ChainLink is up over 840% because a global asset manager called it worthless

Did you hear the one about the global asset manager that went up against a bunch of crypto kids and lost tens of millions of dollars?

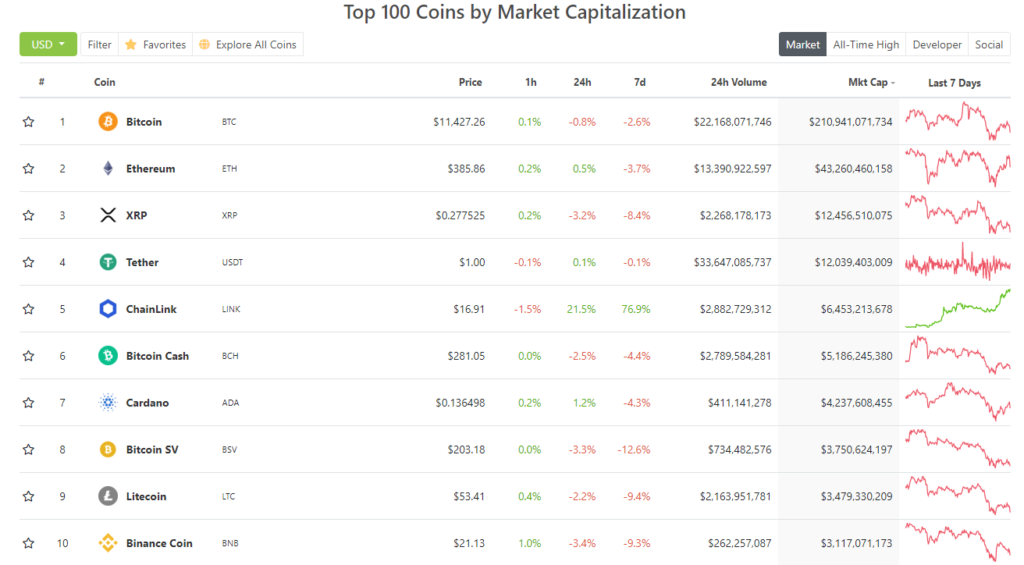

Spot the odd one out:

Source: Coin Gecko

Aside from ChainLink not even being in the top 10 cryptos as little as two weeks ago, it’s also the only one that’s up over the last seven days… and fairly significantly.

77% gains in seven days are huge, even during a crypto bull run. But ChainLink’s longer-term gains are even more impressive than that.

Source: Coin Gecko

It’s up 139% in the last two weeks and 615% in the last year.

Even more impressively, it’s up over 840% from its Corona-induced low in mid-March.

However, if you look at the chart above, you’ll see that it only really started going parabolic in July.

Why?

Well, that’s when global asset manager Zeus Capital released an investment report titled The ChainLink Fraud Exposed.

The 58-page report argued that ChainLink is a pump & dump scam of a project that’s going down to zero.

And it even went as far as to state that it was shorting ChainLink, with a target price of $0.07… and encouraged anyone reading the report to do the same.

You might think that a damming report by a seemingly reputable global asset manager would have spelled disaster for ChainLink’s price.

But then, this is crypto.

And in crypto things rarely go the way “old white men in suits” think they will.

How a bunch of kids on the internet raised enough hype to liquidate a global asset manager’s short… and send ChainLink on a meteoric price rise

Now, in order to understand how that report had the exact opposite effect Zeus Capital thought it would, we need to take a quick tour of ChainLink’s history.

If you ever read Crypto Wire (RIP), you’ll know that back in June 2019 I actually ranked ChainLink.

Looking back at that issue now, I gave it a fairly good ranking, but with some major caveats, which brought its score down significantly.

I’m going to repost the caveats section here, so you get the context of what happened with Zeus Capital’s report.

From Crypto Wire June 2019:

Caveats

I feel I’ve covered most of the major caveats in the other sections.

To reiterate, so far I have brought up two major caveats:

1. ChainLink controlling 30% of the total supply.

2. Competition from platform cryptos creating their own decentralised oracles.

But there is a third: 4chan.

If you haven’t heard of 4chan, I don’t recommend you go searching for it. If you have, you’ll know why I’m making that recommendation.

4chan is a place on the internet that still operates like the internet did in the 90s. It’s “the wild west”.

It’s basically a series of anonymous image-based message boards where anything goes. And I mean anything.

You can think of it as like the primordial goo from which life emerged. And just like the life that emerged from that goo, some of it is good and some of it is bad. Very bad.

A lot of the content that goes viral on the internet – both good and bad – originated on 4chan.

And a lot of hype and FUD about certain crypto projects originates on 4chan, too. From its /biz message board.

4chan can cause some serious volatility in projects it takes an interest in. And the number one crypto that 4chan is interested in is ChainLink, or “Stinky Linky” as they call it.

This makes it pretty hard to sort some of ChainLink’s fact from its fiction. And it is also the reason a lot of people believe ChainLink is a scam.

I’ve done a fair bit of research into the scam allegations and I can’t find anything of substance.

