Arbitrum and the sham of “decentralised” governance

Arbitrum’s fall from grace illustrates everything that’s wrong with the crypto industry right now.

Until a couple of weeks ago, Arbitrum was the golden child of Ethereum layer-2s.

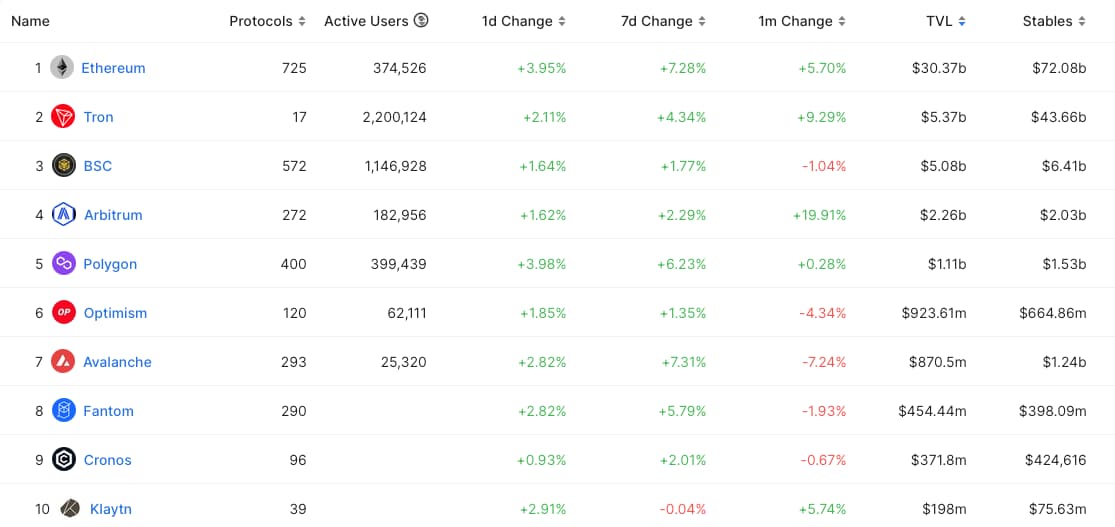

As you can see, it now has more total value locked (TVL) than previous #1, Polygon, which I wrote a deep dive on here.

Actually, it’s worth reading the intro to that deep dive (which you can do without a premium subscription) to get a handle on what layer-2s are and why Vitalik sees them as the future of Ethereum.

But to get back on track, here’s how things stand with Ethereum Virtual Machine (EVM) compatible chains:

Tron and BSC are completely different layer-1s that are compatible with the EVM, so what we’re really concerned with here are Arbitrum, Polygon and Optimism.

And as you can see, Arbitrum has by far the most momentum and double the TVL of its nearest competitor, Polygon.

In terms of its mechanics, Arbitrum is an optimistic rollup designed to help Ethereum process a higher number of transactions per second (TPS).

As Arbitrum states:

Arbitrum is a technology suite designed to scale Ethereum. You can use Arbitrum chains to do all things you do on Ethereum — use Web3 apps, deploy smart contracts, etc., but your transactions will be cheaper and faster. Our flagship product — Arbitrum Rollup — is an Optimistic rollup protocol that inherits Ethereum-level security.

And why do we need Arbitrum?

Here’s what Arbitrum has to say (don’t worry I’m going somewhere with this, I promise)

Ethereum is awesome; on its own, however, it’s also very limited. The Ethereum blockchain only allows about 20-40 transactions per second (TPS) (that’s in total, for all Ethereum users); when the limit is reached, users are forced to compete against each other for their transactions to be included, which causes fees to go up. …

Q: And Arbitrum Rollup fixes this?

