This week in crypto: there’s a $10 trillion money tsunami heading straight for us (sort of)

The world's biggest asset manager is moving into crypto. Probably nothing.

$10 trillion.

It’s a lot of money, right?

It’s one of those numbers that’s so big, it’s impossible to imagine.

Luckily, we don’t have to, because someone else has done it for us.

And here’s what $10 trillion looks like:

Impressive.

A less fun way to think about it is $10 trillion is bigger than the GDP of every country in the world, except China and America.

Anyway, that’s how much money BlackRock has under management. It’s, by far, the biggest asset manager in the world.

And its CEO, Larry Fink, is “the undisputed King of Wall Street”, according to the Financial Times.

What does any of this have to do with crypto?

Well, Larry here isn’t a fan.

He famously called Bitcoin an Index of money laundering, back in 2017, when it was cool for Wall Street guys to hate on crypto.

Since then like most of his ilk, he’s changed his mind.

And this month, BlackRock went into business with Circle, the issuer of USDC.

(USDC, if you’re not aware is the most trusted centralised stablecoin, with a market cap of around $50 billion. It’s the 5th biggest crypto overall.)

From Circle:

BOSTON — April 12, 2022 — Circle Internet Financial, a global internet finance firm and the issuer of USD Coin (USDC), today announced it has entered into an agreement for a $400M funding round with investments from BlackRock, Inc., Fidelity Management and Research, Marshall Wace LLP and Fin Capital.

And that $400 million funding isn’t even the most interesting part of that deal. This is:

In addition to its corporate strategic investment and role as a primary asset manager of USDC cash reserves, BlackRock has entered into a broader strategic partnership with Circle, which includes exploring capital market applications for USDC.

So not only is BlackRock going into business with Circle, but it’s also going to be the place where Circle stores its $50 billion USDC cash reserves.

And on top of that, on Monday, BlackRock launched its first ever ”blockchain and tech” ETF.

Although if you look at its top holdings, you can see it’s not really a blockchain ETF at all. Like almost all “blockchain” ETFs, it just invests in companies tenuously related to blockchain, not blockchains themselves.

Still. It’s a start. And It’s an absolute sea change from where we were back in 2017, when these kinds of asset managers saw crypto as the antichrist.

