Is crypto selling its soul for institutional adoption?

How does the world’s second largest investment bank go from panning crypto to saying it is the future of finance in just three short months? Clue: 🤑

“In the next five to 10 years, you could see a financial system where all assets and liabilities are native to a blockchain.”

Where would you assume that quote comes from?

Go on, take a guess…

Well, it actually comes from the same company that said this about crypto in May:

“Cryptocurrencies Including Bitcoin Are Not an Asset Class… We believe that a security whose appreciation is primarily dependent on whether someone else is willing to pay a higher price for it is not a suitable investment for our clients.”

Yep, it was the great vampire squid itself, Goldman Sachs.

So how does the world’s second largest investment bank go from panning crypto to saying it is the future of finance in just three short months?

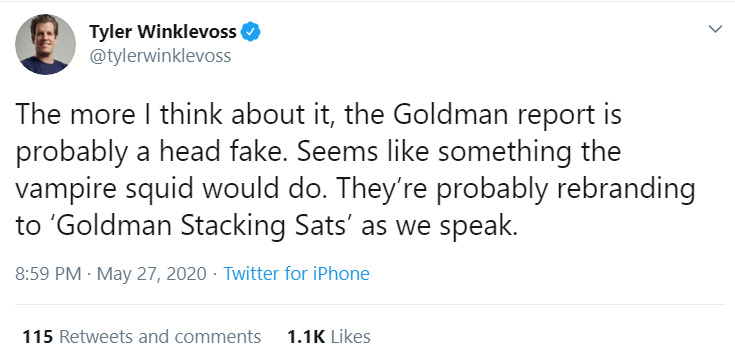

Well, as Facebook twin and Gemini exchange co-founder, Tyler Winklevoss said at the time:

Source: Twitter

If you ever read that vampire squid article I linked earlier, you’ll know Goldman has a history of this kind of thing.

In fact, the author makes a compelling argument that Goldman was responsible for – and profited from – every major financial crisis since 1929.

But to get back to our opening line…

It was said this week by Goldman Sachs’ new global head of digital assets, Mathew McDermott, in an interview with CNBC.

It seems he’s been paying close attention to what crypto is capable of and plans to use it to make the traditional financial world more profitable and efficient.

“what you’re doing today in the physical world, you just do digitally, creating huge efficiencies. And that can be debt issuances, securitization, loan origination; essentially you’ll have a digital financial markets ecosystem, the options are pretty vast,” says McDermott.

Trillions of dollars on the table

McDermott, who is interestingly based in the UK, first plans to tackle the $1 trillion per day repo market, which he calls the “essential plumbing” of finance.

The repo market is basically the short-term lending market that financial institutions rely on to run. There’s a good five-minute explainer video from the Wall Street Journal on it here.

“In securities finance and repo, if you look at those markets, they’re ripe for standardization.

“There’s a lot of legacy processes in the vast movement of collateral that makes them very cost inefficient, so by leveraging distributed ledger technology, you can standardize processes to manage collateral across the system, and you have a much more efficient settlement process given the real time settlement,” says McDermott.

And that’s just to start with.

If you’ve been following this space, you’ll know that every financial product and most major asset classes can be made more efficient, more secure, more accessible and more liquid with crypto.

McDermott clearly recognises this. And I’m sure a number or other higher-ups in various investment houses do, too… McDermott “hinted” at crypto collaboration with JPMorgan in that CNBC interview.

And if you weren’t aware, JPMorgan recently created its own stablecoin JPM Coin, which it plans to use to make settlements cheaper, faster and more efficient.

Institutional adoption comes at a price

Now, here’s the thing about the long awaited “institutional adoption” the crypto world has been courting for years… it comes at a price.

In most cases, these institutions make centralised cryptos on private blockchains. This means they are missing out on the core principal of crypto: decentralisation.

Without decentralisation, there’s no point using blockchain technology, you might as well just use a database. It would do the same job, and do it much more efficiently at that.

Here’s what I wrote about the difference between private (centralised) and public (decentralised) blockchains when I came back from Paris Blockchain Week in 2019:

There has been a lot of discussion online about public vs private blockchain. They are basically like the difference between the internet and an intranet.

A private blockchain is owned, built, managed and secured by a company. A public blockchain is public, like the internet.

The idea of a public blockchain is that it maintains and secures itself. Well, to be more precise, its users do.

