This week in crypto: what the hell is going on?

It’s been a pretty extraordinary week in crypto.

By Friday, we were looking at 20% price drops all across the board.

Things have picked up a bit over the weekend, but most of the major players are still down 15% or more.

And because Bitcoin led this drop, it took the entire market with it.

In fact, the only crypto in the top 30 that isn’t down is… yes, you guessed it: Tezos.

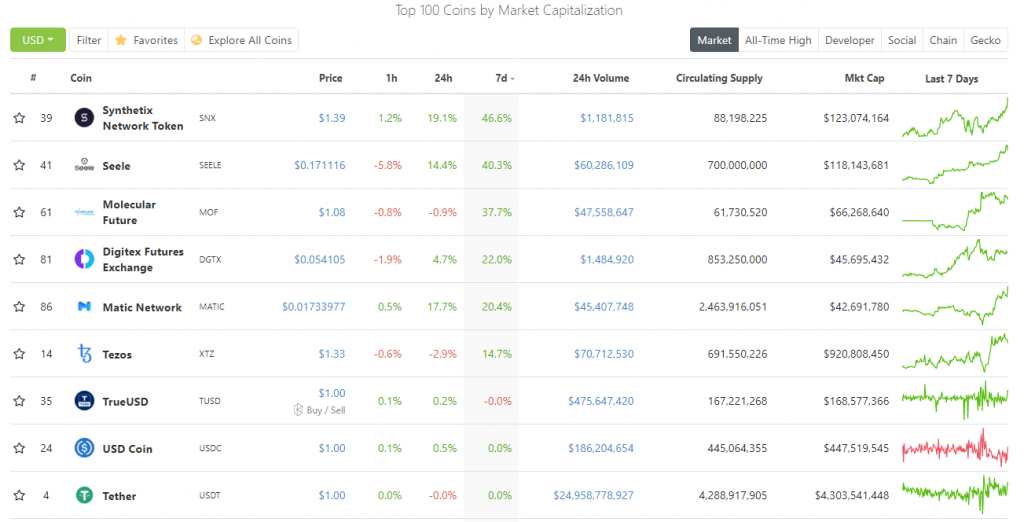

You can see what’s up over the las seven days in this screenshot from CoinGeko that I took at around 10am on Sunday the 24th of November:

Source: CoinGeko

As you can see, not only is Tezos not down, but it’s 15% up.

This is likely because of all the “big money” pouring into Tezos staking through Coinbase and a number of other big exchanges.

And that’s before we even think about the impact the Swiss stock exchange’s Tezos ETP is having – which I covered last week.

The reason these Tezos staking providers are important is because they all need to hold a certain quantity of Tezos in reserve so they can offer Staking to their clients.

And of these providers Coinbase is the biggest. If you read last week’s edition, you’ll know that the Swiss Tezos ETP is even using Coinbase as its custody provider.

What that means is everyone who buys that Tezos ETP is really buying through Coinbase.

That could create a huge amount of demand for Coinbase’s staking of Tezos.

Plus, you have all the other institutional clients Coinbase is providing Tezos custody and staking for.

And what you end up with is Coinbase needing to source a massive amount of Tezos.

As I said, in order to be a staking provider, you need to have a certain amount of Tezos locked up for security.

In fact, as a staking provider, you need to lock up eight times the amount of Tezos that people are staking with you.

And at the moment, Coinbase is way over subscribed. Or over delegated, if you want to use the correct term.

If Coinbase is over delegated, then it can’t pay out its staking rewards to its clients. So it’s being forced to buy up Tezos. A lot of Tezos.

Jack Miller explains it well in this Twitter thread.

