This month in crypto: Ethereum ETFs incoming

It’s official, Ethereum spot ETFs are coming… sort of.

You’ve probably noticed over the last few months that the bulls are back in town.

“Buy bitcoin” searches on google spiked 826% last month in the UK.

While the overall crypto market is up about 65% over the last year.

And many individual projects are doing even better...

Here's the performance of the top 10 (non-stablecoin and staking) crypto projects by market cap over the last year:

- Bitcoin: +118%

- Ethereum: +59%

- BNB: -11%

- Ripple: +56%

- Solana: +330%

- Cardano: +10%

- Dogecoin: 0%

- Tron: +100%

- Avalanche: +64%

- Polygon: -8%

Average: +71.8%

(Price data taken from Coin Gecko on the 18th of November 2023.)

And just for fun, let’s compare the 65% overall crypto market gain to the FTSE 100 and S&P 500:

FTSE 100: +1.61%

S&P 500: +13.84%

(Price data taken from Google Finance on the 18th of November 2023.)

While we're at it, let’s compare the top 10 cryptos by market cap to the top 10 stocks by market cap:

- Apple: +25%

- Microsoft: +53%

- Saudi Aramco: +10%

- Alphabet (Google): +39%

- Amazon: +54%

- Nvidia: +220%

- Meta (Facebook): +199%

- Berkshire Hathaway: +16%

- Tesla: +30%

- Eli Lilly: +64%

Average: +71%

(Price data taken from Google Finance and companies by market cap on 18 November 2023.)

Wow, look at that, the average gain for the top 10 cryptos and top 10 stocks are pretty much exactly the same.

And while a 71% average isn’t so surprising for crypto in a bull market, it’s very exciting for stocks.

Especially big tech stocks.

There are also no losses in the top 10 stocks vs two losses and a 0% for crypto.

I think it’s fair to say big tech is back.

But anyway, this is a crypto newsletter, not a stocks newsletter. So I won’t dwell on it too much. But it’s pretty fun to do these kinds of comparisons when things are going up, don’t you think?

I also find it pretty fun to do them when things are going down… but I’m well aware most people don’t.

Anyway, the reason Bitcoin is up so much is because of the much anticipated spot Bitcoin ETFs – which I covered here back in July: The ETF special, or: the battle for Bitcoin’s soul.

Since July, it's looked more and more likely that they will get approved by the 10th of January deadline.

Bloomberg’s analysts now “believe there’s a 90% chance of approval by Jan. 10”.

And BlackRock is “growing increasingly confident the SEC will approve its BTC ETF by January” according to a senior correspondent at Fox Business.

But given the SECs record of rejections, and its Chair Gary Gensler’s war on crypto, it’s far from a forgone conclusion.

(See my article: high noon at the crypto corral for more on that.)

However, it now looks like spot Bitcoin ETFs may just be the beginning...

BlackRock and Fidelity both filed for Ethereum ETFs this week

First we got rumours that BlackRock was registering an Ethereum Trust in Delaware…

“The website for Delaware’s Division of Corporations showed that an iShares Ethereum Trust was registered Thursday. A similar notice for the iShares Bitcoin Trust came one week before BlackRock’s filing for a bitcoin ETF in June.” – CNBC.

And then a couple of days later we got confirmation. BlackRock really was creating an Ethereum ETF:

“Asset management giant BlackRock on Thursday officially filed for a spot ethereum exchange-traded fund (ETF), doubling down on its cryptocurrency bets amid investor optimism about the approval of such investment vehicles.” – Reuters.

Not to be out done by number one, the third largest asset manager in the world, Fidelity, then filed for its own Ethereum ETF:

“Fidelity, an asset management firm overseeing $4.5 trillion in assets, has become the latest firm to seek approval for a spot Ether exchange-traded fund (ETF).

In a filing with the United States Securities and Exchange Commission (SEC) on Nov. 17, Fidelity proposes to list and trade shares of the Fidelity Ethereum Fund on the Cboe BZX Exchange.” — Coin Telegraph.

So it seems like if the spot Bitcoin ETFs do get approved, spot Ethereum ETFs won’t be far behind.

And Ethereum ETFs could eventually have a major draw over Bitcoin ones: dividends.

Let’s not forget that Ethereum recently moved from a proof-of-work (PoW) consensus to a Proof-of-Stake (PoS) one.

And aside from reducing its energy usage by 99.99%, the switch to PoS also means people who secure the network by staking their Ethereum now get rewarded for doing so.

In fact, the 8th biggest crypto by market cap (Lido Staked Ether) is just a liquid staking product for Ethereum.

