The bulls are back in town

Looks like crypto is finally going mainstream (again). This week we have PayPal, Deutsche Bank, Citibank and JPMorgan all playing crypto catch up.

[Please note this post uses affiliate links. If you want to know what that means, or find out why I use affiliate links, you can take a look at my disclaimer page.]

Wow, I go away for a few weeks and look what happens!

PayPal becomes a crypto exchange and payments provider, opening a new crypto gateway for hundreds of millions of people around the world.[i] (But one you definitely shouldn’t use… more on that in a minute.)

Citibank – the 4th biggest bank in the US – predicts $318k Bitcoin in 2021.[ii]

The Chief Investment Officer of Blackrock – the world’s largest asset manager, with $7.4 trillion assets under management – says “crypto is here to stay” and “Bitcoin can replace gold to a large extent.”[iii]

Deutsche Bank says investors are favouring Bitcoin over gold as an inflation hedge.[iv]

JPMorgan – the worlds largest investment bank – which has famously been opposed to Bitcoin – now says Bitcoin’s price could triple.[v]

American billionaire investor, Paul Tudor Jones moves almost 2% of his net worth into Bitcoin, calling it the “best of inflation trades” and likening it to “investing with Steve Jobs and Apple or investing in Google early.” (You might remember I wrote a whole feature on Bitcoin and inflation a few months back… yeah, I know it sounds boring, but it’s not. It affects every facet of your life.)

And not to be outdone, Mexico’s third richest person, Ricardo Salinas Pliego revealed that 10% of his liquid portfolio is invested in Bitcoin.[vi]

Then this happened…

Join coin confidential

As a free subscriber, you’ll get coin confidential’s newsletter and access to new articles, weeks before they open to the public.

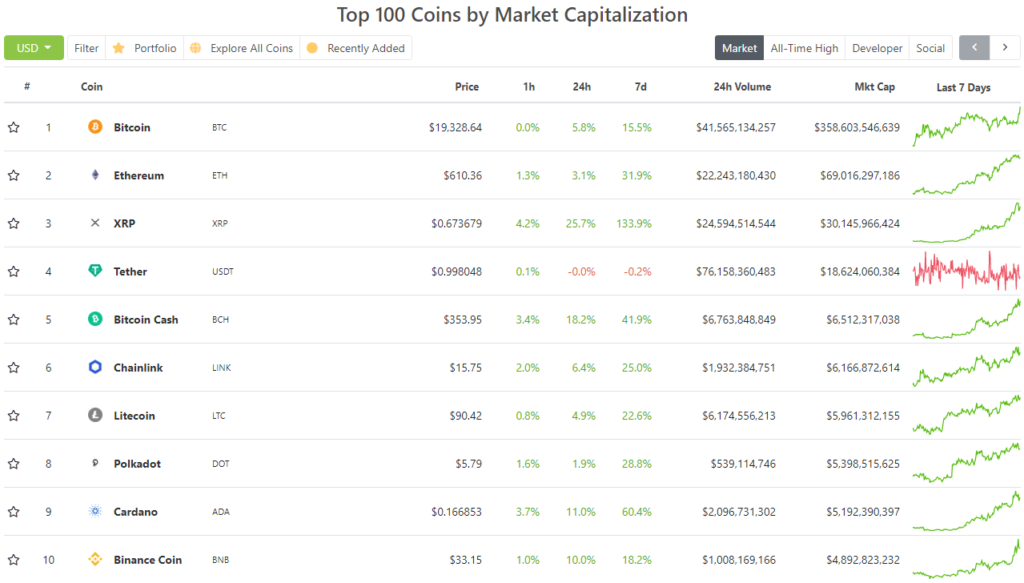

Bitcoin went on an absolute tear… getting within a few hundred dollars of its All Time High, set back in December 2017.

And eventually, it dragged the rest of the market up with it.

(Although, to be fair, if you’ve been following crypto closely for the past year or so, you’ll know that Ethereum has made much bigger percentage gains than Bitcoin over the last 12 months.)

Cue mainstream crypto mania…

Phone calls from friends and relatives asking if this is a good time to buy (clearly, it’s not. Wait for the inevitable pullback… like we say today).

Crypto on the TV news.

Crypto on the radio.