Arbitrum rollup fixes this! The basic idea is this: an Arbitrum Rollup chain runs as a sort of sub-module within Ethereum. Unlike regular, layer 1 ( “L1”) Ethereum transactions, we don’t require Ethereum nodes to process every Arbitrum transaction; rather, Ethereum adopts an “innocent until proven guilty" attitude to Arbitrum. Layer 1 initially “optimistically assumes” activity on Arbitrum is following the proper rules. If a violation occurs (i.e., somebody claims “now I have all of your money”), this claim can be disputed back on L1; fraud will be proven, the invalid claim disregarded, and the malicious party will be financially penalized.

It then goes on about fraud proofs in detail and mention some of its other scaling solutions.

Did you notice what was missing?

Let’s go over it again.

Arbitrum is needed because Ethereum can only carry out 20-40 TPS, and that makes transactions slow and expensive.

Makes sense.

And Arbitrum fixes this.

Great!

And it does it without sacrificing too much security or decentralisation.

Again, Great!

Here’s why we don’t sacrifice too much security or decentralisation.

Okay… but are you going to tell me about your main benefit of increasing TPS? Like… how much do you increase it by?

Oh, no. Don’t worry about that.

Right… but isn’t that your entire reason for existing?

Yeah, but you don’t need to worry about that. We don’t want to bog you down with boring numbers. Why don’t we tell you about our fraud proofs instead…

But maybe you could tell me how many TPS you can actually do? That’s just one number.

Shhhh. Here’s how our fraud proofs work.

***

Yeah, they don’t ever actually give you their TPS number. And it’s not in their whitepaper either.

It’s not a super big deal. It’s pretty fast by all accounts. But it’s impossible to get an actual number.

And if you do an internal google search of their site with “transactions per second”, you get three results.

The first one is the one that talks about Ethereum’s TPS and doesn’t tell you what Arbitrum’s is.

This is the second one:

And the third one is just an archive of all the questions that user in the picture above has asked.

However, most news sources report that Arbitrum processes 40,000 TPS. I have no idea where they got that information from. It’s probably right? Or it could just be that one news source said it and everyone else is copying what they said.

Either way, Arbitrum certainly doesn’t make it easy to find out.

And that is kind of a microcosm of the main issue with Arbitrum… its complete lack of transparency.

What if we just say it’s decentralised, but then don’t actually give up any power?

Things got heated this month when Arbitrum announced it was going to be governed by a Decentralised Autonomous Organisation (DAO).

Usually, this would be a good thing.

Unless most of the token supply is held by project insiders and Venture Capitalists (VCs) as it is with the majority of newer crypto projects – in which case it’s pointless.

Arbitrum was going to solve this problem by doing an airdrop to all the people who actually used the network.

This would ensure the token distribution was fair, and the DAO governing the network would be truly decentralised.

That was the idea, at least.

But then greed got in the way, as it tends to do in crypto… and in traditional finance, to be fair.

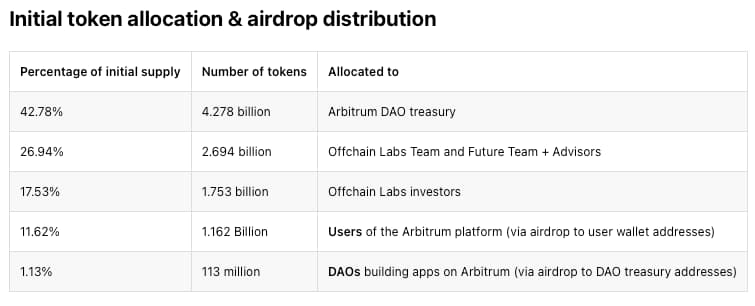

Here’s how Arbitrum decided to allocate its initial token supply:

Hmm, that doesn’t seem so decentralised.

Looks like VCs and insiders are getting 44.47% between them.

Users and people building on Arbitrum are getting 12.75%.

And the DAO treasury will hold 42.78%.

So, in terms of actual voting power we can discount the treasury, because that’s just used for funding things the DAO deems worthwhile:

Funding: Requests funds/grants or otherwise propose how to spend or allocate funds from the DAO Treasury held by The Arbitrum Foundation

(source: Arbitrum DAO constitution)

Also:

Arbitrum DAO Treasury

A smart contract on the Arbitrum One chain that contains tokens collectively controlled by the Arbitrum DAO.