And while we’re on the subject of ridiculous sums of money…

Here’s who made the most from crypto in 2021

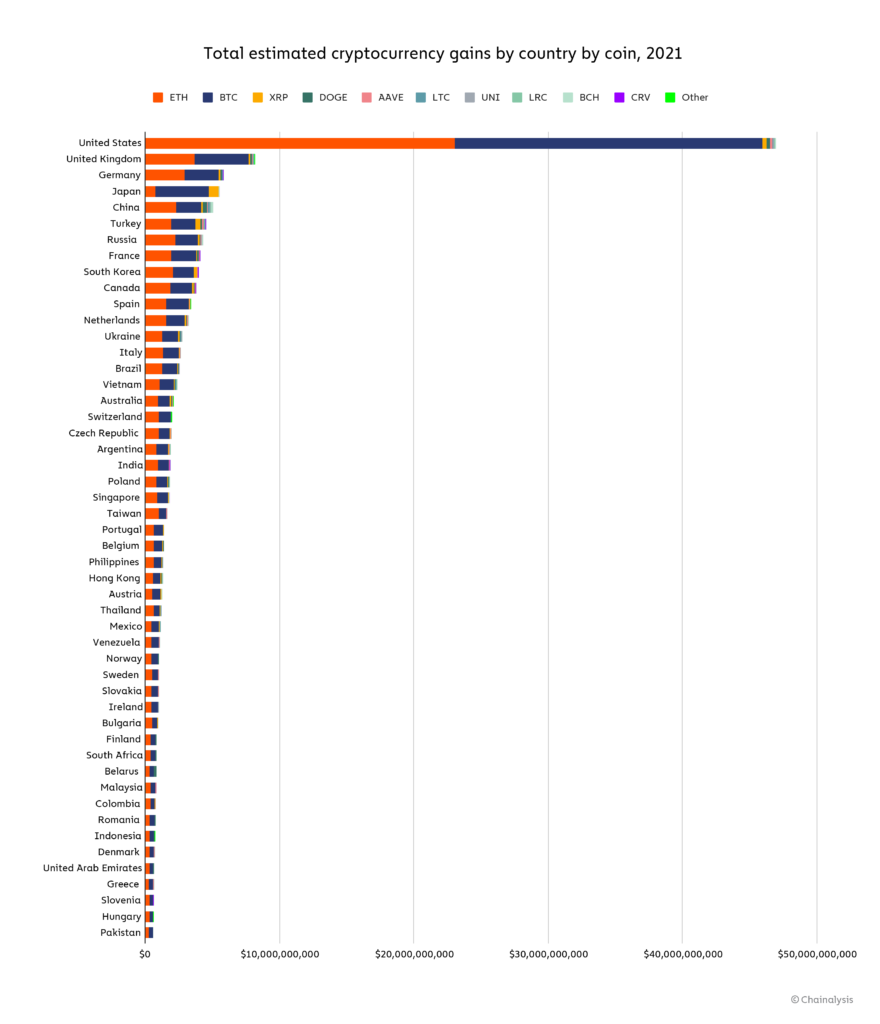

Chainalysis has released its annual crypto gains by country report, and, as you can see below, the UK is ranked 2nd.

Although, we’re a long way behind our friends in America.

Probably more interestingly, people made more money with Ethereum last year than they did with Bitcoin.

Chainalysis says this is due to the rise of DeFi in 2021, which mainly takes place on Ethereum.

With all the new layer-1s fighting it out for Defi dominance in 2022, it’ll be interesting to see how these numbers change in next year’s report.

I’d imagine Terra and Solana will rank pretty highly.

The crash is real. “Proper” investments behaving like crypto

It’s no secret that markets are down this year. Crypto and “real”:

The reasons people give for this are all pretty standard and boring: inflation fears have led to interest rate increases, which can lead to a recession and also means future stock earnings aren’t worth as much, which makes people dump growth stocks, which pulls down the rest of the market, which makes people dump more stocks. Then this combines with fears over China’s ability to make things, because of its continued covid lockdowns, and the ongoing war in Ukraine, which also affects gas and oil prices, which then feeds inflation, which then brings us right back to the start of this very long paragraph.

But, as a result, we’re now seeing some crypto-like drops in proper stocks.

For example:

- Netflix, part of the famous FAANG stock group, fell 35% in a day and is 71% down from its all-time high (ATH).

- Tesla fell 12% in a day, when Elon Musk announced he was buying Twitter. It’s 29% down from its ATH.

- Facebook is down 48% since its ATH.

- And Google is down more about 20% from its ATH.

Actually, how does this all stack up against crypto?

Let’s see.

- Bitcoin is down roughly 42% from its ATH.

- Ethereum is down roughly 40% from its ATH.

- And the overall crypto market is down 16.5% YTD.

(CoinGecko now has a fun, price drop since all-time high page, if you’re interested.)

So the crypto market has lost more money this year than the S&P 500, but not as much as the Nasdaq.

Meanwhile Bitcoin and Ethereum are doing better than Netflix and Facebook, but not better than Google and Twitter.

Of course “better” is very relative here. None of these investments are doing well. But I like this game, it’s the opposite of the one I usually do. You know, the which investment has gained more one.

Actually, I usually add the FTSE 100 into this. How’s that doing?

Right, it’s up 1.7% YTD. It’s winning! Wow, that has literally never happened before. Well done the FTSE!

Quickfire news

Time to level with you. I’ve spent way too much time playing around with the prices of things and run out of time.

I’m about to catch a plane to Budapest, so I really need to wrap this up. But there’s still a lot to cover, so I’m going to do it quickfire.