And crypto comment pieces (as usual, written by people who don’t have a clue what they are talking about) in every major news publication, both online and in print.

Yeah… it’s been an intense few weeks in the cryptosphere.

I even got a scam email from Legder support (note the misspelling) this morning telling me my hardware wallet is vulnerable and I need to download their latest (fake) software.

If you have an email, from: “no-reply@legdersupport.com” ignore it and report it as phishing. IT IS A SCAM.

What can we expect going forward?

Crypto right now:

The golden bull run is back… meat’s back on the menu… the boys are back in town…

So strap in, because the next few months will be a rollercoaster.

If you were around in the crazy days of 2017, you’ll probably remember it was not all sunshine and stardust.

There were many, many days with 50%+ drops in major cryptos and people screaming the sky was falling.

Much like what we’ve just seen today:

But this time it’s different, right?

Well, yes.

And no.

So the main argument for 2020’s bull run is institutional adoption.

It’s been talked about for years, but it seems it’s finally become more than just a meme.

As you can see in my bullets at the beginning, institutions and big name billionaires really are buying in.

And there is also some compelling evidence this is happening on a large scale. Here’s a great post I saw the other week to that effect:

The main narrative as to why is because they see Bitcoin as a great hedge against inflation, traditional currency devaluation and the stockmarket.

Just to set the scene here: we’re still in the midst of a global pandemic, businesses are dropping like flies, unemployment is surging, countries are borrowing more than at any time since the second world war…

And yet stock markets (at least US ones) are at All Time Highs.

So if you’re an investor, where do you put your money?

It probably wouldn’t be a bad idea to have a small percentage in crypto as a hedge against all this chaos. It’s easy to see why institutions and big name investors are now taking this approach.

And given that the entire crypto market is currently worth less than 1/3 of Apple’s stock… big investors buying in can have a massive effect on crypto prices.

And then that leads to people seeing prices shooting up and fearing they will miss out if they don’t buy in…

And then that leads to more people doing the same thing…

And then some people decide to take profits…

And then the price falters…

And then people get scared it will continue heading down and sell…

And then the price drops lower so more people get scared and sell…

And then the price drops to a level that other people see as a great place to buy…

And then prices start to go up again…

And then it repeats all over again, forever and ever.

I cover this cycle in a lot more detail, and with real-world examples from 1929, Black Friday and the 2008 crisis in this article: Why are crypto prices falling? The definitive guide.

But just like the last bull run, the takeaways remain the same…

5 Key things to keep in mind during this bull run

I go into these in much more detail in the above article, but to recap:

1. Never invest more than you are happy to lose.

And the word happy there wasn’t chosen at random. If losing the money you’ve put into crypto will make your life worse… if you need that money at all, you’re probably too heavily invested.

Not only with this keep you sane. But it will actually set you up to make more money. (I explain why in this guide.)

2. Set sell targets and stick to them.

Given how volatile we know crypto is, it’s a good idea to have some specific price targets in mind for when you will sell a certain percentage of your stack.

Many people like to sell 50% of their investment if it doubles in value. That way, any gains after that are effectively “free”… unless you start thinking about opportunity cost, but that’s a topic for another article.

3. Watch out for scams.

The more money there is in crypto, the more enticing it is for scammers. So be on guard.

4. Keep your crypto on a hardware wallet.

This goes along with #3. If you keep your crypto on a hardware wallet, you are much better protected from hackers and scammers. (for more on this see this guide).

There is also the age old crypto adage to remember: “not your keys, not your crypto”. That basically means, if you don’t have the keys to your wallet… if you keep your crypto on an exchange… then it’s not really your crypto at all.

If the exchange gets hacked, gets shut down for breaking some regulatory rule or goes out of business, you could lose all of your crypto… and many, many people do.

(again, for more on this see this guide)

5. Most important of all… enjoy the ride.

Watch out for PayPal

This story is yet another confirmation of why you shouldn’t keep your crypto on an exchange.

As I said in this article’s opening, PayPal has made waves by becoming a crypto exchange… with one major caveat.

Like Revolut, Robinhood and a number of other crypto “exchanges”, if you buy crypto through it, you’re not really buying crypto at all, you’re buying an IOU.