But, although, ChainLink is not a scam. It is a very popular topic within the 4chan community. And that community has a lot of power on the internet.

For example, in the past, 4chan managed to:

- Crash Apple’s stock price by 10% by starting a rumour Steve Jobs had died (back when he was still alive)

- Made the swastika symbol appear as Google’s top trending topic in July 2008, forcing Google to issue an apology

- Started the Anonymous movement – those people who wear guy forks masks.

- Made Kim Jon Ung Time readers’ person of the year in 2012 – and made the entire list spell out “KJU gas chambers”.

So manipulating the price and information about a crypto is child’s play for 4chan. And that’s definitely something to consider, given how much attention ChainLink gets over there.

So what happened when Zeus Capital issued a damming report about ChainLink and opened up a short against it?

ChainLink’s community – Link Marines as they call themselves – went to war.

Pretty soon the Link Marines identified Zeus Capital’s short and set about trying to pump ChainLink’s price enough to liquidate it.

This would achieve three things.

1. It would cost Zeus Capital a lot of money.

2. It would turn Zeus Capital’s report – and Zeus Capital itself – into a laughingstock.

3. It would make ChainLink investors a lot of money.

Well, they don’t call themselves Link Marines for nothing.

In no time, news of Zeus Capital’s short was everywhere, with price targets to liquidate it.

The Link Marines managed to drum up so much hype and draw so much attention to their cause that at one point ChainLink’s volume even overtook Bitcoin’s.

And to give you some context here. ChainLink is not a small, no-name project. Even when Zeus Capital released its report, it was worth over $2 billion.

It takes a lot of buying (or a lot of manipulation) to make an asset of that size move like it has.

People kept on buying and on the 8th of August tens of millions of dollars’ worth of shorts were liquidated… which then caused a massive price surge and launched ChainLink’s price 52% in just 24 hours.

From Cryptoslate:

One cryptocurrency trader noted that per his data, there was a $16 million LINK position, along with a series of “$1m+” positions, that was liquidated on a cryptocurrency futures platform. Analysis by another trader indicates that at least $40 million was liquidated on Binance’s ChainLink market alone.

Was Zeus Capital’s short among those liquidated?

It seems pretty likely. One Twitter user thought they found Zeus Capital’s short, and tweeted its liquidation in real time:

Source: Twitter

Whether it was their short or not is up for debate. But if they really did have a big short on ChainLink, it’s very likely it’s now been liquidated.

Was Zeus Capital playing 4D Chess and manipulating Link Marines into pumping its own position?

Of course, there is another narrative that’s emerged…

Given that crypto is still largely unregulated, Zeus Capital could have been lying all along.

Instead of being short on ChainLink, they may actually have been long… and could now be sitting on a massive profit.

The whole report and subsequent defamatory tweets could all have been part of a plan to send ChainLink’s price soaring and profit.

Of course, that would be highly illegal – not to mention immoral – in normal markets. But in crypto, the waters aren’t so clear.

And as I’m sure you know, investment banks aren’t exactly known for their morals.

Is ChainLink actually just a big pump and dump scam?

And then this brings us to a question at the heart of many crypto investment stories. Is ChainLink legit, or is it actually just one big fraud?

If you read Zeus Capital’s report, it makes a number of good points.

The main one being that cheaper, faster, better alternatives to ChainLink’s product are already on the market, with many more on the way.

That and the fact ChainLink’s creator has a shady past and some dodgy affiliations. Oh and that the management hold a massive amount of the ChainLink supply (true) and are pumping the price so they can cash out themselves, in what would be one of the biggest pump and dumps in crypto history.

When I looked into ChainLink last year, I concluded it most likely wasn’t a scam. But it certainly wasn’t completely transparent. And I brought up many of the same caveats Zeus Capital highlights in its report.

Since then, ChainLink’s been on an absolute tear and is now in full snowball effect.

There are even people talking about it flipping Ethereum’s market cap… which, given it’s simply a token built on top of Ethereum is hard to get your head around.

So has ChainLink just proven itself to be extremely useful to DeFi, just as the crypto world goes DeFi crazy?

Or is it part of an elaborate pump and dump scam?

Or has it simply found itself at the right place at the right time?

Honestly, I have no idea. And I wouldn’t like to put money on it either way.

Given what we know about cryptos that more than 8X in price over just a few months, it rarely ends well… just ask Nano holders.

But even if ChainLink is heading for the mother of all crashes, it could easily have a very long way to go yet.

Or it could all come crashing down tomorrow.

Either way it’s going to be fun watching it all play out.

Thanks for reading.

And if you’re wondering why you’re getting this issue a day earlier than normal, that’s because it’s my birthday today, so I’m taking a long weekend off.

If you thought this issue was worth a birthday pot of tea, you can buy me one here.

Harry

PS If you’ve been following IOTA’s progress, you’ll want to pay close attention next week as IOTA 1.5 is going live on the mainnet, bringing “over 1k TPS and 10 second confirmation times”:

Source: Twitter

It’s gonna be big.

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).