Here goes…

In American crypto news

- Fidelity to Allow Retirement Savers to Put Bitcoin in 401(k) Accounts: Wall Street Journal.

- New York (sort of) bans Bitcoin mining: Coin Telegraph.

- Meanwhile, Fort Worth becomes the first city government in America to mine bitcoin: USA Today.

- Meanwhile NewYork’s Mayor calls for an end to its restrictive BitLicense (that drove crypto businesses out of New York and into places like Texas, Miami and Wyoming): Yahoo! Finance.

In UK regulation news

- FCA appoints Victoria McLoughlin as the new head of crypto regulation: Financial Times.

- Bank of England wants £320 million to regulate crypto: Bloomberg.

- Interesting piece about the UK’s stance on crypto: Financial Times.

And that last article I linked above has a telling quote:

“It doesn’t matter how many people you get from the Treasury on your side or how many people you have in Parliament on your side, what happens in practice is that they then put you in front of the FCA,” says Daniel Masters, chair of CoinShares, the crypto fund management and trading group regulated in Jersey. “They will not cross the rubicon of the FCA’s independence.”

Masters says that in 2019 Glen brokered a meeting with then FCA boss Bailey (now at the Bank of England). While he found Bailey “extremely affable and quite open minded,” the attitude of other FCA officials left him convinced of their hostility to digital assets. “What that taught me is that somewhere else at the FCA, this anti-crypto sentiment exists,” says Masters.

Thankfully, or hopefully, the FCA is now warming up to crypto.

From another piece in the Financial Times:

[David] Raw, who is the FCA’s co-director of consumer and retail policy, said adopting a global approach by working with international regulators was imperative to coordinating crypto asset regulation, but affirmed the FCA does not intend to over-regulate.

“We cannot ignore the risks around fraud and financial crime but we cannot over-regulate and through over-regulating stamp out exciting innovations,” Raw said.

Bitcoin hit $42,069 on 4/20

There are two memeable numbers when it comes to crypto: 420 and 69.

420 has become a cultural phenomenon. Well, a cannabis cultural phenomenon.

And 69 for obvious reasons.

Thanks Bill and Ted.

Well, on the 20th of April – 4/20 in US date format, Bitcoin’s price hit $42,069.

Yes, really. You can look it up on CoinGecko if you don’t believe me.

Maybe Elon Musk is right. Maybe we really are living in a simulation.

Safemoon Scam exposed, holders ignore reality

Here’s a fun video that’s been doing the rounds: I uncovered a billion dollar fraud.

It’s basically a guy showing that Sefemoon is a scam. Of course, most people know that. Most people knew that as soon as they heard about it.

But that didn’t stop people buying it.

And even after this video has come out, most of the Safemoon community still believe in the project for some reason.

Just have a browse of their subreddit.

Well, we know the reason: FOMO + Sunk cost fallacy.

New crypto deep dive incoming

Okay, I think we covered nearly everything there.

The last thing to say is that I’m planning another crypto deep dive in the next few weeks. It’s been a while since I’ve done one, and there are a few interesting projects I have on my radar.

So keep an eye out for that. Probably around this time next month.

That’s all for this week.

I hope I catch this plane.

Thanks for reading.

Harry

Full disclosure: At time of writing, I held the following cryptos: Ethereum, IOTA, Radix, Mina Protocol, Aleph Zero.

Disclaimer: This content does not constitute financial advice, tax advice or legal advice. Your money and how you choose to spend it is your responsibility. Nothing that appears here should be construed as investment advice or recommendations to buy or sell any securities, cryptos or investments. coin confidential does not offer investment advice. We merely provide information. Crypto investing is highly risky. You should not base any investment decision solely on information we publish. We believe all information we publish to be accurate, but we cannot guarantee it. Always do your own research before making any decisions about your money. See the full disclaimer for more.

Subscribe for exclusive content

The best newsletter in crypto, or your money back (it's free).