(source: Arbitrum DAO glossary)

So in terms of voting power we should discount the DAO treasury section for now.

Which means insiders and VCs will have 77.71% of the voting power (Insiders: 47%, VCs: 30.64%).

Users and people building on Arbitrum will have 22.28%.

Hmm.

That looks just like any other insider/VC owned centralised crypto project.

Ah, but like all those insider/VC owned projects, the insiders and VCs will be subject to token lockups ranging from one to four years:

Vesting and lockup details

While the user and DAO airdrops will be available in one week, all investor and team tokens are subject to 4 year lockups, with the first unlocks happening in one year and then monthly unlocks for the remaining three years.

(Source: $ARB airdrop eligibility and distribution specifications)

Okay, maybe it won’t be centralised for a year then, when the VC’s and insider’s tokens unlock.

Ah, but that’s kind of annoying for the insiders though.

What if, instead of that, they decided to allocate, say 750, million tokens to themselves?

That would give them and extra 7.5% of the total supply, or 13.10% of the voting supply.

They could call it something like the “The Arbitrum Foundation Administrative Budget”.

Interesting…

Eventually it would bring the insider’s allocation up to 34.44% of the total supply.

And it would also mean that in the first year – before insiders and VCs get enough tokens to completely control the network – the insiders would control 37% of the available voting rights.

That’s because the only people who can vote until the unlock are the users and DAOs, who between them control 12.75% of the total supply, but – in theory, all of the current voting supply.

Now if the insiders got 7.5% of the supply, they would control 37% of the available voting supply vs the 63% controlled by users and DAOs.

But as the insiders would all vote as one, then the insiders could easily control any vote that came along.

And they could even sell off a load of tokens and make some money and still control enough to control any vote that came along.

(Or they could just sell off the tokens and sail away into the sunset, as, at time of writing (5th April) 750 million Arbitrum tokens are worth $922.5 million (£740 million).)

Wouldn’t that be great?

Just one problem.

Since the DAO governance is already live, this would need to be made into a governance proposal and voted on – solely by the users and DAOs.

When is a vote not a vote? When it’s a “ratification”

Well, all the above actually happened.

The proposal went out. You can read it here.

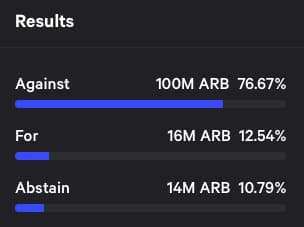

And it turns out the users and DAOs didn’t really like the idea, so they voted against it – with size.

Here are the voting results.

That’s a pretty clear HELL NO.

Now, if Arbitrum’s decentralised governance worked as it should – and as it was presented, with a “constitution” and everything – that would be the end of it.

But it turns out this “vote” wasn’t really a vote, because the Arbitrum insiders had already swiped those supposedly locked tokens from the DAO treasury and started selling them.

Yes, really.

From CoinDesk:

The Arbitrum Foundation began selling ARB tokens for stablecoins even before its governance community of tokenholders had "ratified" the organization's nearly $1 billion budget, according to a blog post from one employee early Sunday.

Unsurprisingly, the world of crypto kicked off.

Sorry not sorry

Arbitrum went from golden child to demon spawn, and issued a long-winded rationalisation for what it did.

Its sorry not sorry post started by saying, “let’s put aside the question of funding the Foundation for just a second”. And then went on and on about how it had to set up the Arbitrum foundation before the DAO could work properly.

It then tried to justify ignoring the vote by saying it was “was intended to act as a ratification” and the point of the vote was actually to “inform the community of all of the decisions that were made in advance”.

Right.

But the dictionary definition of a ratification is:

The act of voting on a decision or signing a written agreement to make it official.

A ratification needs to be voted on or signed. It was voted on, and the vote was no.

