central bank will move toward launching a CBDC, a step it has said it would not take without clear support from the White House and Congress. …

The first phase of the multi-year project, dubbed "Project Hamilton," focused on developing software that is flexible and resilient. The work resulted in code that is capable of handling 1.7 million transactions per second. Researchers also found the "vast majority" of transactions settled in under two seconds.

Here’s an interesting bit:

The team developed technology that can be adjusted as more policy questions regarding the structure and purpose of a CBDC are addressed.

For example, the first version of the code did not include intermediaries or fees, but researchers said those roles and features could be added after policymakers and other parties make decisions on the best way for consumers to access their funds and conduct transactions.

Remember, as we saw earlier, policy makers don’t want a CBDC that’s better than commercial banks. That would be bad for business.

And on the technical aspects, well, it’s not only “not really a real crypto” it’s not a crypto at all. It doesn’t use distributed ledger technology at all.

From The Stack:

The [project] did not rely on distributed ledger technology, saying that a) it wasn’t necessary to match the “trust assumptions” under their approach; i.e. that the CBDC would be administered by a central actor and b) that “even when run under the control of a single actor, a distributed ledger architecture has downsides… it creates performance bottlenecks, and requires the central transaction processor to maintain transaction history, which one of our designs does not, resulting in significantly improved transaction throughput scalability properties.”

The architecture that achieves 1.7 million TPS does “not keep a history of transactions nor do we use any cryptographic verification inside the core of the transaction processor to achieve auditability” — breaking many assumptions about what, precisely, a CBDC should be and do.

Ark predicts $1 million Bitcoin and $180,000 Ethereum by 2030

What a difference a year makes.

Last year, when I reported on Ark’s annual “big ideas” report, it was the darling of the investment world.

As I said:

Ark’s flagship fund has gained 143% over the last 12 months, and 672% over the last five years.

Even by crypto standards, that’s a good return. But in the stockmarket, it’s otherworldly.

To put that into perspective, the S&P 500 benchmark has returned 23% in the last 12 months and 97% over the last five years.

Ark’s flagship fund has got so big and so popular it now risks “having too much money and not enough stocks,” Bloomberg reports.

So when Ark releases its “Big Ideas” report, people listen.

Things are a little different now. Ark’s flagship fund is down 53% in the last 12 months.

Meanwhile the S&P 500 benchmark is up 16% over the same timeframe.

In other words, Ark has lost a lot of people a lot of money over the last year.

Remember when I said: “But if things were that simple to predict and account for, everyone would be an investment genius.”?

Well Ark’s Cathie Wood IS without a doubt an investment genius. And she just lost her investors more than half of their money.

However, obviously when Ark releases its big ideas report, people still listen.

Last year Ark said, “we believe Bitcoin has earned an allocation in well-diversified portfolios” and went on to make some price projections for different scenarios.

It calculated that if other S&P 500 companies were to follow in Tesla’s footsteps and convert 10% of their cash to Bitcoin, Bitcoin’s price could go as high as $400,000.

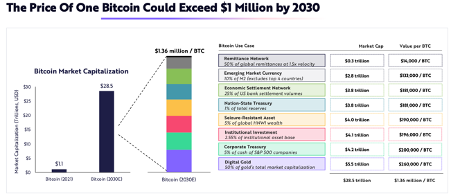

This year, it’s making even bolder predictions about crypto.

It points out that institutional holders make up 7.91% of Bitcoin’s total supply, nation states like El Salvador are adopting Bitcoin as legal tender, “concerns about Bitcoin’s lack of sustainability seem uninformed”, and Bitcoin mining has evolved into a multibillion-dollar industry.

It concludes that by 2030, one Bitcoin could exceed $1 million.

Its predictions for Ethereum are just as positive.

