IOTA launches coordicide early

2020 has certainly started well for crypto.

The overall market is up over 45% since the start of the new decade, with a few key projects flying much higher than that.

At time of writing (10am on the 7th of February):

- Our old favourite, Tezos, is up 97%.

- IOTA “the one crypto to rule them all” is up 107%.

- Tezos’ main rival, Cardano, is up 85%.

- And even Ethereum, which should really be leading the market by now, given what’s coming, is up 70%.

The question everyone now seems to be asking, is: are we back in the bull market, and how likely are we to see another 2017-style run?

So, instead of the issue I had planned for this week – about the rise of Decentralised Finance (DeFi) – I’m going to give you a more market-oriented one.

…Or more accurately, an IOTA-oriented one, as that’s where the most exciting things have been happening.

IOTA jumps 22% in 29 hours amid co-founder departure and coordicide alphanet

This was a very big week in IOTAland for two reasons:

One: Its genius yet volatile co-founder “come from beyond” officially severed ties with the project, in a very public way…

Two: IOTA launched the alphanet of coordicide.

(If you don’t know what coordicide is yet, or its significance to the entire world of crypto, you can find out all about it in my article here.)

Why didn’t a co-founder quitting tank IOTA’s price?

You would probably have thought that a co-founder leaving a project and threatening to sue it into oblivion would cause a price crash. But not in this case.

Come from beyond (CFB) has been a major player in crypto since pretty much the beginning. And there is no doubting his skills and intelligence.

However, he is also very unpredictable and prone to outbursts and stunts like the above tweet.

He has also slowly been less and less involved in IOTA over the last couple of years, after starting his own project.

According to another IOTA co-founder, David Sønstebø, CFB didn’t really have anything to do with IOTA anymore and had become a roadblock.

So, CFB leaving was taken as a very positive sign by most investors.

If you want to read exactly what went down and why – and discover a lot about the beginnings of IOTA – you can read David Sønstebø’s take on the whole thing on IOTA’s official blog. If you’re a follower of IOTA, it’s well worth a read… and not too long.

IOTA coordicide progress shocks everyone

A few hours after the CFB drama, IOTA announced it had launched its coordicide alphanet.

An alphanet is basically just another name for a testnet. It’s the first iteration of a testnet, hence the name “alpha”.

After the alpha testing, things usually move on to beta testing, and finally a full launch.

The significance of the alphanet launch is it wasn’t planned for another three months – at least.

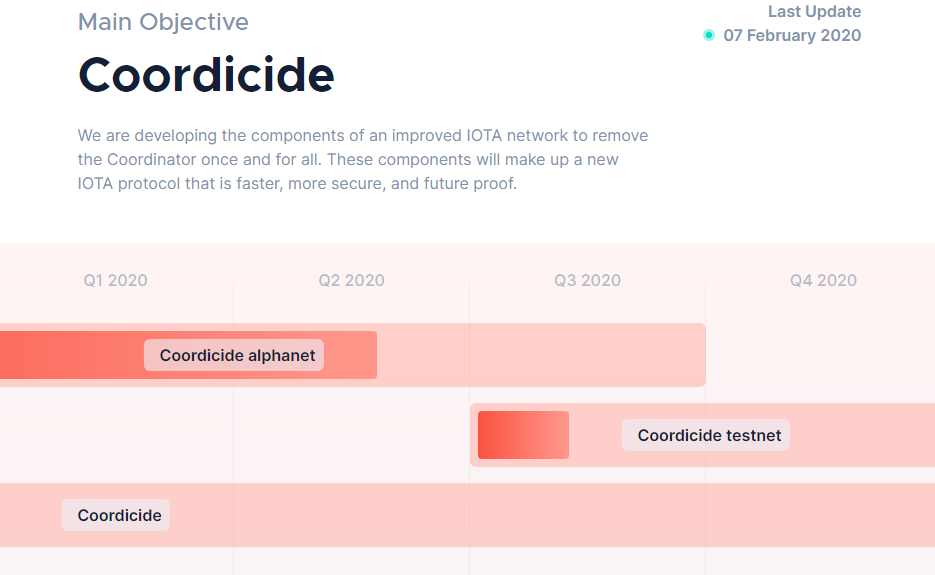

As you can see in IOTAs original roadmap, the coordicide alphanet wasn’t supposed to launch until sometime in Q2 2020:

The roadmap has since been updated to reflect the new release, as you can see:

Did CFB know about this planned early release, and time his tweet to affect its reception? Probably. Does it matter? No.

As you can see, following CFB’s departure on the 2nd of Feb and the coordicide alphanet on the 3rd, IOTA’s price jumped:

As if that wasn’t enough, IOTA announces “chrysalis” with coloured coins – basically tokens on IOTA

And in a classic “but wait, there’s more!” fashion, IOTA also announced an update to its mainnet called chrysalis.

As you can probably get from the name, chrysalis is the IOTA mainnet undergoing a transformation to get it ready for the full launch of coordicide.

So, not only do they have the coordicide alphanet up and running, they have also upgraded the mainnet as well.

Chrysalis brings with is a number of upgrades, but most notably “coloured coins”.

The idea of coloured coins has been around since the early days of Bitcoin. But back then, they never really took off, given Bitcoin’s transaction fees.

With IOTA, transactions are free, and so coloured coins can basically work like tokens on Ethereum.

People can tag specific IOTAs to represent certain things.

For example, a country could convert its entire monetary supply into coloured coins on IOTA. Or a property could be tokenised on IOTA using coloured coins.

The advantage that coloured coins have over traditional tokenisation is that they are using existing IOTAs, not creating new ones.

So everything runs on the mainnet, which given IOTAs structure, will actually speed up transactions for everyone… and decrease available supply, which should increase IOTA prices.

If you want to know more about the IOTA chrysalis upgrade you can read about it on the official IOTA blog.

And the same thing goes for the coordicide alphanet. Read about it on the IOTA blog here.

Bitcoin sets $10,000 in its sights

I couldn’t write a market-oriented issue without mentioning big daddy bitcoin.

“The tide that raises all boats” has been making significant price moves of its own.

And given that it’s now approaching a nice round number – $10,000 – even the mainstream media is starting to pick up on it.

With the Bitcoin halving set for the 12th of May, many crypto commentators are predicting an new all-time price high in 2020.

And with every $500 or so move upwards, Bitcoin gathers more media attention.

Plus, we now have news there is a record amount of money in Bakkt’s bitcoin futures. So it seems “institutional interest” is picking up, too.

As I write this, Bitcoin is sitting at $9,767.

If it passes that $10,000 mark, expect your friends and relatives to start asking you about “Bitcoins” again.

Ethereum price finally “does something”

Realistically, Ethereum should be in a much better position than it is, relative to Bitcoin.

If you want to know why, then take another look at this issue: three major developments coming to crypto in 2020.

But as the maxim states: “markets can remain irrational a lot longer than you and I can remain solvent.”

Ethereum’s price hasn’t really done a lot in the last few months, prompting people to start reposting the ol’ meme again:

For a very long time, when Ethereum did “do something” after a period like this, it usually took a swift step down in price.

But not this day!

Ethereum is finally picking up steam. As you can see in its three-month price chart.

So far, 2020 is shaping up to be the most exciting year in crypto since the 2017 golden bull run… and we’re barely a month in.

In the next couple of issues I’ll be covering the rise of security token offerings (STOs) and DeFi, rounding off our key developments to look out for in 2020.

So stay tuned…

Thanks for reading.

Harry

PS If this really is the start of another golden bull run – and even if it’s not – now is probably a good time to take another look at the three golden rules of crypto investing (you’ll find it about 2/3 the way into the guide).

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).