A new kind of ICO: Compound’s COMP token is up 234% since Monday

Compound has managed to become the top player in Decentralised Finance (DeFi) this week, with a swift 5-day coup.

Between Monday and Friday Compound:

- Created a new kind of ICO and launched its COMP token

- Got COMP token listed on Coinbase (likely the fastest Coinbase listing ever)

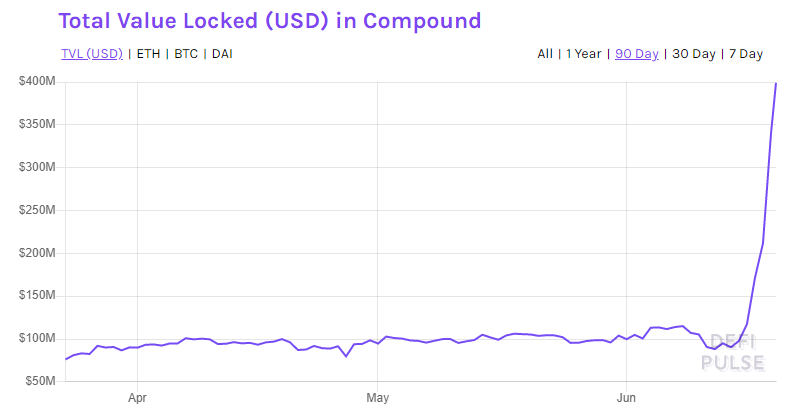

- Drew an extra $250 million into its DeFi lending platform

- Watched its COMP token more than triple in price in the space of 24 hours

- Overtook Maker as the biggest DeFi crypto by market cap

That’s a lot of information. So let’s backtrack a bit and discuss what Compound actually is before we dig into those bullets.

If you’ve read my feature on DeFi, you’ll likely recognise the name Compound.

But in case you haven’t here’s a quick recap:

From my article What is DeFi and why is it such a big deal? (with the figures updated):

How does DeFi work?

Right now, the biggest branch of DeFi is lending.

Which I guess is apt, as this is also how the world of traditional banking first got going.

At its most basic level, a bank takes money from person A and then lends that money out to person B.

It pays parson A interest for using their money, and person B pays the bank interest for lending out person A’s money.

The bank makes money because it pays person A less interest than it collects from person B. A lot less.

For example, a typical savings account with NatWest currently pays out 0.1% interest[i]. Whereas a typical loan with the same bank charges 7.9% interest.

So NatWest will gladly borrow £5,000 off you, and then charge someone else 79 times what it’s paying you to lend your money out. 79 times!

Why do people put up with this? Because that’s just the way things are done.

At least, that’s just the way things were done.

Now we have DeFi lending.

The main idea of DeFi lending is you cut out the bank – and its ridiculous cut – and match lenders directly with borrowers.

For example, on what’s probably the most well-known DeFi platform, compound, you can currently lend out your money using the Tether stablecoin at 12.88% interest, or borrow against it at 18.05% interest.

You can see the different rates for lending and borrowing on compound below (accurate on Friday 19th June).

Source: compound finance

So, instead of getting 0.1% interest with a bank, you could be getting over 12% with DeFi.

The reason DeFi rates can be so much better than banks is because lenders are matched directly with borrowers. There is no bank taking a ridiculous cut.

So compound is basically the second biggest and most well-known player in DeFi lending.

(Maker is more well-known and has more money locked up in its platform, but Maker is harder to use, and really did not come out of the crypto-corona crash earlier this year well. For more on that see my April article “How to buy $8 million of Ethereum for $0”.)

And being a DeFi platform, it recently decided to make its governance decentralised, too.

So instead of Compound’s future being decided by its team, its future will be decided by its token holders.

From Compound’s blog in February:

At Compound, our goal is to create financial infrastructure that applications and developers can rely on, forever. To get there, we intend to fully decentralize the Compound protocol — removing the largest single point of failure (our team), and creating an indestructible, open protocol that can evolve in entirely new ways.

And it would do that by creating a governance token called COMP.

Again, from Compound:

In addition to being a standard ERC-20 asset, COMP allows the owner to delegate voting rights to the address of their choice; the owner’s wallet, another user, an application, or a DeFi expert. Anybody can participate in Compound governance by receiving delegation, without needing to own COMP. The token also includes code to query an address’ historical voting weight, which is useful for building complex voting systems.

So far so standard. A crypto company decides it wants to get more decentralised, so it creates a token that gives people voting rights over its development.

But then it did something different. Instead of having a standard ICO (Initial Coin Offering), or even a more in vogue IEO (Initial Exchange Offering), compound created its own token distribution method.

Of the 10 million total COMP supply, around 4.2 million is to be distributed to users of the compound platform, simply for using it.

The remaining 5.8 million tokens are allocated as follows (from compound):

- 2,396,307 COMP have been distributed to shareholders of Compound Labs, Inc., which created the protocol

- 2,226,037 COMP are allocated to our founders & team, and subject to 4-year vesting

- 372,707 COMP are allocated to future team members

- 775,000 COMP are reserved for the community to advance governance through other means — which will be announced at a future date

- 0 COMP will be sold or retained by Compound Labs, Inc.

Here’s how the COMP token distribution works (again from Compound):

- 4,229,949 COMP will be placed into a Reservoir contract, which transfers 0.50 COMP per Ethereum block (~2,880 per day) into the protocol for distribution

- The distribution is allocated to each market (ETH, USDC, DAI…), proportional to the interest being accrued in the market; as market conditions evolve, the allocation between assets does too

- Within each market, 50% of the distribution is earned by suppliers, and 50% by borrowers; in real-time, users earn COMP proportionate to their balance; this is separate from the natural interest rates in the market

- Once an address has earned 0.001 COMP, any Compound transaction (e.g. supplying an asset, or transferring a cToken) will automatically transfer COMP to their wallet; for smaller balances, an address can manually collect all earned COMP

So, if you want to get COMP tokens, you need to use the platform… which is why Compound has seen an extra $250 million (and counting) flowing into its platform since Monday:

Source: DeFi Pulse

And incredibly another $50 million has flowed in since I started writing this article a few hours ago, as you can see below:

Source: DeFi Pulse

Which is probably because of COMP token’s meteoric price rise over the last 24 hours. As you can see, it’s up over 234%:

Source: Coinmarketcap

In fact, compound’s COMP token has just managed to overtake Maker’s own governance token (MKR) in market cap.

In terms of crypto’s “Game of Thrones”, COMP is now sitting in 26th place with a total market cap of $494 million vs MKR’s 29th place and $472 million market cap, according to live data from Coin Gecko (it’s too new to be on the official coinmarketcap list yet).

(As always prices are right as of Friday afternoon.)

But it’s fair to say COMP has had more than a little help straight out of the gate.

On Thursday, Coinbase announced it was going to be listing COMP on its Coinbase Pro platform – giving it the kind of immediate legitimacy most new tokens could never dream of.

Which accounts for COMP’s massive price rise over the last 24 hours.

It’s fair to say COMP’s rise has taken much of the crypto community by surprise, which is refreshing.

This kind of thing hasn’t really happened since the heady days of 2017.

Could it be a sign of things to come, or is COMP just a fluke?

And as COMP gains more and more publicity, will it rise to higher heights, or are we going to see an equally spectacular crash within the next few days?

I guess we’ll have to wait and see.

Okay, that’s all for this week.

If you thought this week’s issue was worth a pot of tea, you can buy me one here.

Thanks for reading.

Harry

[i] https://personal.natwest.com/personal/savings/instant-saver.html

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).