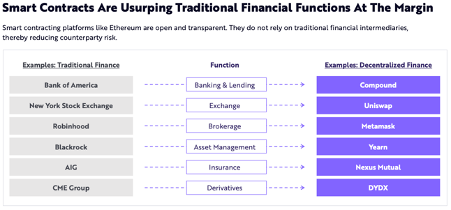

It has a great slide about how smart contracts are “usurping traditional finance”:

Personally, I wouldn’t have chosen a few of those DeFi examples. There are better representatives available. But it makes a great point. And I guess they are the most well-known.

Anyway, its conclusion on Ethereum is that it could exceed a $20 trillion market cap in the next 10 years.

That would put the price of 1 Eth over $180,000.

Although it doesn’t mention anything about Ethereum competitors potentially taking its market share – which is clearly already happening – so maybe that prediction is a little too optimistic.

Or maybe Ethereum will continue to reign supreme and swallow the whole market. Who knows?

(Who knows is sort of a theme of this issue, isn’t it?)

Anyway, you can read the full big ideas 2022 report here.

The second biggest DeFi hack ever was just bailed out by a VC, to the tune of $320 million

A couple of weeks back, a hacker exploited the wormhole token bridge between Ethereum and Solana and got away with $321 million of wrapped Ethereum (wETH).

As Coin Telegraph points out, this could have tanked the price of all wETH on Solana, but it didn’t because the VC behind wormhole bailed everyone out:

The cross-chain ETH-wETH is supposed to have an exchange ratio of 1:1 against one another. Therefore, the unauthorized minting of wETH leads to significant inflation, which can quickly degrade confidence in the underlying bridge. After the latest "bailout" by Jump Crypto and a patch fix, however, things appear to be back to normal, with Wormhole developers tweeting:

"All funds have been restored, and Wormhole is back up. ETH contract has been filled, and all wETH are backed 1:1."

There are a number of crazy things about this story.

- The hacker exploited a bug that the wormhole developers themselves found, put on a public website, and didn’t get round to patching.

- The hackers made a ridiculous amount of money.

- The VC firm backing wormhole (Jump Crypto) seemingly paid $300 million+ to bail out the project.

Here’s what Jump Crypto had to say about it:

“Jump Crypto believes in a multichain future and that Wormhole is essential infrastructure. That’s why we replaced 120k ETH to make community members whole and support Wormhole now as it continues to develop.”

Jump must be into wormhole for a hell of a lot to decide it was worth paying $300 million+ to keep it going.

And finally – in what will likely be the biggest crypto story of the year – YouTube “rapper” arrested for $4.5 billion crypto heist

This story is almost certain to be made into a film. It’s too crazy not to.

And it fits perfectly with this issue's theme of, "nothing is real and everything is possible".

So, back in 2016, when few people had even heard of crypto, Bitfinex was hacked. As you probably know, Bitfinex is a major crypto exchange.

The hackers reportedly got away with $71 million in Bitcoin. And after a few months people stopped talking about it.

Then, six years later the US Justice Department makes a shock announcement. It’s arrested the alleged hackers and seized $3.6 billion in Bitcoin.

$3.6 billion! As far as I can work out, that’s the largest seizure of any kind in history.

From the Washington Post:

At the time of the theft, that amount of bitcoin was worth about $71 million. But the cryptocurrency has appreciated so much in the years since that the total value is now around $4.5 billion. Federal officials said they were able to seize about 94,000 of the stolen bitcoin, with an estimated value of $3.6 billion.

As I write this that 94,000 Bitcoin is currently worth $4.2 billion.

(Side note: I wonder who will end up with that $4.2 billion. The US government, Bitfinex or someone else?)

But that isn’t even the crazy part of the story.

No.

The craziest part is the Hackers are a New York power couple, one of whom, Heather Morgan, is also an aspiring rapper and influencer.

Her rap alias is Razzlekhan. And she’s… well, she’s not very good. As far as I can see her channel has been wiped. But her videos have been reposted on other channels.

