Crypto's Coronapocalypse

What happens to a highly volatile, highly liquid asset during a pandemic?

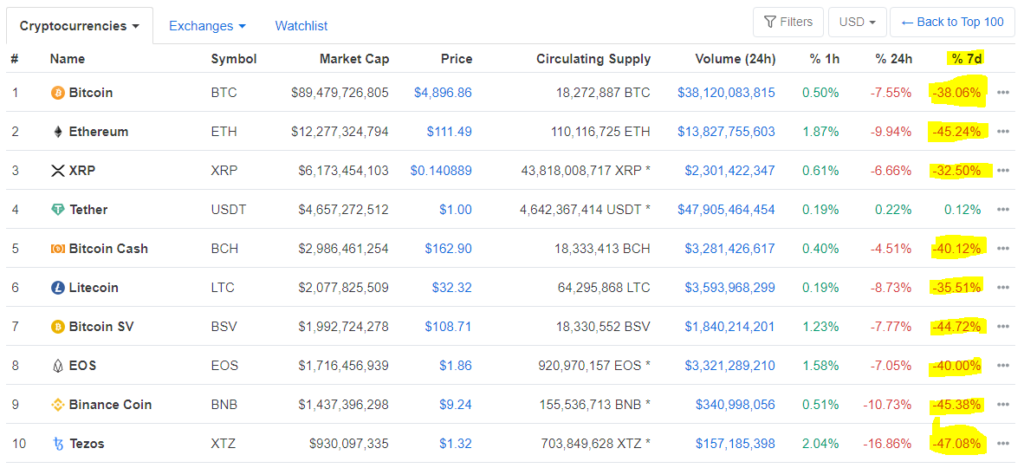

This:

Over the course of the last seven days, crypto shed around half of its value. With the entire market cap dropping from $220 billion to $120 billion in less than 24 hours.

Taking a broader look, we can see crypto is now exactly back where it was 12 months ago. It’s as if 2019’s progress never happened.

But, of course, you probably know all of this already.

Because, for a change, these massive price swings aren’t crypto-related at all. Crypto is just being carried along on the wave of a much bigger issue.

Living through a Black Swan event

The Coronavirus pandemic is pretty much a perfect example of a Black Swan.

And if you’re not familiar with that term, I’ll explain.

The idea of a Black Swan was put forward by Nassim Taleb in his 2017 book, called… The Black Swan.

It’s basically an unforeseen, highly unlikely, catastrophic event that goes on to wreak havoc on the world.

And it has three specific criteria:

- It is extremely rare, so rare that it’s impossible to predict.

- It has a catastrophic impact when it does occur.

- And people always claim that it was obvious and easy to predict and prepare for in hindsight.

I particularly like that last point, because it sums up how people always act after any major event that blindsides humanity.

A few past examples of Black Swans are the 2008 financial crisis, the 2001 dot-com bubble and hyperinflation in Zimbabwe.

As I write to you today, we are pretty much at peak uncertainty with the impact of the coronavirus.

It’s still too early to see what will actually happen, how dangerous it really is, how long it will last and how many people it will kill.

Uncertainly is what people fear most

When you know something is inevitable, you can prepare yourself for it. When you have no idea, you panic.

And, boy, are people panicking right now.

If you’re self-employed, you’ve probably already had a lot of work cancelled. And even if you’re a full-time employee, you might not be faring too much better.

The virus is killing people, and the reaction to the virus has put thousands, likely millions, out of work.

Right now, people are worried about their jobs, their lives and their toilet roll.

So it’s not surprising they’re pulling everything out of their investments. All of their investments.

Afterall, that’s what investments are for. They’re there to provide you with money when you need it.

Which is why, this is the current state of the world’s major markets (YTD):

- FTSE 100: -34%

- S&P 500: -21% (not yet open for the day)

- Dow Jones: -20% (not yet open for the day)

- Nikkei: -27%

- Dax: -35%

That kind of puts crypto’s -34% fall YTD into perspective.

And while a -34% fall in the space of a couple of weeks is entirely normal in the world of crypto, it certainly isn’t for the FTSE 100, or any of the world’s major stockmarkets.

So where do we go from here?

If you’re in the position where you don’t need to worry about your job, or the jobs of anyone in your family, this is probably the greatest buying opportunity you’re ever likely to see.

At some point in the next 3-12 months, the pandemic will come to an end. A vaccine will be created and the coronavirus will be relegated to the history books.

But its impact will still be felt for a very long time.

You can’t put millions of people out of work for months on end and expect things to just pick up as normal when the virus dies.

However, while “real life” is going to take a very long time to recover, the markets are likely to bounce back much faster. They always do.

And anyone with enough spare capital to do some buying while the prices are tanking will make off like a bandit.

But the question is, how do you know that “spare capital” will still be “spare” after the coronapocalypse has played out?

Given all that, if you are thinking of putting any money into the market, or pulling any out, now’s probably a good time to take another look at this: why are crypto prices falling? The definitive guide.

I wrote it to be applicable not just to crypto, but to any investment. As you’ll see in the guide, events like this always come down to fear vs greed.

Right now we’re at peak fear. But at some point, the pendulum will start to swing the other way.

And when it does, those in a position to capitalise on it are going to make a hell of a lot of money.

Whether that’s moral or not, is up to you to decide.

Thanks for reading.

Harry

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).