This month in crypto: May 2021

This month's edition is worth reading for HSBC's absurdity alone...

If I had to choose one word to describe this month in crypto it would be volatility.

In the last month we saw Dogecoin gain more than 500% in seven days to become the fifth biggest crypto by market cap… with much of that growth coming in less than 24 hours.

This then prompted many people to freak out and declare that when Dogecoin inevitably crashes it will summon the four horsemen of the crypto apocalypse: regulation, regulation, regulation and… regulation.

Never one to overdramatise, Cardano’s Charles Hoskinson even did a whole video on how terrible the influx of money into Dogecoin was.

From that video:

It’s going to hurt each and every one of us. After the bubble bursts – because it will – there’s going to be congressional inquiries. There’s going to be Senate hearings. There’s going to be SEC running around. There’s going to be all kinds of regulators running around saying, ‘this is proof that crypto can’t control itself, we need to come and save you’. And we’re not gonna like the outcome.

This was all against the background of the crypto market hitting $2 trillion for the first time ever.

Some other notable milestones were:

Bitcoin surpassing the market of the US banking industry – or at least its index.

Bitcoin’s market cap hitting $1.2 trillion and overtaking British Pound Sterling in size. Although it’s got some ways to go before it surpasses the Chinese Yuan, which is next on the list, as you can see below.

Ethereum also hit multiple all-time highs, topping out this week at around $2,800 (£2,000).

This was against the backdrop of the European Investment Bank issuing €100 million (£87 million) of bonds using Ethereum, in collaboration with Goldman Sachs, Santander and Societe Generale.

And meanwhile the former President of the New York Stock Exchange called crypto “the best kept secret in the world… and maybe the history of the financial markets.”

He went on to praise DeFi and basically said that traditional Wall Street banks have been superseded by crypto.

…which is one of the key themes of my “everything you need to know about crypto in one essay”… essay.

All the pieces are coming together.

Or, at least they were until crypto did as crypto does and this happened:

For a couple of days it looked like we might have hit the top. But, as per crypto, a week later and many coins are back at all-time highs.

Still, this correction serves as a good lesson. No one knows what crypto is going to do in the short term. And even in a bull market there will be massive corrections.

That’s why a lot of crypto investors leave cash aside ready to buy the dip… if it does turn out to be just a dip.

Of course, people will always assign reasons for these crashes, dips, corrections… whatever we want to call them,

And this month’s two big dips were no exception.

The first one was on Sunday the 18th, for which a blackout in China that hit Bitcoin miners was blamed.

The second was last weekend, for which President Biden’s proposed tax hikes were blamed.

If you haven’t heard, Biden plans to basically double capital gains tax from 20% (like it currently is in the UK) to, a strangely precise, 39.6% for people earning $1 million or more.

And he plans to spend that extra cash on free childcare and education for the less well off.

Obviously the markets – traditional and crypto – didn’t like that and took a dive.

Although, of course, no one really knows why the markets really crashed (more on that here). But it sure is fun to make up narratives.

Okay, enough price talk. What else has been going on?

Institutions have been insitutioning

ARK dumps Tesla to buy Coinbase

2021’s hottest asset manager, ARK invest, dumped around $178 million of Tesla shares and around $13.4 million of NVIDIA shares to buy into Coinbase.

In total, it looks like ARK bought around $432 million of Coinbase shares in the first week or so of its listing. (source: CoinDesk)

Since then Coinbase’s share price has continued to drift lower and lower. It’s now down around 18% from its initial listing.

By its own logic, HSBC should delist many of its own funds

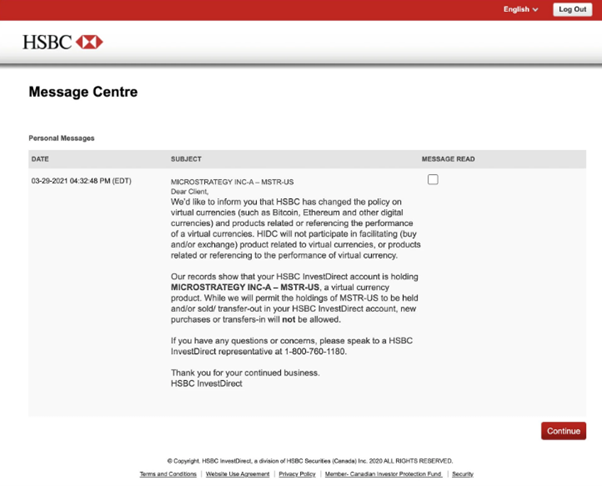

Meanwhile, HSBC, the bank made famous the world over for laundering over $800 million of cartel drug money, decided to ban its clients investing in Nasdaq-listed tech firm, MicroStrategy.

The reason? Because, as you might remember from this article, MicroStrategy holds some of its cash reserves in Bitcoin.

It sounds made up, right? But it’s not.

Here’s the notice HSBC sent out to its customers.

And here’s the story about it on Reuters.