Here’s one of them (if it’s still up). Be warned, like I said. It’s… it’s not good:

If that video doesn’t load, the one in this tweet should:

idk much about crypto security but this person shouldn’t have been able to steal 4.5 billion dollars of it pic.twitter.com/i86nu7naKK

— jack wagner (@jackdwagner) February 8, 2022

As you can probably already tell, this story is going to run and run and run. It’s got everything. And it’s blowing up everywhere.

And according to The Verge, the videos and songs everyone is sharing are just the tip of the iceberg:

There’s MUCH more. She’s got like a dozen songs, even a concept album about smoking weed in a cemetery and things getting “NC-17” with... some sort of spirit that she calls grandpa but implies isn’t actually her grandfather? Okay, yes, I know how that sounds, but quite honestly, after listening to all of her songs, I think “High in the Cemetery” might be one of the better ones. But I didn’t love the twist at the end of the album where a perverted genie is revealed to actually be Mark Zuckerberg (I swear to you I’m not making that up).

There are already articles coming out saying this couple mightnot be the hackers (although they do seem to have the necessary skills). What if they aren’t and it’s all just a massive PR stunt to up Razzlekhan’s AKA The Crocodile of Wall Street’s fame?

Either way, I imagine all the major streaming companies are in bidding wars to tell the story as I type.

And I’m sure I’ll be writing more about it in the coming weeks, too.

Crypto never fails to entertain, that’s for sure.

coin confidential is going weekly – so you’re getting twice as much content

Right, that’s almost it for this month.

But I do have one more piece of news. Coin confidential is going weekly.

Instead of one free and one premium issue every month, from the first weekend in March I’ll be doing an issue every week, and they will alternate between free and premium.

So whether you’re currently a free or a premium subscriber, you’ll be getting twice as much content.

Free subscribers will be getting two issues a month and premium will be getting four issues (two free and two premium).

You might have noticed that these issues have been getting very, very long over the last six months or so (this one is over 7,000 words, for instance).

There’s just so much going on in crypto now, it’s hard to cover everything fun/important/unusual in one “this month in crypto” issue every month.

Moving to weekly will mean I can cover things as they happen and cover different types of stories, too.

One week might be news, another week an explainer, another a deep dive into a specific crypto, and another week could be exploring one key issue or topic in detail.

So there’ll be more content and more variety. And if something is getting too long I can break it into two parts.

I’m also changing my crypto reviews to crypto deep dives and getting rid of the numbered rankings.

With all of the new UK crypto regulation, I need to be super careful I’m not giving anything that could be taken as an “invitation or inducement to investment”.

But if you’ve read any of my reviews, you’ll know I don’t really like giving the different sections rankings out of 10 anyway. It seems far too subjective.

I like to think of the reviews more as investigations, where I show you what I’ve discovered and let you make up your own mind and continue your own research. Which really makes them more of a deep dive than a review anyway.

And on that thought…

The next premium issue is a deep dive into Aleph Zero

Aleph Zero (AZERO) has been getting a lot of hype in the more underground crypto communities I follow. But it’s yet to really break into the mainstream crypto world.

So I think it’s a super interesting project to do a deep dive into.

It promises a lot: 100k transactions per second, near-instant finality, secret smart contracts, a star-studded team and a very high level of polish and professionalism. If anything, it almost feels too slick.

Yet its market cap is still extremely low and it’s only trading on one exchange.

In fact, it only started trading publicly a couple of weeks ago.

At this point I don’t know if I’m going to discover it’s as promising as Radix or as disappointing as constellation.

Time will tell.

I intend to publish that deep dive on the first weekend in March, or potentially the last weekend in February, if I’m making good time on it.

And after that, we’ll be going weekly.

If you want to get sent the Aleph Zero deep dive as soon as I publish, you can subscribe to coin confidential premium for £10 a month.

When you join, you’ll also get instant access to my full archive of crypto reviews deep dives, which includes Solana, Polkadot, Algorand, Radix, Mina Protocol, IOTA and Fantom.

Okay, that’s all for today.

Thanks for reading.

Harry

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).