This month in crypto: Binance against the world 🌍

Binance is facing a "global crackdown" from regulators. Here's why... and what we can expect going forward.

Well, that escalated quickly.

Less than 48 hours after I sent out last month’s newsletter– which was mainly about UK regulators cracking down on crypto – the Financial Conduct Authority (FCA) “banned” Binance.

You’ll notice I put banned in quotes there. That’s because it didn’t really ban Binance.

Luckily for crypto, the FCA only deals with regulated financial industries. And crypto – for now at least – is unregulated.

So the FCA banned Binance from carrying out any regulated financial activities.

As the FCA put it:

Binance Markets Limited is not permitted to undertake any regulated activity in the UK. This firm is part of a wider Group (Binance Group).

…

No other entity in the Binance Group holds any form of UK authorisation, registration or licence to conduct regulated activity in the UK.

In the same statement, the FCA also made it clear it has no authority to ban normal crypto trading. Only certain crypto derivatives and securities:

While we don’t regulate cryptoassets like Bitcoin or Ether, we do regulate certain cryptoasset derivatives (such as futures contracts, contracts for difference and options), as well as those cryptoassets we would consider ‘securities’.

However, the banks got the picture. UK regulators don’t want the plebs messing with crypto. And they especially don’t want us messing with crypto using Binance.

Over the next few weeks, pretty much every major UK bank started blocking payments to Binance, with most telling their customers it was for “our own good.”

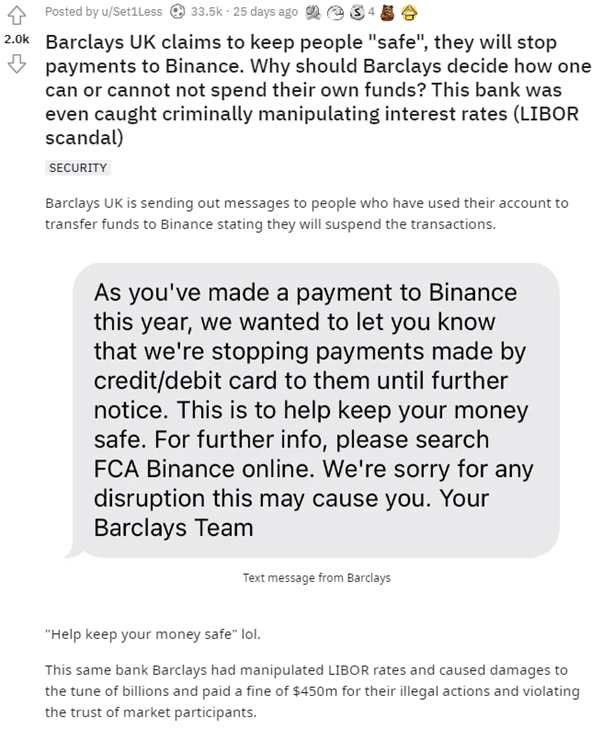

Barclays said it was “to help keep your money safe”:

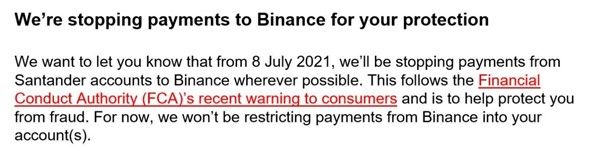

Santander said it was “for your protection”:

And NatWest and Starling banned payments to Binance without quite as much fanfare or doubletalk.

Meanwhile, Binance was booted out of the Faster Payments system when its payments provider, Clear Junction cut ties:

Clear Junction can confirm that it will no longer be facilitating payments related to Binance. The decision has been made following the Financial Conduct Authority’s recent announcement that Binance is not permitted to undertake any regulatory activity in the UK.

Oh, and as if all that wasn’t enough, “a group of Italian and international investors” filed a class-action lawsuit against Binance.

The investors say they lost “tens of millions” of dollars because Binance had service outages during peak trading hours.

It’s safe to say, July was not a good month for Binance.

Why is Binance taking all the heat?

If you’ve been following all this, you might be wondering, why Binance?

Binance is one of the most trusted exchanges in crypto. True, it’s not perfect. And I’d feel happier leaving money in Coinbase or Kraken. But it’s far from the worst.

And it’s proven itself time and again by reimbursing customers when it fell victim to hacking.

Personally, I think the reason all this happened was because Binance overstepped.

In April Binance launched tradeable “stock tokens”.

These are basically cryptos that represent, and are backed by, real stocks.

In the same way that USDC is backed by US dollars, these stock tokens are backed by actual shares.

From Coin Telegraph in April:

Cryptocurrency exchange Binance is launching tradable stock tokens that aim to enable a wider section of the public to pocket capital returns on equities, including potential dividends, without having to purchase full, traditional shares.

…

Binance CEO Changpeng Zhao believes that digital stock tokens will provide a bridge between traditional and crypto markets and broaden access to equity markets, resulting in a “more inclusive financial future.”

Sounds pretty cool, right?

Not to regulators.

A couple of weeks after this, Germany’s financial regulator (BaFin) set the anti-binance ball rolling.

It told Binance that it was in violation of EU securities law and risked being fined as much as $6 million, or 3% of its turnover.

At first Binance seemed to shrug off these warnings, saying:

Binance takes its compliance obligations very seriously and is committed to following local regulator requirements wherever we operate. We will work with regulators to address any questions they may have.

But that anti-binance ball just kept growing in size and speed.