So, even by Arbitrum’s weird little semantic play, it still broke its agreement.

And even if we were to accept Arbitrum’s made up definition of a ratification, which it seems to think is actually a statement of intent, then why even have a vote on it?

Just say that you’ve decided to steal 750 million tokens out of the DAO treasury and use them for yourselves?

Actually, I can see why they didn’t do it that way.

Anyway, Arbitrum’s sorry not sorry statement doesn’t stop there. It then goes on to compare itself to other highly centralised layer-2 scaling solutions and VC-owned layer-1s to show that this is what new crypto projects do.

Everyone else allocates most of their tokens to insiders, so why can’t we?

It then chastises people for calling it out on its shadiness, saying (in bold): “The Arbitrum Foundation is the only one that even asked for the community’s ratification of these decisions.”

So token holders should be grateful that they were even asked to ratify Arbitrum’s theft.

There’s then another few hundred words about the pitfalls of on-chain governance and a few hundred more about the role of the Arbitrum foundation.

Then it finally it gets to its real explanation of what it did:

We believe that a lot of the negative sentiment around AIP-1 was driven by confusion around the notion of AIP-1 being a ratification and not a request. For those that didn’t realize that this was a ratification, they may have been surprised to see that the Foundation’s tokens have already been separated and begun to be utilized.

In hindsight, we should have made it clearer that this was indeed a ratification of a decision that had been made, which explains why there has been movement in the treasury that had been set aside for the Foundation. The Foundation treated this as a ratification of its initial setup, not an initial grant request from the DAO Treasury, and indeed has begun to use these tokens in the interest of the DAO, including conversion of some funds into stablecoins for operational purposes.

Again and again it says this vote wasn’t a real vote but a ratification, and it also admits to selling the tokens before the vote – sorry ratification – even took place.

And it again implies that everyone who called them out was wrong because in the original proposal “the 'Steps to Implement' section it did make clear that this was indeed a ratification of funding that had already occurred.”

I still don’t understand how something can be ratified if the vote was “no”. But then I don't work for Arbitrum.

Blockworks summed the whole thing up well in a post on the original proposal (post 106):

To recap, we believe these are the primary issues the community sees with the proposal in its current state:

750M ARB tokens with no vesting period to be sent from the community allocation.

These tokens were moved prior to the voting period for AIP-1, which was received very poorly by the community.

50M ARB tokens were already spent by the Foundation. 40M were loaned to Wintermute, and 10M were sold to cover operating costs.

Again, these tokens were moved prior to the voting period for AIP-1, which was received very poorly by the community.

Lack of clarity surrounding the Arbitrum Foundation: the selection of the initial directors, the justification for 750M ARB, the process for creating and allocating “Special Grants,” and the necessary operational expenditures need further elaboration.

AIP-1 contained too many elements to fit into one proposal. Each individual element should be its own AIP that is discussed and voted on separately.

High ARB requirement of 5M to submit proposals.

What happened to Arbitrum’s price throughout this fiasco?

Now, you might assume that throughout all furore, Arbitrum’s token price would have tanked.

But then you’d be forgetting that this is crypto. And in crypto prices don’t follow logic.

In fact, Arbitrum’s token has remained pretty level, hovering between $1.19 and $1.53 since its release on the 23rd of March.

I’m sure this saga still has more to play out. But it’s hard to know if it will hurt Arbitrum’s prospects or not.

Another layer-2 golden child, Polygon (which I wrote a deep dive on in March. You can read it here) had an even bigger fiasco when it first launched.

Polygon, or Matic as it was called back then, started its life with a colossal pump and dump scam.

I covered it here: What caused Matic Network’s monumental pump and dump?

In short, Matic climbed around 240% in two weeks and then crashed 70% in less than one hour.

But it ultimately meant nothing.

Because, as I pointed out in my deep dive, three years later – even with the bear market dragging everything down – Polygon’s Matic token is up over 9,000% from that pump and dump low.