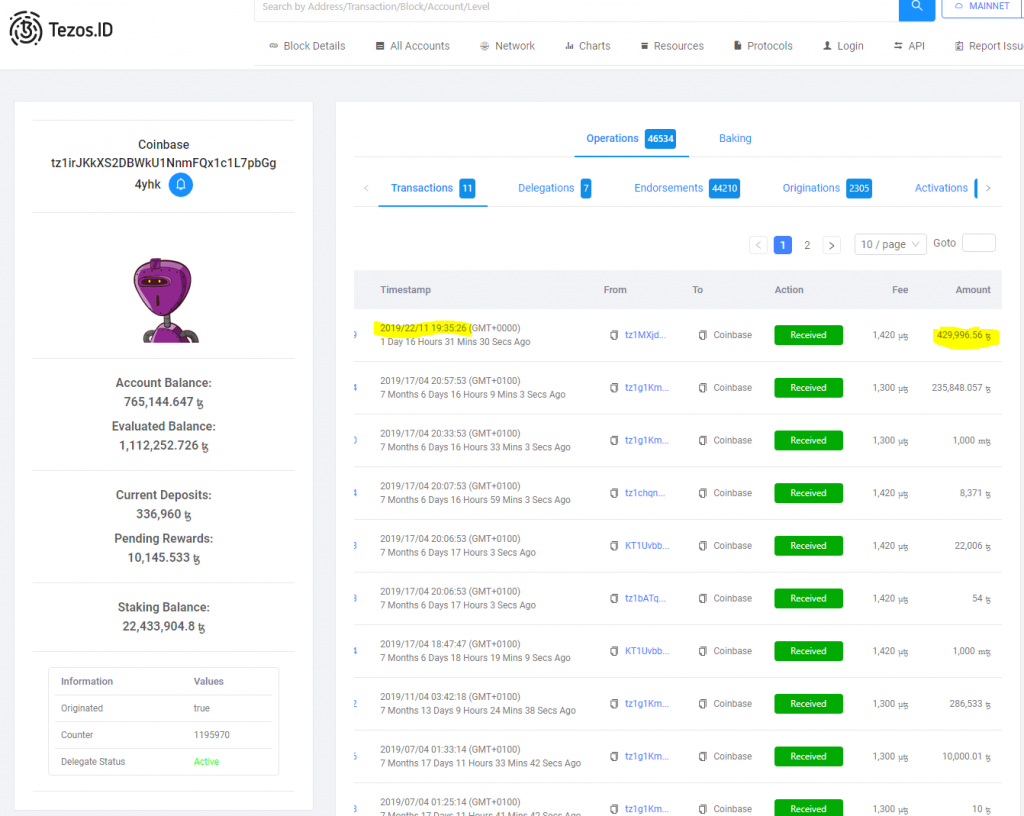

And we can see on the Tezos blockchain explorer, Coinbase acquired another 430,000 Tezos – worth around $559,000 – on Friday the 22nd of November.

Source: Tezos.ID

Now, if Jack’s assumptions are correct, Coinbase still needs to buy around 1.57 million Tezos – worth around $2,000,000 – to get back on track.

So this might explain how Tezos seems to be the only crypto in a very, very long time that can maintain its value, even as Bitcoin drags the rest of the market down.

But that’s enough about Tezos.

Why is the crypto market collapsing?

As I said in my opening, this has been a terrible week for most cryptos, and the crypto market in general.

But what caused it?

To be honest, right now, it looks like nothing has caused it.

There were reports earlier in the week by The Block that Binance’s Shanghai offices had been raided by Police. And some people are crediting this with the crash.

But it doesn’t really feel like a big enough event to have led to this destruction.

Especially as is was completely fake news.

As Binance told Bloomberg, it hasn’t even had a Shanghai office for two years. And Binance’s CEO says he is now suing The Block for making up a false story.

There have also been some more “China is banning crypto” rumours doing the rounds, which may or may not have contributed to the crash.

But seeing as China’s President, Xi Jinping has gone all in on crypto – as I reported at the time – then it’s clear to most people that those rumours were clearly false.

So what’s caused the crash?

Well, given that these kinds of crashes happen all the time in crypto, I’m writing a full feature on why they happen and what you can do to protect yourself from them.

I’m about half-way through it right now, and I hope to get it to you on Monday or Tuesday. So look out for another email from coin confidential then.

(If you’re not yet a subscriber, you can sign up for free here.)

And that’s why this week’s “this week in crypto” is pretty short.

However, before I go, I thought it was just worth mentioning one more story.

$7.8 trillion institutional goliath Fidelity accelerates crypto offering

As CoinDesk reported this week, Fidelity Digital Assets (FDAS) is planning to sign up its first exchange by the end of the year.

As you may know Fidelity is one of the world’s largest financial institutions with $7.8 trillion assets under management.

Back in October 2018, it launched FDAS, as its venture into the crypto space. But it took a while to get going.

In fact, it only launched its over the counter (OTC) trading service for institutions back in June.

But the thing about OTC trading, is it’s only really used for big trades. Once FDAS starts signing up exchanges, it can offer more nimble trading to a much wider variety of clients.

From CoinDesk:

The move would likely give FDAS access to a broader market and liquidity for smaller trades. OTC desks primarily trade with larger institutions and high-roller “whale” investors, whereas exchanges serve retail traders and smaller institutions.

“An exchange has more small order activity and is more comprehensive than an OTC desk which may rely more on relationship driven activity and is mostly used for larger block trades,” said John Todaro, director of research at Tradeblock, a provider of institutional trading tools.

So it looks like we’ll soon have three major players in the “institutional money” crypto space: Coinbase, Bakkt and FDAS.

And all three only really got going this year.

It’s going to be interesting to see what these three monsters will bring to the market in 2020.

Okay, that’s all I have time for today. As I said, look out for another email from me on Monday or Tuesday.

Thanks for reading.

***

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).