By mid-July regulators in Japan, Germany, Italy, Hong Kong, Canada, Thailand and the US were all gunning for Binance in what Reuters called a “global crackdown”.

The crackdown worked. On the 16th of July, Binance announced it would halt all stock token trading and “shift our commercial focus to other product offerings.”

I guess the lesson here is regulators really, really don’t like unregulated companies messing with regulated securities (stocks).

And that’s fair enough.

But you can’t stop progress.

And at some point the world of crypto and the world of securities is going to merge.

In fact, they already are, as I wrote back in 2020 in my How Security Token Offerings (STOs) will forever change global finance feature.

So I expect we’re going to see a lot more regulatory crackdowns in the coming years, as crypto and securities become more and more closely related.

Would I still use Binance?

In the immediate future, however, the bigger question is, should you keep using Binance?

Personally, I will continue to use it in the same way I have always done. I’ll only use it to trade crypto that I can’t get on Coinbase Pro, Bitpanda Pro or Kraken. I won’t use it to store my holdings and I won’t use any of its savings or lending products.

I still “trust” Binance. It still has pretty much the cheapest prices around and the best liquidity.

But regulators are clearly gunning for it. And it’s hard to know how that will play out in the end.

Whether you choose to keep using it is entirely up to you. As I’m sure you’re sick of me saying by now, I don’t offer any advice or recommendations. I just write commentary.

So, what else has been going on this month?

Central Bank Digital Currencies (CBDCs) are still plugging away.

CNN reports there “could” be a digital Euro by 2026.

France completed a digital Euro experiment using Tezos and Nem.

Axios says 81 countries – representing 90% of global GDP – are currently exploring CBDCs.

And the Bank of International Settlements (BIS), International Monetary Fund (IMF), and World Bank Group produced a 37-page report into CBDCs.

The key takeaway? “If coordinated successfully, the clean slate presented by CBDCs might – in time and in combination with other improvements – be leveraged to enhance crossborder payments.”

So basically, CBDCs could make cross border payments better.

You’d have thought that would be obvious. But at least they came out and said it.

Oh, and another financial heavy hitter produced another big report into crypto this month.

(well, last month. But I didn’t get time to cover it.)

The World Economic Forum (WEF) – the one that runs “Davos” every year – wrote a surprisingly well-researched “DeFi policy-maker toolkit”.

Honestly, it’s probably one of the best overviews of DeFi I’ve seen. It even covers things like flash loans.

And it recommends that:

Generally, it may be wise to consider a technologically neutral approach to balance meeting the objectives of regulatory regimes with promoting innovation and market development.

Which is definitely relevant, given how many regulatory meetings and discussions concerning crypto have gone on in the US in the last couple of weeks.

It feels like we’re at an inflection point with crypto regulation. And I don’t think anyone really knows how it’s going to play out.

Okay, on to better news…

Ethereum “triple halving” scheduled for the 4th of August

The long awaited “London” hard fork is scheduled to take place on the 4th of August.

I feel like I’ve written that this is scheduled to take place next month for the last three months in a row.

But, as I’m sure you know, launch dates in crypto rarely go to plan.

Why is this upgrade a big deal?

Here’s what I wrote about it last month:

Next month we’re set for Ethereum’s London hard fork, which will bring some very big changes.

The most notable of these – for Ethereum holders – is something called EIP 1559.

As Hackernoon wrote in March:

“If EIP-1559 was live yesterday, it would have burned roughly 17,000 ETH. Annually that equates to over 6.2 million ETH! It will have more effect than halving has on Bitcoin.”

So, basically, Ethereum will switch from being inflationary to deflationary.

It kind of feels like with the huge crash we’ve seen, no one is paying attention to what this could mean for Ethereum.

But like I said back in April, “All else being equal (which it never is in crypto, to be fair) we could see a big price rise in Ethereum as it becomes more and more scarce.”

However, it looks like I might be writing about this again next month. Apparently the Ethereum developers found a bug in the code a week or so ago. And it’s unclear if that’s going to delay the upgrade again.

I guess we’ll see in a few days.

The Radix mainnet is now live

Speaking of crypto delays…

Radix was due to launch its mainnet last month. But, unsurprisingly, had to delay for a few weeks to make sure everything was ready.

Given Radix has been in development since 2013, a one month delay isn’t really that big of a deal.

And a few days ago, the mainnet launched without a hitch.

There will still be a few more upgrades over the next couple of years until Radix achieves all of its vision. But it’s now well on the way.

And to show you just how confident the Radix community are that Radix will be the best crypto out there, they’ve thrown down a gauntlet…

Here’s what they said in a recent reddit post:

If you can provide any L1 smart contract platform whose long term roadmap matches or eclipses the long term roadmap features of Radix, then Radix community members pledge over 10k+$ in total to transfer to whomever can make a well-sourced case.

So far, no one has claimed the prize.

If you want to know more about Radix, and why I believe it could be one of the most promising cryptos on the planet, you can read my in-depth review of it here.

Although, you’ll need to join as a premium member to do so. If you do choose to become a premium member, you’ll also get access to all the other premium content, including:

My top seven long-term crypto holds.

Oh, and you’ll also get sent my Solana review as soon as I publish it, later this month.

Okay, that’s it for this month.

Hopefully next month there are more positive and exciting things to write about. I’m sure the London hard fork is going to cause a huge stir… if it goes ahead as planned.

Thanks for reading.

Harry

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).