So, if the big asset managers start holding vast amounts of Ethereum for their ETFs, it would be crazy for them not to also set up network validators and make an additional 3%-5% return on their holdings.

And once one of those big ETFs started passing on a percentage of those rewards to holders of the ETF as dividends, then the others would all have to follow suit or lose business.

So, in the long run, Ethereum ETFs will pay out dividends, which could make them extremely popular.

If those Bitcoin ETFs do get approved, it’s going to be very interesting.

Things happening in the UK crypto scene

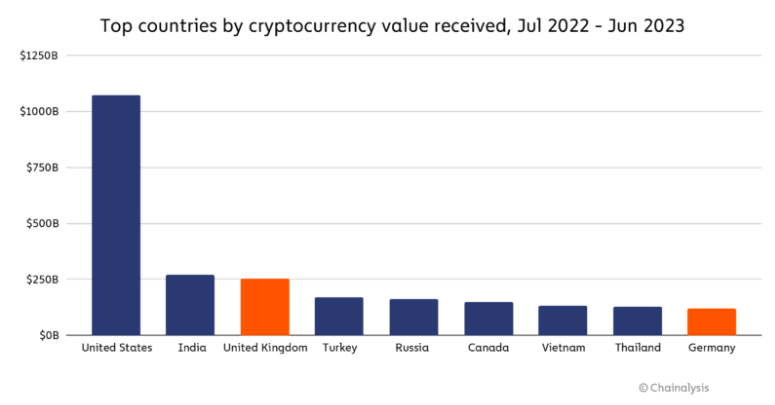

First, an easy one: guess which country has the biggest crypto economy in the world?

Answer: (unsurprisingly) America.

Okay, guess who has the second biggest crypto economy?

Answer: India.

I don’t know if I’d have got that one right.

How about the third biggest?

It’s the good old United Kingdom, as you can see on this chart from Chainalysis:

I’m not sure why the figures only go up to June, seeing as Chainalysis only released the research this month. But there you go.

I wonder how those numbers will change, now that the UK and Europe have their own crypto regulations in place… while US crypto regulation is, to coin an American term, a dumpster fire.

The Bank of England even published plans to regulate stablecoins this month.

For some reason they’ve decided stablecoins “should not be permitted to pay income or interest to consumers”.

Well, I say for some reason. But they actually make the reason very clear. They don’t want people to use stablecoins for saving, only for spending.

In line with its view that stablecoins used in systemic payment systems should not be used as a means of investment, the Bank further considers that issuers under its regime should not pay interest to coinholders. This would align the treatment of systemic stablecoins with cash, e-money, and a potential digital pound. Prohibiting e-money institutions from paying interest already incentivises the use of e-money for payments rather than as a means of investment. – Bank of England.

After all, it’s better for economic growth when people spend rather than save. And economic growth is what authorities care about.

Double call-back: JPMorgan has a proof of concept with Avalanche

I just saw this news this morning:

Onyx by J.P Morgan and Apollo Global have announced a collaborative effort under the Monetary Authority of Singapore’s (MAS) Project Guardian, showcasing a proof-of-concept (PoC) that marks a first and pivotal step toward revolutionizing the asset and wealth management industry. …

In preparation for a multi-chain future, Onyx Digital Assets leveraged a variety of interoperability protocols to tap into assets tokenized on blockchains beyond its platform built on Consensys Quorum. To that end, LayerZero connected Onyx Digital Assets with a permissioned Avalanche Evergreen Subnet, which facilitated subscriptions and redemptions for funds offered by WisdomTree, a leading asset manager and pioneer in fund tokenization. – Avalanche press release.

I thought that was quite interesting given I dedicated last month's premium issue to big banking blockchain and its implications. You can read it here.

And also, because I wrote a huge deep dive on Avalanche last summer, which you can read here.

Okay, that’s all for today.

Thanks for reading.

Harry

Full disclosure: At time of writing, I held the following cryptos: Ethereum, IOTA, Radix, Mina Protocol, Aleph Zero.

Disclaimer: This content does not constitute financial advice, tax advice or legal advice. Your money and how you choose to spend it is your responsibility. Nothing that appears here should be construed as investment advice or recommendations to buy or sell any securities, cryptos or investments. coin confidential does not offer investment advice. We merely provide information. Crypto investing is highly risky, and you could lose 100% of the money you put in. You should not base any investment decision solely on information we publish. We believe all information we publish to be accurate, but we cannot guarantee it. Always do your own research before making any decisions about your money. See the full disclaimer for more.

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).