Its main benefit is that it is immutable and decentralised. No one party has control over it. And because of that, it is incredibly secure, and in theory almost unhackable.

Think bitcoin, Ethereum, Monero, Stellar Lumens, etc.

Private blockchains on the other hand are, by their nature, centralised. They have a single point of failure – the company that controls them.

An example of a private blockchain is what JP Morgan has set up for its JP Morgan coin. And likely what Facebook will do for Facebook Coin.

In these instances the company that set them up will have control over how they work. They will be able to freeze out users, reverse transactions, completely rewrite the rules as they like.

Many crypto experts argue that a private blockchain has no advantages over a traditional database. It is centralised and because of that it is not secure.

The general view of many commentators is that private blockchains will eventually go the way of the intranet.

Once major companies actually get their heads around what blockchain is and the benefits it provides, they will move over to public blockchains.

I wrote this after listening to a panel discussion in which an insurance firm revealed it was using a private blockchain to power many of its products. But it had soon realised that using a private blockchain was not a long-term solution.

As I wrote at the time:

He [Olivier Jaillon, owner of bespoke insurance firm La Parisienne Assurances] stated that blockchain powered insurance was cutting their costs by a factor of 10.

What does this have to do with public vs private blockchain? Well, Jaillon also revealed they are currently using eight to nine million IoT devices to power these insurance products, and the number of devices is increasing exponentially every month.

Right now, he said they are using a private blockchain to power all this, but they have realised a private blockchain is not a long-term solution. It simply cannot handle the amount of data they need to process.

Remember, on a private blockchain a company either does all the computing itself, or it pays for other entities to do it for it. The bigger it gets, the more it costs. With a public blockchain, the network sustains itself. The costs are essentially zero.

He also realised a private blockchain was simply not secure enough to trust with this kind of data on a major scale. So they are currently searching for a public blockchain that can fit their needs.

It’s clear to me that eventually all the major institutions will come to this realisation. And given how many smart people tend to work in these places, they likely already have.

So, at some point in the future, the world of finance will move onto public blockchains.

But before that, you can be sure that the institutions, the vampire squids, are going to try to convince the world that their centralised systems are the right way to go.

And they will succeed for a time.

But eventually, one of two things will happen:

1. They will either give in and use public blockchains themselves.

2. They will be displaced by forward-thinking upstarts that saw the benefit of public blockchains from the beginning.

Or more likely, a combination of the two.

But isn’t all that “institutional money” going to 10x my favourite cryptos?

The “institutional money” meme has been around in crypto since at least 2017.

The idea is that given how small crypto’s market cap is compared to traditional stocks, institutional interest could 10x, 100x, or even 1,000x certain cryptos.

To give you an idea of the difference in market cap, the highest the total crypto market ever got was around $830 billion, and it now sits around $355 billion.

That is the total crypto market cap of every crypto in existence.

There are currently five single companies in the S&P 500 that have market caps of over $1 trillion: Apple, Microsoft, Amazon and Alphabet (Google).[i]

If, say Ethereum were to ever gain massive investor interest and top $1 trillion itself, its price would be up over 22x from where it is today.

And if, say, IOTA were ever to top $1 trillion its price would be up over 1,000x from where it is today.

Of course, this is all completely pie-in-the-sky thinking. But given time, if crypto really does fulfil its potential and form the basis of the world’s technology, I don’t see any reason we won’t see $1 trillion plus market caps for the leaders in the space.

The trillion-dollar question is… which cryptos will be leading the space by then?

Even before that happens, we could see a massive influx of the fabled “institutional money”.

As CNBC wrote in its interview with McDermott:

While McDermott wouldn’t say whether he personally owned any cryptocurrency, he did have an observation that will probably raise cheers in the crypto world. Since the boom days of bitcoin a few years ago, interest has shifted from retail and rich investors to large institutions, he said.

“We’ve definitely seen an uptick in interest across some of our institutional clients who are exploring how they can participate in this space,” he said. “It definitely feels like there is a resurgence of interest in cryptocurrencies.”

So there should be exciting times ahead, whether you’re interested in crypto “for the tech”, “for the movement” or just for the money.

Thanks for reading.

If you thought this week’s issue was worth a pot of tea, you can buy me one here.

Harry

[i] https://fknol.com/list/market-cap-sp-500-index-companies.php

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).