This is a much bigger story than it first appears… at least in terms of HSBC’s relevance.

Because as you probably know, Tesla also holds Bitcoin in its cash reserves. So does HSBC also plan to stop allowing its customers to hold Tesla shares?

And what about index funds and ETFs that hold Tesla, MicroStrategy and, now, Coinbase?

HSBC itself produces a number of these.

By its own logic HSBC should now delist all its own funds that track the S&P 500 or Nasdaq.

Or maybe it will just remove any companies that have anything to do with crypto from its tracker funds?

However, if it did do this, that would mean they weren’t really tracking the indexes they were supposed to anymore – seeing as Tesla is currently the 8th biggest company in the S&P 500.

The more you think about it, the more absurd it becomes.

I’d love to be able to point this all out to one of the high ups at HSBC and see how they tried to justify it.

In other (former) crypto-hating institutions news, JPMorgan is planning to launch an actively-managed Bitcoin fund “as soon as this summer”.

The Central Bank Digital Currency (CBDC) race hots up

Bank of England begins work on possible CBDC

I can’t decide of this is THE BIGGEST NEWS EVER, or barely news at all.

On the 19th of April the good ol’ Bank of England set up a taskforce to “coordinate the exploration of a potential UK CBDC.”

(If you want to know what on earth a CBDC is and why it’s such a big deal, you can read my explainer: Everything you need to know about Central Bank Digital Currencies)

You can read the Bank of England’s press release here. But to be honest, there isn’t a lot in it.

It’s hard to work out if this taskforce will actually do anything, or if it will just tick boxes, hold meetings and write reports.

From the tone of the release, I’m guessing it’s the latter. But you never know.

Meanwhile, in Japan…

The Bank of Japan has started testing its own CBDC, with a proof of concept that will run for the next 12 months. (Source: Bank of Japan)

If the proof of concept goes successfully it will then roll out a pilot program, according to its roadmap.

It will be interesting to see which big country will be the first to release a full-scale CBDC and how the rest of the world responds.

That day can’t be too far off now.

Crypto news from Cardano, Ripple and IOTA

Of course, while all of the above has been going on, individual cryptos have been making strides, too.

IOTA completes Chrysalis upgrade

IOTA competed its upgrade to Chrysalis this week, which makes it fully “enterprise ready”.

What that basically means is serious players can now start using and building on IOTA.

Or, as IOTA puts it:

Partners, academia, and developers can now start to build on the Tangle and plan for the future. There will not be substantial changes on the way to IOTA 2.0, Coordicide, as the majority of the code-base including tools, libraries, and APIs already exists in Chrysalis. Projects built on today’s codebase will not require major refactoring later on.

So we may see some big news coming from IOTA-related projects in the coming weeks and months.

Especially as IOTA has been working hard with Object Management Group to become the standard protocol of the Internet of things. More on that here.

Cardano inks its deal with Ethiopia

It’s been a long time coming, but Cardano has finally confirmed its partnership with the Ethiopian government.

From decrypt:

The deal will see Cardano-based decentralized identity solution Atala Prism initially deployed in the country's schools. It will be used to create "tamper-proof records" of educational performance across 3,500 schools and five million students to instantly verify grades.

Although, as CoinDesk points out:

The much-touted project is still in its early stages. O’Connor [Cardano’s Director of African Operations] told CoinDesk the company is only beginning to develop the code for this project, and does not expect to launch anything before January 2022.

Still, that’s a pretty major win for Cardano, and could bring more legitimacy to crypto in general.

Ripple is up, down and everywhere

Love it or hate it, Ripple is a major force in the world of crypto.

Right now, it’s in the middle of a court battle with the Securities Exchange Commission (SEC) over whether it is a security or not.

With the twists and turns of the lawsuit, Ripple’s price has been lurching all over the place.

[Ripple’s] price has been a wild ride in April, beginning with a rally of nearly 250%, followed by a 50% crash, and now a 60% rebound.

It’s up another 16% since that article was published.

And that’s despite Ripple being delisted from many major exchanges while the lawsuit plays out.

Even if you’re not a fan of Ripple (and I’m not personally) you should still be rooting for it to win this case. The fewer cryptos that get deemed securities by the SEC the better it will be for the whole ecosystem.

And on that note…

Pro crypto SEC commissioner proposes “safe harbor” for crypto projects

Let’s end this month’s issue on a positive note.

Hester Pierce, or “crypto mom”, as she’s become known, released an updated version of her Token Safe Harbor Proposal this month.

The main takeaway is that it would exempt crypto projects from securities laws if they can become decentralised within three years of launch.

You can read her official statement about it here.

But, basically, if this proposal became law it would be hugely bullish news for the whole crypto space.

Oh, and on top of that Gary Gensler, who literally teaches a course on crypto at MIT, has now been confirmed as the Chair of the SEC.

So it seems everyone is slowly coming around to crypto… except for HSBC, of course.

Okay, that’s all for this issue.

Thanks for reading.

Harry

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).