The SushiSwap saga

How a two-week-old crypto project rose from the dead to suck $830 million out of the world’s biggest DeFi exchange… after a public exit scam.

Well, no sooner did I write last week’s article on the wild west of DeFi than did one of the most popular DeFi names – SushiSwap – exit scam and crash 75% in 24 hours.

The creator of SushiSwap – which was basically a copy and paste of the popular Uniswap exchange – is an anonymous coder that calls himself “chef Nomi”… hence “sushi” swap.

And on Saturday he took roughly $13 million of the projects devshare funds – originally designated for further development – traded them for Ethereum and stepped down as “head chef”. [i]

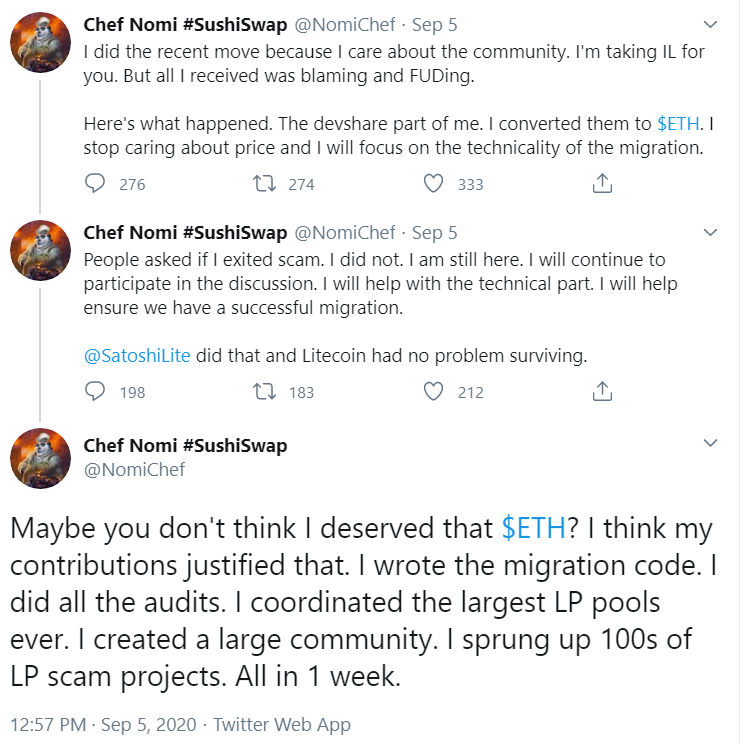

The cryptosphere understandably went nuts and Nomi then insisted that he hadn’t exit scammed and that he “deserved” the Ethereum.

Source: twitter

And, of course, some good memes came out of it:

Source: Reddit

Just another day in DeFi.

But that isn’t even half the story…

A few days later SushiSwap rose from the dead and sucked $830 million out of Uniswap

This is where things get really weird.

With SushiSwap in a death spiral, Sam Bankman-Fried (SBF), CEO of both FTX exchange and quant trading firm Alameda Research, went on a twitter offensive.

He had a lot of money tied up in SushiSwap and he wasn’t about to see it go to zero without a fight.

In a long Twitter thread, he laid out why he was invested in SushiSwap, explained how Nomi was a “piece of shit” and set out his plans to bring SushiSwap back from the brink.

Source: Twitter

It worked, and Nomi handed control of the then $80 million project over to SBF… just like that.

SBF, seeing which way the wind was blowing then pushed forward SushiSwap’s “migration”.

This “migration” was a dastardly plan to syphon all the liquidity out of Uniswap and into SushiSwap.

As Decrypt put it: “Decentralized finance is living through what may become one of its most defining moments. In less than 48 hours, a two-week-old upstart will attempt to drain liquidity from DeFi’s largest exchange, in a never-before-attempted vampire-like attack, which right now has $1.3B in tokens at stake.”

So did it work? Yes. As you can see in Uniswap’s locked value chart below:

Source: DeFi pulse

In total SushiSwap leeched around $830 million of crypto from Uniswap and into SushiSwap.[ii]

Bear in mind that up until this attack Uniswap was the largest DeFi project in crypto… and SushiSwap had only been alive for 14 days.

So it was no mean feat for SushiSwap to topple the king… even after its founder “hadn’t” just exit scammed.

But the SushiSwap saga wasn’t over yet.

SushiSwap’s new leadership was decided by a twitter poll

While all this was going on, SushiSwap’s new leadership was being decided… by how many likes they gained on twitter.

Yes, seriously.

Source: twitter

After the contenders had gained enough likes on twitter, they were then entered into a vote on SushiSwap itself to be one of the nine… what is in effect board members for SushiSwap.

Source: Twitter

This may all sound completely absurd. And it is… but it’s even more absurd when you remember that while all of this was going on, SushiSwap’s 14-day-old SUSHI token maintained a market cap of around $200 million… And it’s even higher today.

You couldn’t make this stuff up…

Thanks for reading.

I hope you found this saga as entertaining as I did.

And as usual, if you thought this issue was worth a pot of tea, you can buy me one here.

Harry

PS As you may remember, I was planning to write a summary of the top five “Ethereum killers” for this week’s edition, but I’ve been too busy to put in enough research, so I’m pushing it to next week.

[i] https://www.theblockcrypto.com/linked/77090/sushiswap-founder-converts-portion-of-developer-fund-to-6m-in-eth [ii] https://www.coindesk.com/sushiswap-uniswap-migration-defi-amm-wars

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).