That’s because you can’t actually move your crypto off PayPal once you’ve bought it. The only way to get it off is to buy something with it or exchange it for traditional currency.

Which also means, if PayPal decides your account is suspicious… for any reason… it can confiscate your crypto for six months. (or maybe longer, I haven’t had time to look into it fully). And in crypto, as you know, six months is an eternity.

This point was brought home this week when PayPal suspended a user’s account for… using PayPal to buy crypto.

Confused? I’ll let Coin Telegraph explain:

A PayPal user reports their account has been restricted after they traded crypto too frequently using the platform.

According to U.S.-based Reddit user TheCoolDoc, PayPal sent them a message stating that it had permanently limited their account “due to potential risk.” The user said they had made at least 10 crypto transactions within a week, purchasing during dips and selling when the price was high, and PayPal had asked for an explanation for each transaction.

“The system flagged my account thinking I was selling items worth $10,000 in one week when I hadn’t done so in the last 6 years I’ve held a PayPal account,” the user said. “I submitted the stuff for review with my photo ID and wrote ‘PayPal Crypto’ for each crypto transaction because what else could I say?”

In a matter of hours, PayPal reportedly sent a message stating that the user would “not be able to conduct any further business” using the platform. The user stated that the remaining funds in the account — $462 — were placed on a 180-day hold.

You can read the full story here on the original Reddit post.

In conclusion, always remember… not your keys not your crypto.

Binance Jersey shuts up shop – here’s what you need to do now

If you’ve read my guide: The cheapest, easiest and safest way to buy Bitcoin in the UK, you’ll know that Binance Jersey was the cheapest way to get hold of Bitcoin.

It certainly wasn’t the simplest, safest or easiest, but it was the cheapest.

Well this month Binance closed down Binance Jersey and told users to start using Binance.com instead.

So if you have any crypto stored on Binance Jersey, you need to move it off or you could risk losing it.

The good news is the main Binance has exactly the same low rates as Binance Jersey did, and it allows deposits and withdrawals in GBP.

And the even better news is, you can trade basically any crypto you desire on it. Every crypto I’ve ever written about on coin confidential is available to trade on Binance.

You can sign up for a Binance.com account with this link.

And on that note…

What’s happening with coin confidential?

If you read my last article, you’ll know that I won’t be writing coin confidential every week.

I’m writing full time for a company in the US (copywriting, not editorial. And not about crypto, just about traditional finance). And unfortunately I can’t take a day off every week to write coin confidential anymore.

But like I said then, I’m going to try write roughly one article a month, which will be a lot like this one, with the most interesting stories I’ve seen, a bit of tongue-in-cheek commentary, a few memes… and maybe just maybe a bit of useful insight.

So first of all, I want to say a massive thank you to everyone who bought me pots of tea over the last year or so. And if you had a recurring payment set up, I’ve now cancelled it for you.

I won’t be asking for pots of tea anymore because I don’t think it’s fair, given my new publishing schedule.

But if you want to help the site, the best way is to use my affiliate links in my guide to the cheapest ways to buy crypto if you want to make an account and trade crypto on Binance, Bitpanda or Coinbase.

If you’re not familiar with affiliate links, I basically get a commission for you joining and trading, but you don’t pay anything extra.

It helps me to keep the site going, but it doesn’t cost you anything.

Maybe down the line I’ll have more time to put into coin confidential, but for now I’m glad I can just keep writing you every few weeks.

Thanks for reading,

And happy Thanksgiving to all my American subscribers.

Harry

[i] https://www.bbc.co.uk/news/technology-54630283

[ii] https://cointelegraph.com/news/citibank-makes-tentative-318k-bitcoin-prediction-for-december-2021

[iii] https://www.cnbc.com/2020/11/20/blackrocks-rick-rieder-bitcoin-can-replace-gold-to-a-large-extent-.html

[iv] https://www.nasdaq.com/articles/deutsche-bank-says-investors-increasingly-prefer-bitcoin-over-gold-as-inflation-hedge-2020

[v] https://fortune.com/2020/10/26/jp-morgan-chase-bitcoin-predictions-analyst-jpm-cryptocurrency/

[vi] https://www.bloomberg.com/news/articles/2020-11-18/billionaire-salinas-has-10-of-liquid-portfolio-in-bitcoin

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).