And that monumental pump and dump now looks like this on Polygon’s chart:

So, in the long run maybe no one will even care about Arbitrum’s abysmal start.

Arbitrum’s fall from grace illustrates everything that’s wrong with the crypto industry right now

All of this may seem trivial. Who cares if the number one layer-2 project doesn’t stick to its word?

Who cares how crypto projects are governed and who cares about who holds the tokens and in what quantities?

A lot of people in crypto don’t. That’s why shady crypto projects and greedy VCs can get away with this kind of stuff.

But people should care.

Because although it’s a bit technical and boring, tokenomics and governance are just as important as tech when it comes to crypto.

Let’s not forget that Bitcoin was created as a backlash to the 2008 financial crisis and the corrupt economic system that allowed it to happen.

(More on that in my everything you need to know about crypto essay, which I’m sure you’ve read by now.)

As I said in that piece:

The maths, the computer code, and the networks that enable crypto are complicated. But the core idea of crypto is a simple one: decentralisation.

This is how Satoshi Nakamoto began the first ever public communication about Bitcoin:

“I've been working on a new electronic cash system that's fully peer-to-peer, with no trusted third party.”

Decentralisation takes the power away from central authorities and spreads it out among the people.

It’s like going from feudalism to democracy.

In terms of finance, we relied on these central authorities to make sure everything ran smoothly. Paying them for this service was only fair.

But, as the famous line goes, “power tends to corrupt, and absolute power corrupts absolutely.”

And over the course of the 20th century, as these central authorities, these financial institutions, became more powerful, they also tended to become more corrupt.

We saw what happened with that in part one.

By decentralising financial systems, it takes the power away from financial institutions and puts it into the hands of those using the system.

No longer is the system owned and run by a powerful third party, but by its participants. It is peer-to-peer.

Bitcoin wasn’t created as a solution to a technology problem, it was created as a solution to a governance problem.

But for most newer crypto projects governance is either an afterthought or – as in the subject of today’s article – a sham.

If you’ve read any of my deep dives, you’ll know this is the section that most projects fall down in.

And the reason these projects have such bad governance is simply because the crypto community allows them to get away with it.

Unlike a traditional company that’s traded on the stock market, crypto projects don’t have to publish their accounts to the public.

They don’t have to report their earnings or costs. They don’t have to tell people who their board members and chief officers are. They’re under no obligation to share any of this with us.

And that’s mainly because they don’t have shareholders.

A traditional company is ultimately owned by its shareholders. A crypto project is ultimately owned by… whoever they decide.

They can give “token holders” as much or as little power and information as they see fit. It’s entirely up to them.

In Arbitrum’s case, it said it would be owned by the community, but then made a major decision about its future without consulting the community that supposedly owned it.

This is par for the course in crypto. And it’s something everyone who’s involved in it should be aware of… not just investors, but people thinking of building on these projects, too.

So, although this Arbitrum fiasco might seem trivial, as I said right at the start, it’s a microcosm of the whole crypto industry.

Crypto had the chance to remake financial and technological systems in a fairer, less corrupt way. But so far, it’s just repeating the same mistakes it set out to fix.

What’s that saying?

The more things change, the more they stay the same.

And on that optimistic note, I’ll leave you.

As always, thanks for reading.

Harry

PS Don’t worry about missing out on the other big stories from this month, we’ll pick them up next time in a bumper edition.

Full disclosure: At time of writing, I held the following cryptos: Ethereum, IOTA, Radix, Mina Protocol, Aleph Zero.

Disclaimer: This content does not constitute financial advice, tax advice or legal advice. Your money and how you choose to spend it is your responsibility. Nothing that appears here should be construed as investment advice or recommendations to buy or sell any securities, cryptos or investments. coin confidential does not offer investment advice. We merely provide information. Crypto investing is highly risky. You should not base any investment decision solely on information we publish. We believe all information we publish to be accurate, but we cannot guarantee it. Always do your own research before making any decisions about your money. See the full disclaimer for more.

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).